Hi there! If you are living in California and have a car, you know that car insurance can be expensive. However, there are ways to lower your car insurance premiums and in this article, we will discuss some of the best strategies.

1. Shop Around for Car Insurance Quotes

Shopping around for different car insurance quotes is the smartest thing you can do to save money on your premiums. Each insurance company has its own pricing model, which means the rates will vary from one company to the next. Comparing insurance quotes from different companies can help you find the best deal possible.

To get started, you can use an online insurance comparison site or work with an independent insurance agent. You can also research insurance companies in California and reach out to them directly for quotes.

2. Increase Your Deductible

Your deductible is the amount you must pay out of pocket before your insurance company will start covering your expenses. Increasing your deductible can be a great way to save money on your premiums.

However, it is important to make sure you can afford to pay your deductible if you ever need to file a claim. You should set your deductible at a level that you are comfortable with and can afford to pay at any time.

3. Drive Safely and Build a Good Driving Record

If you have a good driving record, you are less likely to be involved in accidents and file claims, which means you will be charged lower premiums. Driving safely and following traffic rules can help you build a good driving record.

In addition, taking a defensive driving course can also help improve your driving skills and reduce your premiums. Many insurance companies offer discounts to drivers who have completed a defensive driving course.

4. Bundle Your Insurance Policies

If you have other insurance policies, such as homeowners or renters insurance, you can save money by bundling them with your car insurance. Most insurance companies offer discounts to customers who bundle their policies.

Bundling your policies with one insurance company can also make it easier to manage your insurance and file claims. Many insurance companies offer online tools and apps that allow you to manage all your policies in one place.

5. Choose a Car with Good Safety Features

The type of car you drive can also affect your insurance premiums. Cars with good safety features and high crash-test ratings are generally cheaper to insure because they are less likely to be involved in accidents.

In addition, cars with anti-theft devices and other safety features can also help lower your premiums. Some insurance companies offer discounts for cars with these features, so be sure to inquire about possible discounts when shopping for car insurance.

6. Maintain a Good Credit Score

Your credit score can also affect your car insurance premiums. Insurance companies use your credit score as a factor when calculating your rates, with those who have higher credit scores usually paying less for their insurance.

To maintain a good credit score, pay your bills on time and keep your credit utilization ratio low. You can also review your credit report regularly to make sure there are no errors that could negatively affect your score.

7. Ask for Discounts

Most insurance companies offer discounts for various reasons, such as being a safe driver, having a good credit score, and many more. However, these discounts are not always advertised, and you might have to ask your insurance company about possible discounts.

When talking to your insurance company, ask about possible discounts and how much they would save you. Some common discounts include safe driver discounts, low-mileage discounts, and good student discounts.

Conclusion

Lowering your car insurance premiums in California doesn't have to be difficult. By shopping around for car insurance quotes, increasing your deductible, driving safely, bundling your policies, choosing a car with good safety features, maintaining a good credit score, and asking for discounts, you can save money on your car insurance premiums.

We hope this article has given you some helpful tips for reducing your car insurance costs. Remember, the key is to be a safe driver and do your research to find the best deals possible.

If you are looking for How to Lower Car Insurance Premiums in California | Cost-U-Less you've visit to the right place. We have 8 Pictures about How to Lower Car Insurance Premiums in California | Cost-U-Less like Car Insurance Rates By Zip Code California - New Cars Review, Compare California Car Insurance Quotes - Fast & Secure | Compare.com and also California Insurance: California Car Insurance Rates By Zip Code. Read more:

How To Lower Car Insurance Premiums In California | Cost-U-Less

www.costulessdirect.com

www.costulessdirect.com Compare California Car Insurance Quotes - Fast & Secure | Compare.com

www.compare.com

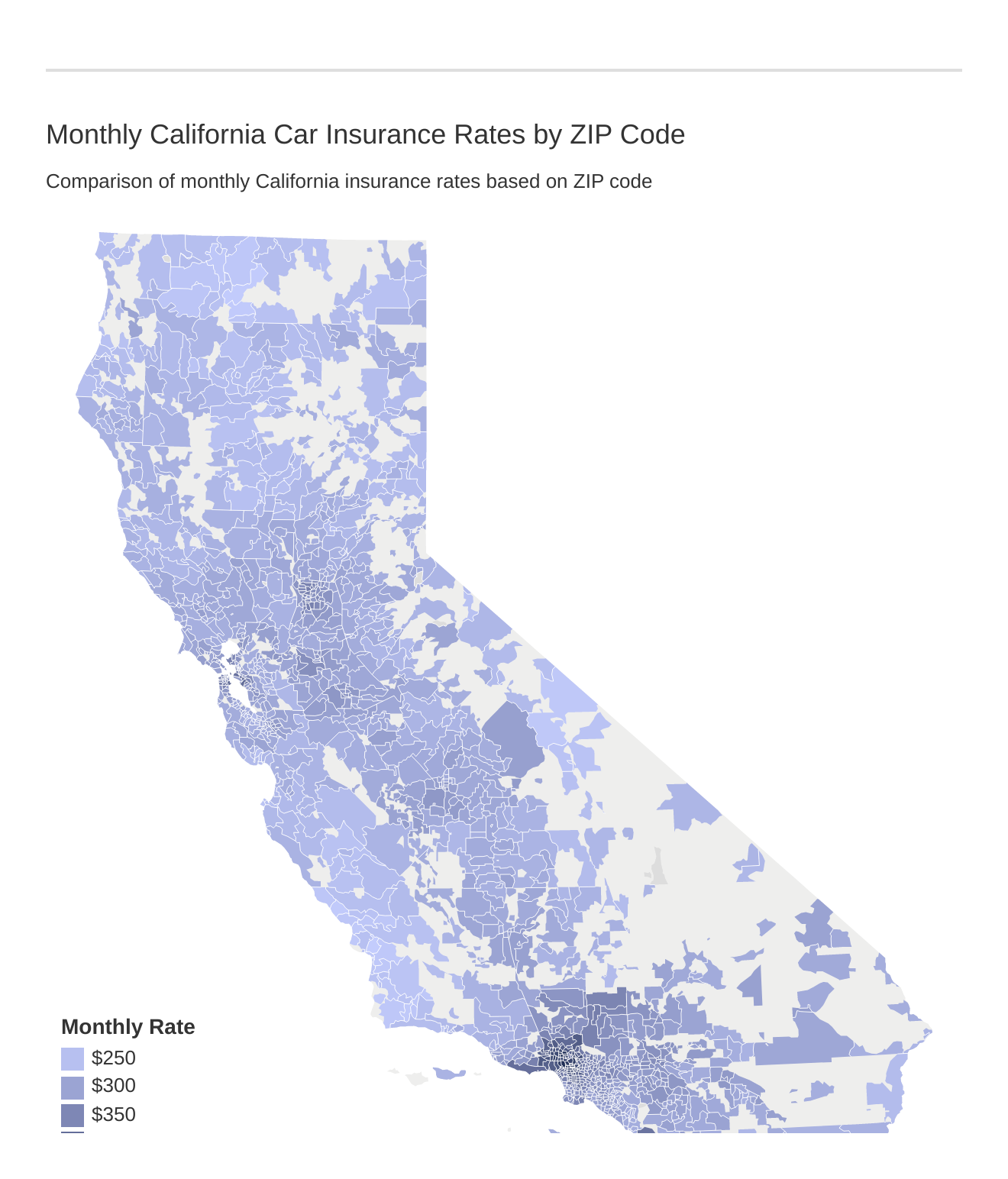

www.compare.com California Car Insurance Rates For 2021 - Rates + Cheapest Vehicles

insuraviz.com

insuraviz.com California Insurance: California Car Insurance Rates By Zip Code

california insurance rates zip car code los county mental health angeles cal medi services regulatory system angles state

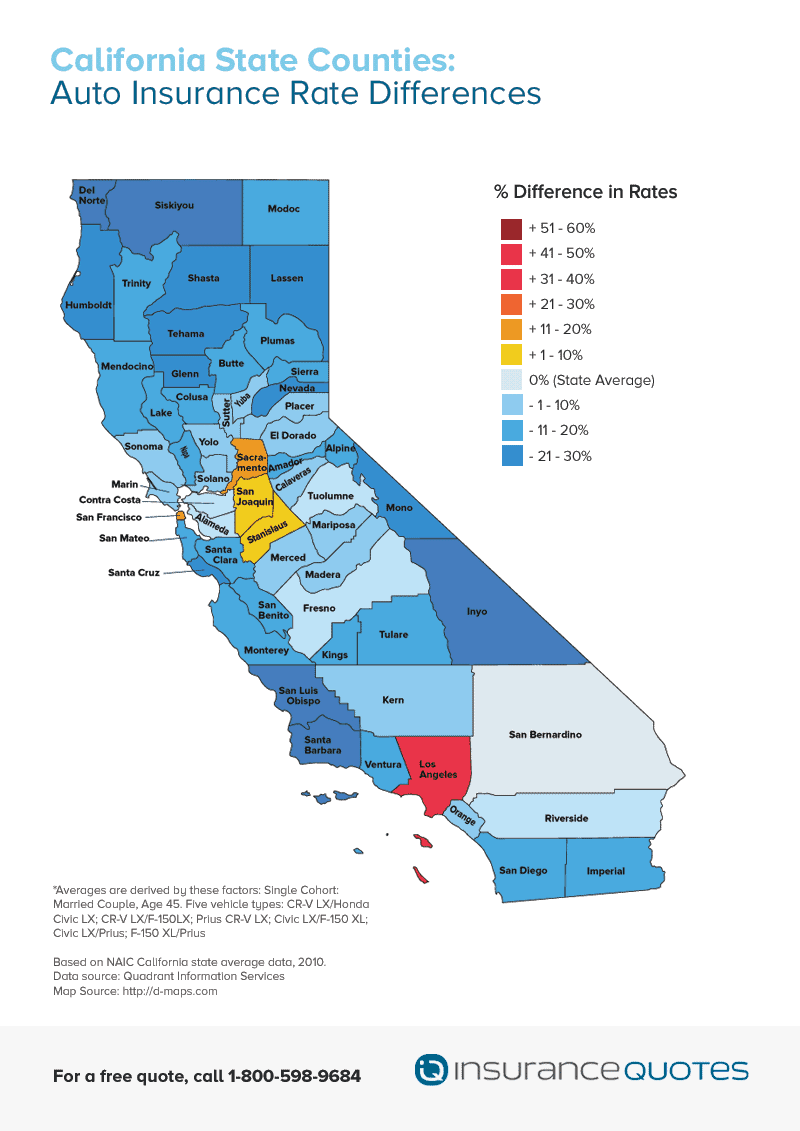

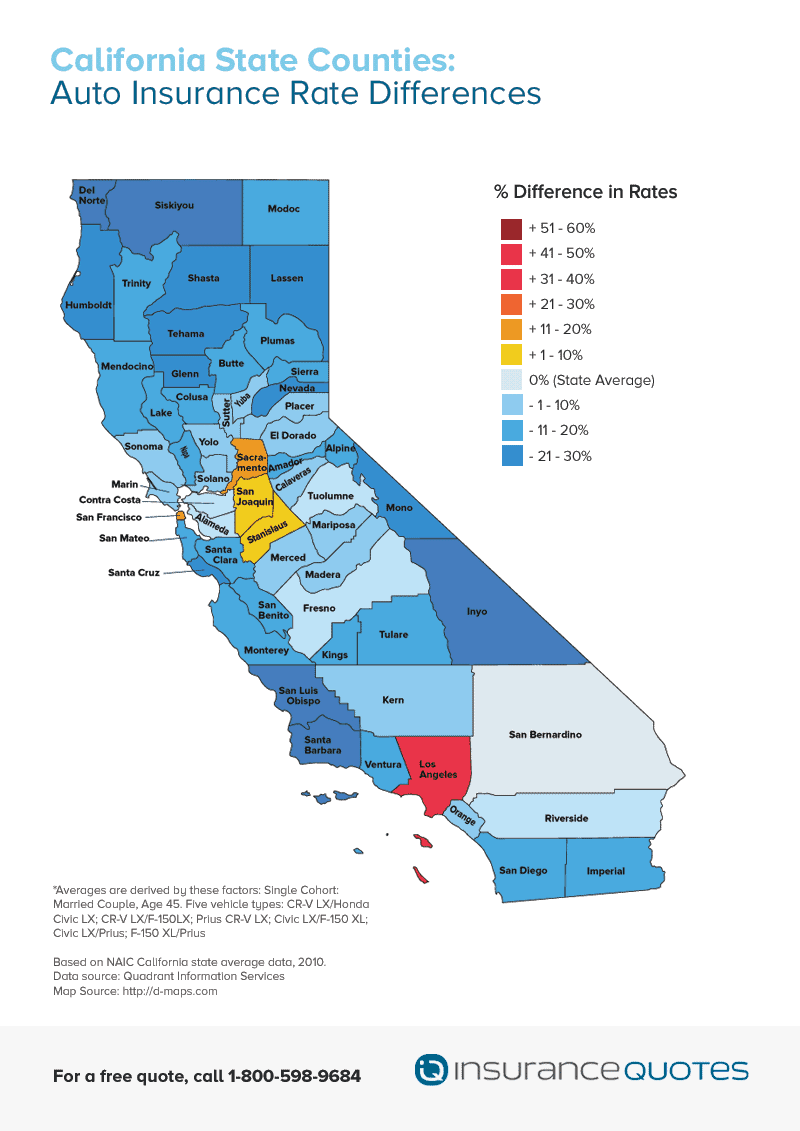

What Are The Average Costs Of California Car Insurance Rates? - IQ

www.insurancequotes.com

www.insurancequotes.com rates leasing greatoutdoorsabq

Car Insurance Rates By Zip Code California - New Cars Review

newcarsbd.blogspot.com

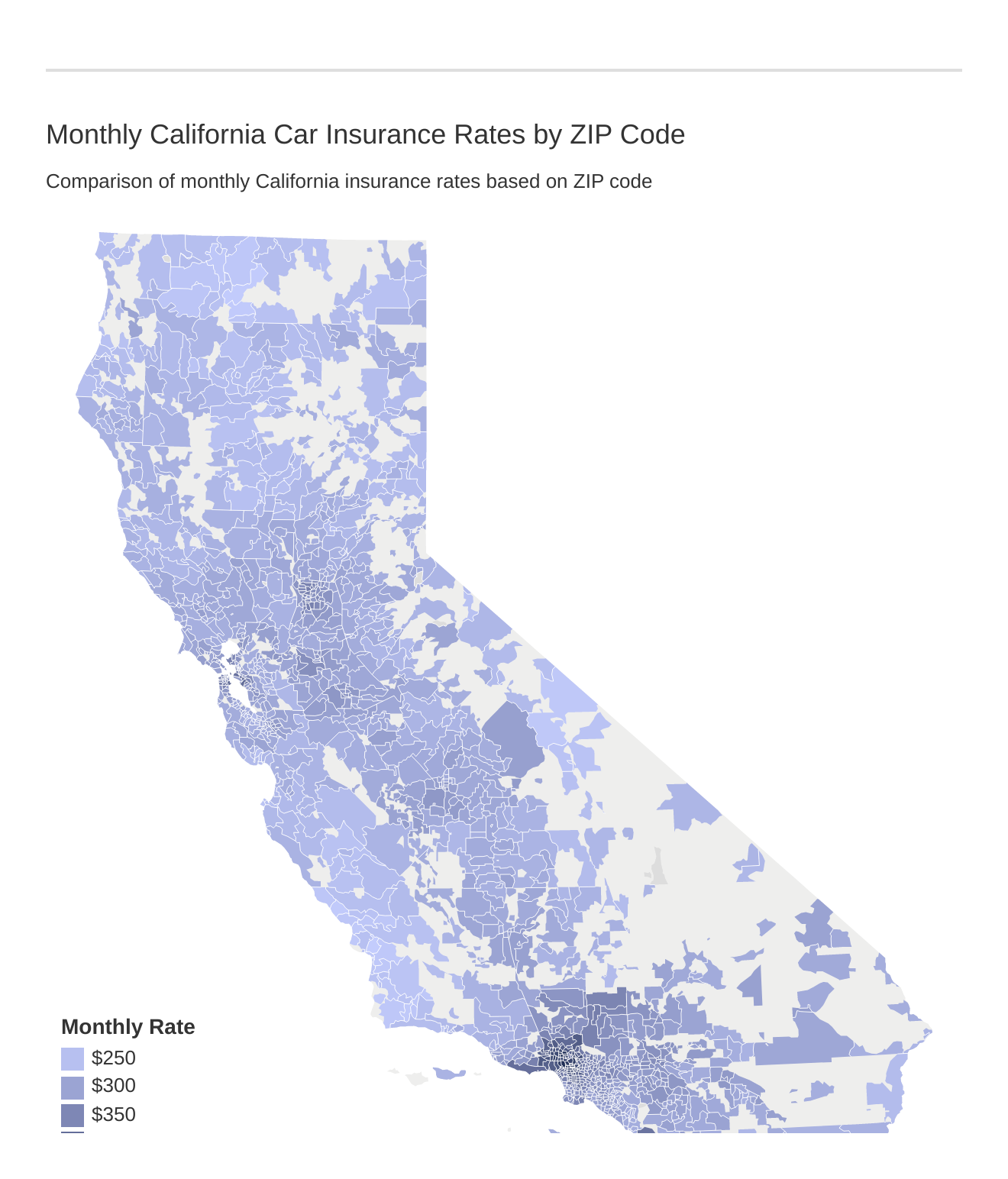

newcarsbd.blogspot.com insurance car california rates zip code cheapest companies october

Car Insurance Rates By Zip Code California - New Cars Review

newcarsbd.blogspot.com

newcarsbd.blogspot.com insurance california rates zip code car basics coverages auto

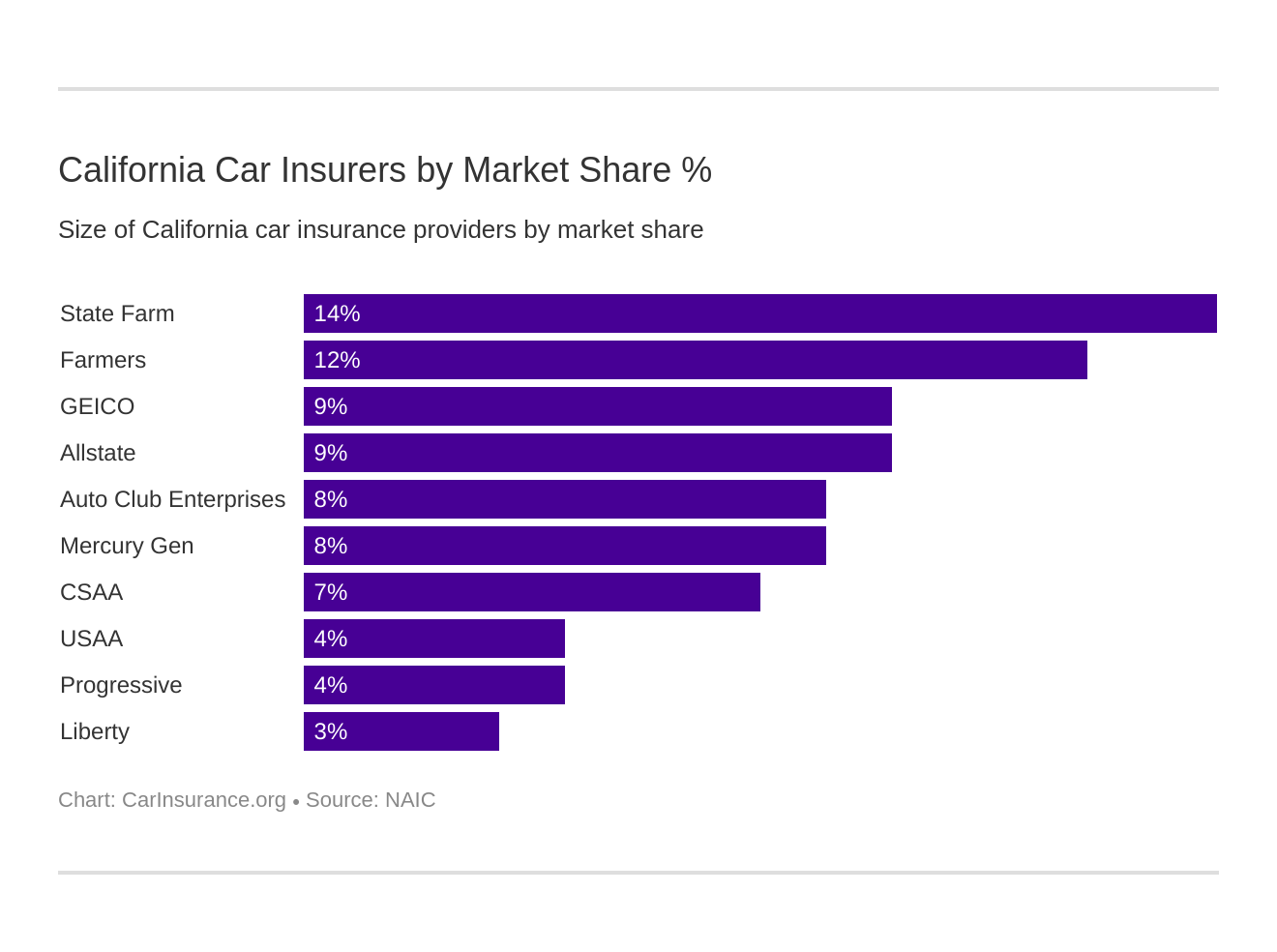

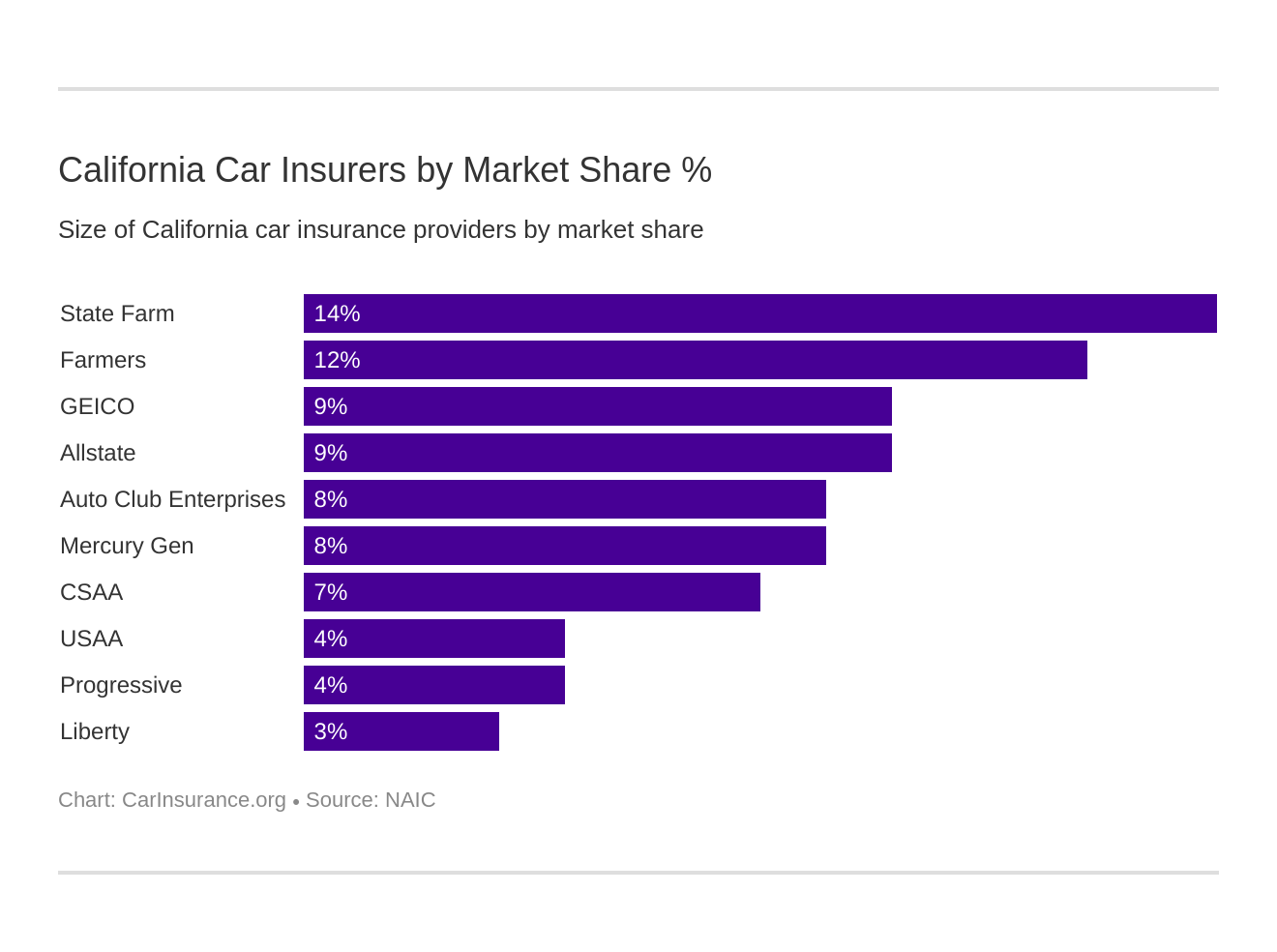

California Car Insurance 2020 (Rates + Companies) – CarInsurance.org

www.carinsurance.org

www.carinsurance.org california car insurance carinsurance companies

Insurance car california rates zip code cheapest companies october. Car insurance rates by zip code california. How to lower car insurance premiums in california

0 Comments