California is known for its sunny weather, beautiful beaches, and scenic drives. But did you know that it’s also known for having some of the highest car insurance rates in the country? In fact, the average annual car insurance premium in California is $1,831, which is considerably higher than the national average of $1,674.

Why are car insurance rates so high in California?

There are several reasons why car insurance rates are higher in California than in other states. One of these reasons is the high population density of the state. With a population of nearly 40 million people, California has more drivers on its roads than almost any other state in the country. This increased traffic leads to more accidents, which in turn leads to higher insurance rates.

Another factor that contributes to high car insurance rates in California is the state’s strict liability laws. California is a “fault” state, which means that if you cause an accident, you are responsible for paying for the damages. This can lead to higher insurance rates, as insurance companies need to charge more to cover the increased risk of accidents.

Finally, California is also known for having a high number of uninsured drivers. In fact, it’s estimated that nearly 15% of drivers in the state are uninsured. This means that if you get into an accident with an uninsured driver, you may be responsible for paying for your own damages. To protect themselves against this risk, many drivers in California choose to purchase uninsured motorist coverage, which can increase insurance rates even further.

How can I save money on car insurance in California?

Despite the high cost of car insurance in California, there are several steps you can take to lower your premiums and save money.

Shop around for the best rates

One of the easiest ways to save money on car insurance is to shop around and compare rates from multiple companies. You may be surprised at how much prices can vary between different insurers, even for the same coverage.

Some of the top car insurance providers in California include Allstate, State Farm, and Progressive. Be sure to compare quotes from different companies to find the best coverage at the best price.

Bundle your policies

If you have multiple insurance policies (such as home and auto insurance), you may be able to save money by bundling them together with the same insurer. Most insurance companies offer discounts for bundling, which can help you save money on both policies.

Consider raising your deductible

Your deductible is the amount you’ll need to pay out of pocket before your insurance company will cover the rest of the damages in an accident. If you choose a higher deductible, you’ll pay lower premiums each month. Just be sure to choose a deductible that you can afford to pay in the event of an accident.

Drive safely and maintain a good driving record

One of the biggest factors that insurance companies use to determine your premiums is your driving history. If you have a history of accidents or traffic violations, you’ll likely pay higher rates. Conversely, if you have a clean driving record, you may be eligible for discounts and lower rates.

Take advantage of discounts

Most insurance companies offer a variety of discounts to help you save money on your premiums. Some common discounts include:

- Good driver discounts for drivers with a clean driving record

- Good student discounts for students with a high GPA

- Multi-car discounts for insuring multiple cars with the same company

- Low mileage discounts for drivers who don’t drive a lot

How much have car insurance rates increased in California?

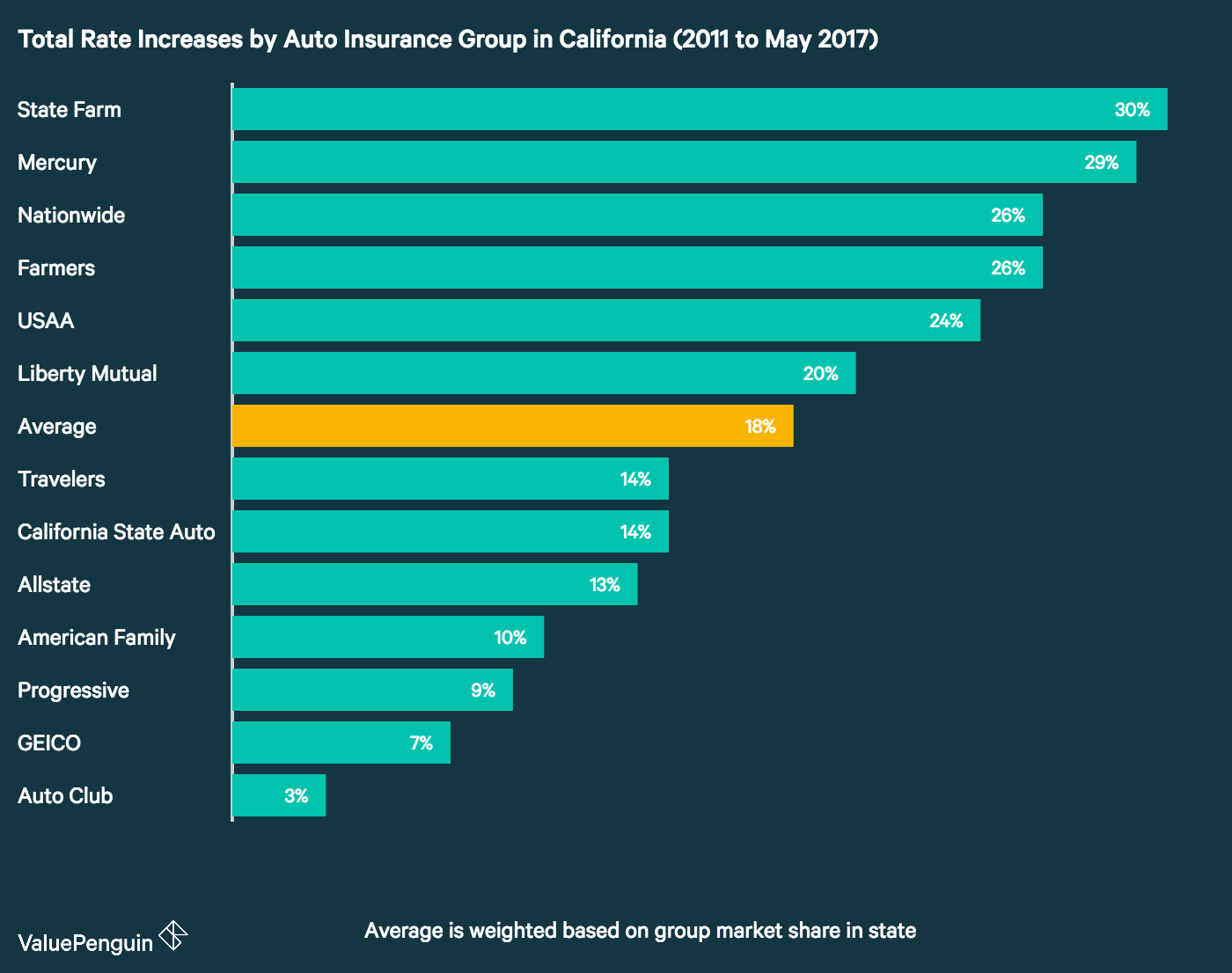

If you’re a California driver, you may have noticed that your car insurance rates have been increasing over the past few years. In fact, between 2011 and 2018, car insurance rates in California increased by an average of 45%. This is due to a combination of factors, including increased traffic, more accidents, and rising medical costs.

Despite these increases, there are still ways to save money on car insurance in California. By shopping around for the best rates, bundling your policies, maintaining a good driving record, and taking advantage of discounts, you can lower your premiums and keep more money in your pocket.

In conclusion

While car insurance rates in California may be higher than in other states, there are still plenty of ways to save money on your premiums. By taking a few simple steps to shop around for the best rates and take advantage of discounts, you can lower your costs and protect yourself on the road.

Remember, driving in California can be expensive, but it doesn’t have to break the bank. With a little effort and some savvy shopping, you can find affordable car insurance coverage that meets your needs and fits your budget.

Sources:

- https://www.zimlon.com/b/car-insurance/california-ca/

- https://www.caranddriver.com/car-insurance-a21769950/california-car-insurance-requirements/

- https://www.carinsurance.org/california/

If you are searching about California Car Insurance Rates for 2021 - Rates + Cheapest Vehicles you've came to the right web. We have 8 Pictures about California Car Insurance Rates for 2021 - Rates + Cheapest Vehicles like Compare Car iIsurance: Car Insurance Rates California Averages, Awasome Car Insurance Average Cost California References - SPB and also California Car Insurance Rates for 2021 - Rates + Cheapest Vehicles. Here it is:

California Car Insurance Rates For 2021 - Rates + Cheapest Vehicles

insuraviz.com

insuraviz.com Read - California Auto Insurance Rates Are Rising In 2017/2018

www.carsurer.com

www.carsurer.com insurance car average age rates california auto usa san prices diego costs

Compare Car IIsurance: Car Insurance Rates California Averages

dcomparecarinsuran.blogspot.com

dcomparecarinsuran.blogspot.com insurance car rates california compare

Who Has The Cheapest Auto Insurance Quotes In California?

insurance california auto car rates cheapest ca cheap companies quotes cost

Awasome Car Insurance Average Cost California References - SPB

starphoenixbase.com

starphoenixbase.com How Much Have Auto Insurance Rates Increased In California? - ValuePenguin

www.valuepenguin.com

www.valuepenguin.com rate auto insurance california florida rates increases car increase georgia hikes much company graph fl states other compared valuepenguin increased

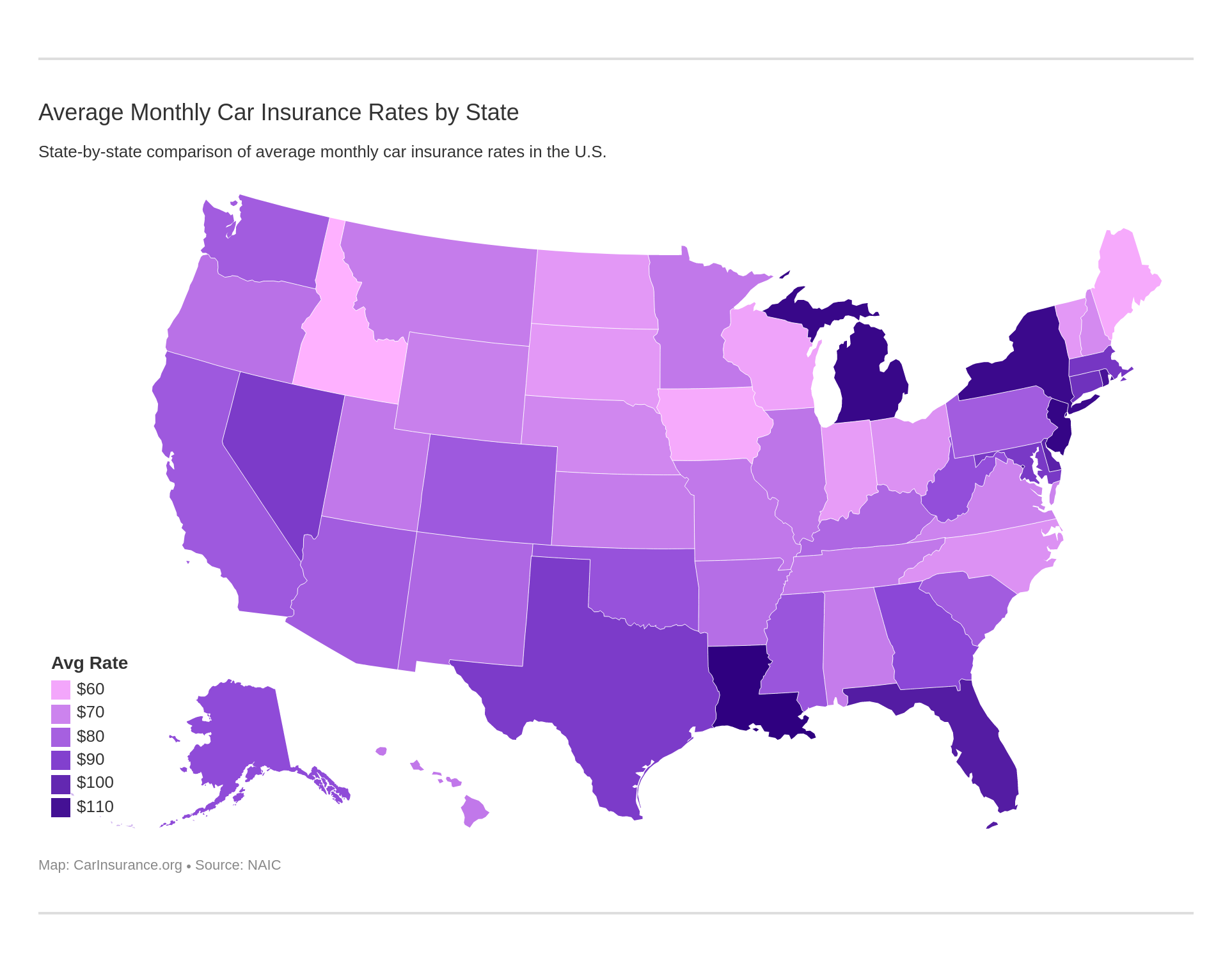

California Car Insurance 2020 (Rates + Companies) – CarInsurance.org

www.carinsurance.org

www.carinsurance.org insurance car average state rates california carinsurance monthly

California Car Insurance Rates For 2021 - Rates + Cheapest Vehicles

insuraviz.com

insuraviz.com tiguan california sequoia m5 challenger lexus telluride prius i8 fusion s550 durango rhode f250 pace cts kinstacdn vehicles comparisons

Who has the cheapest auto insurance quotes in california?. Insurance california auto car rates cheapest ca cheap companies quotes cost. Tiguan california sequoia m5 challenger lexus telluride prius i8 fusion s550 durango rhode f250 pace cts kinstacdn vehicles comparisons

0 Comments