California Car Insurance Rates: What You Need to Know As a responsible driver, you know the importance of car insurance. It's the law in California, and for good reason. Accidents happen, and without insurance, you could be left with a hefty bill to pay for damages or medical expenses. But with so many different companies and policies available, choosing the right insurance can be overwhelming. In this post, we'll take a look at some of the factors that affect California car insurance rates, as well as some tips for finding the best coverage for your needs. Driving History If you have a clean driving record with no tickets, accidents, or other infractions, you can expect to pay lower premiums. On the other hand, if you have a history of accidents or tickets, your rates will likely be higher. Insurance companies consider your driving record to be an indicator of how risky you are as a driver. A driver with a clean record is less likely to file a claim, whereas a driver with a history of accidents is more likely to cost the company money. Age and Gender Another factor that affects car insurance rates in California is your age and gender. According to data from the Insurance Institute for Highway Safety, younger drivers are more likely to be involved in accidents than older drivers. As a result, drivers under the age of 25 typically pay higher rates. Additionally, men are generally considered to be riskier drivers than women, which means they may also pay higher rates. Vehicle Make and Model The type of car you drive can also affect your car insurance rates. Cars that are more expensive or have a higher horsepower are typically more expensive to insure, as they are more expensive to repair or replace if they are damaged in an accident. Additionally, some vehicles may be more prone to theft, which can also affect rates. Zip Code Where you live can also have an impact on your car insurance rates. Insurers consider factors such as crime rates, traffic patterns, and weather conditions when calculating rates. In general, drivers who live in urban areas or areas with high rates of traffic accidents may pay higher rates. Additionally, drivers living in areas with high theft rates may also pay higher rates. Coverage Limits The amount of coverage you purchase can also affect your car insurance rates. In general, the more coverage you have, the higher your premiums will be. However, it's important to balance the level of coverage you need with what you can afford in premiums. Remember, insurance is designed to protect you financially in the event of an accident. If you don't have enough coverage, you could be left with a significant out-of-pocket expense. Finding the Best California Car Insurance Rates Now that you understand some of the factors that affect California car insurance rates, how do you go about finding the best coverage for your needs? Here are a few tips to keep in mind: Shop around: Don't just go with the first insurance company you come across. Shop around and compare rates from multiple companies to find the best deal. Bundle your policies: If you have other types of insurance, such as homeowners or renters insurance, consider bundling your policies with the same company for a discount. Consider your deductible: Your deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premiums, but it also means you'll pay more if you get into an accident. Ask about discounts: Many insurance companies offer discounts for things like safe driving, taking a defensive driving course, or having certain safety features on your car. Read the fine print: Before signing up for a policy, make sure you read the fine print and understand the coverage you're getting. Don't be afraid to ask questions or clarify anything you don't understand. Conclusion Car insurance is an important investment that can protect you financially in the event of an accident. California car insurance rates are affected by a variety of factors, including driving history, age and gender, vehicle make and model, zip code, and coverage limits. To find the best coverage for your needs, be sure to shop around, bundle your policies, consider your deductible, ask about discounts, and read the fine print. With a little research, you can find the right coverage at a price you can afford.

If you are searching about title you've visit to the right web. We have 8 Images about title like Car Insurance Rates By Zip Code California - New Cars Review, Why Does Your ZIP Code Matter So Much for Auto Insurance Rates? and also California Insurance: September 2017. Here you go:

title

www.ticketsnipers.com

www.ticketsnipers.com snipers

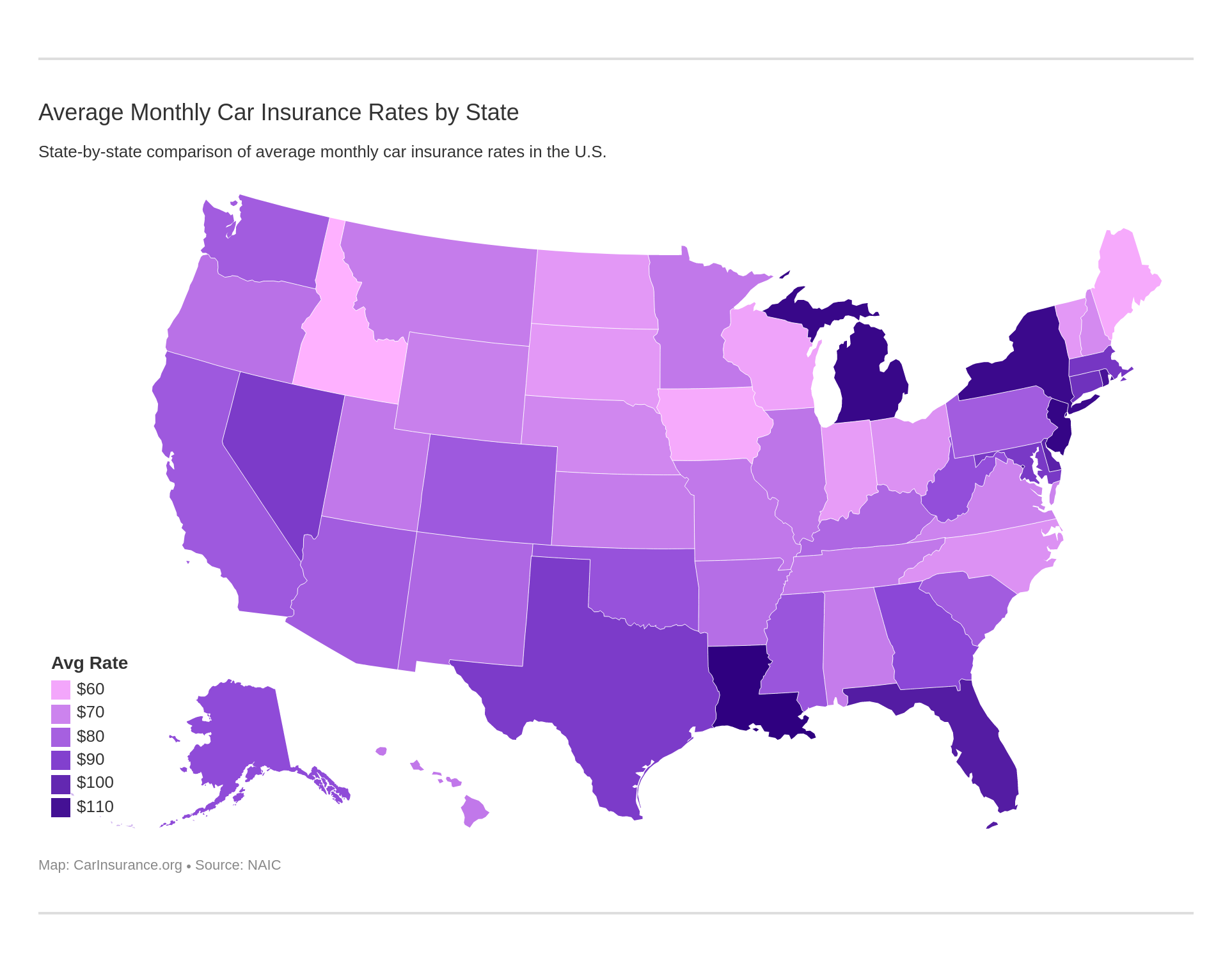

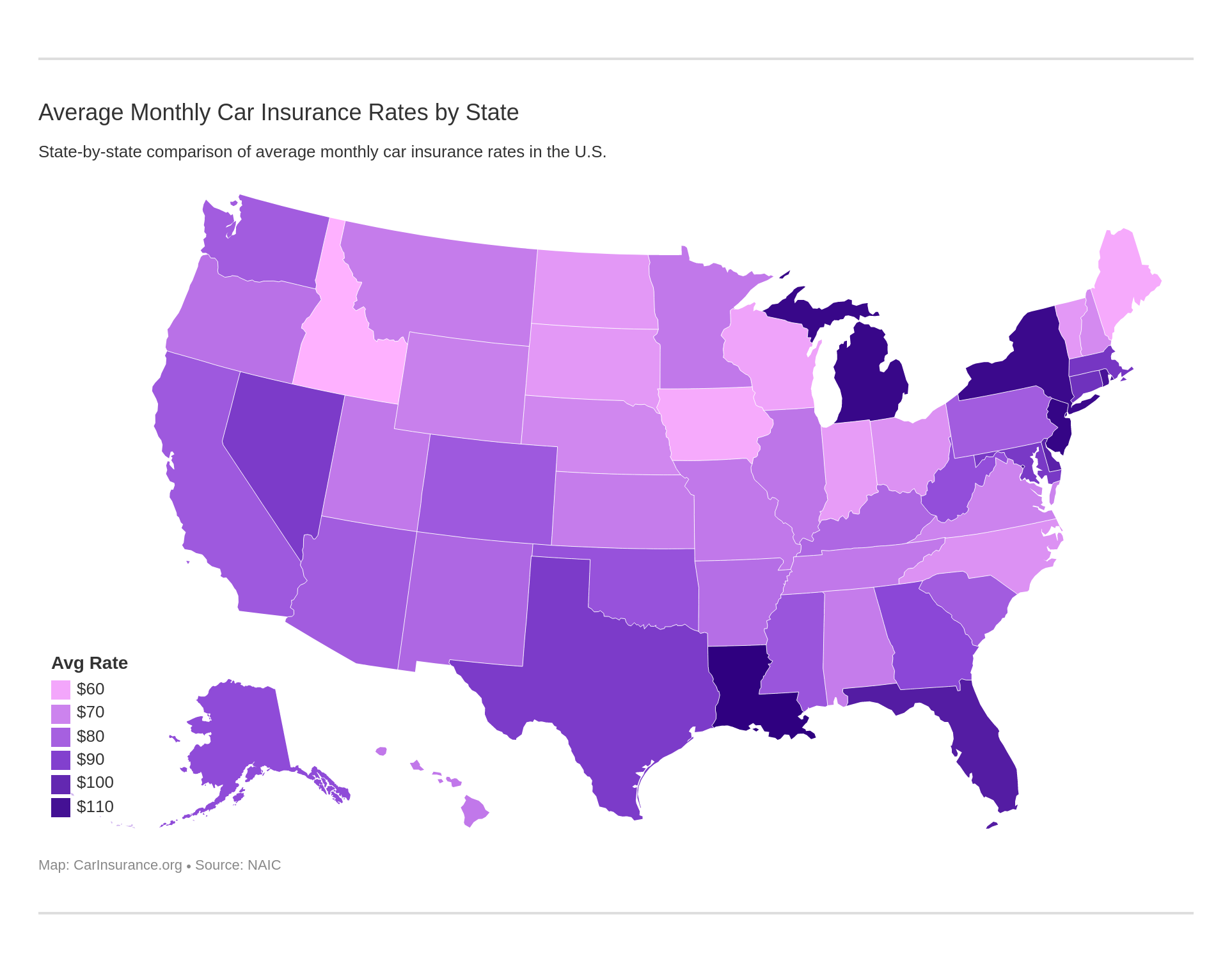

California Car Insurance 2020 (Rates + Companies) – CarInsurance.org

www.carinsurance.org

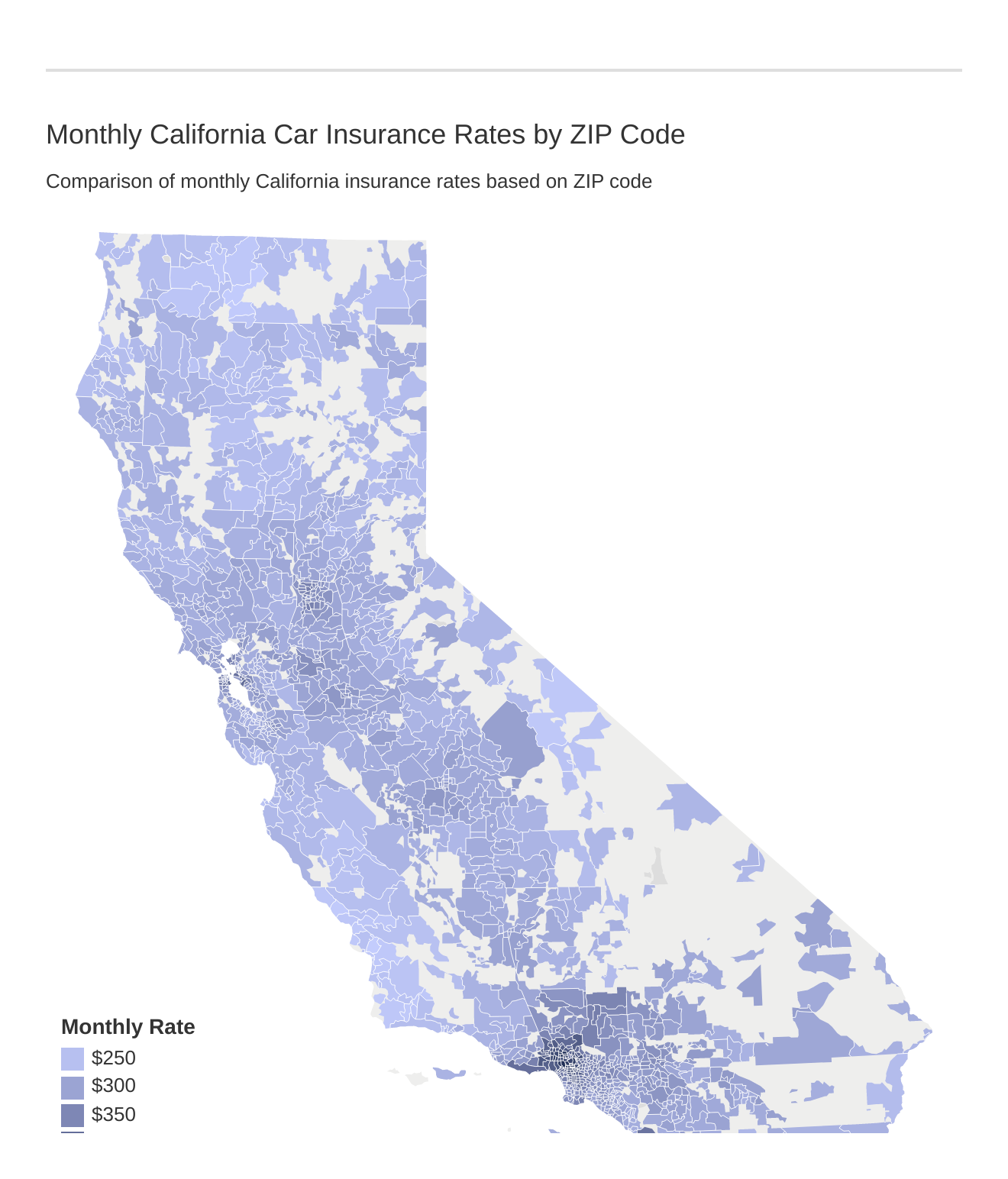

www.carinsurance.org insurance car average state rates california carinsurance monthly

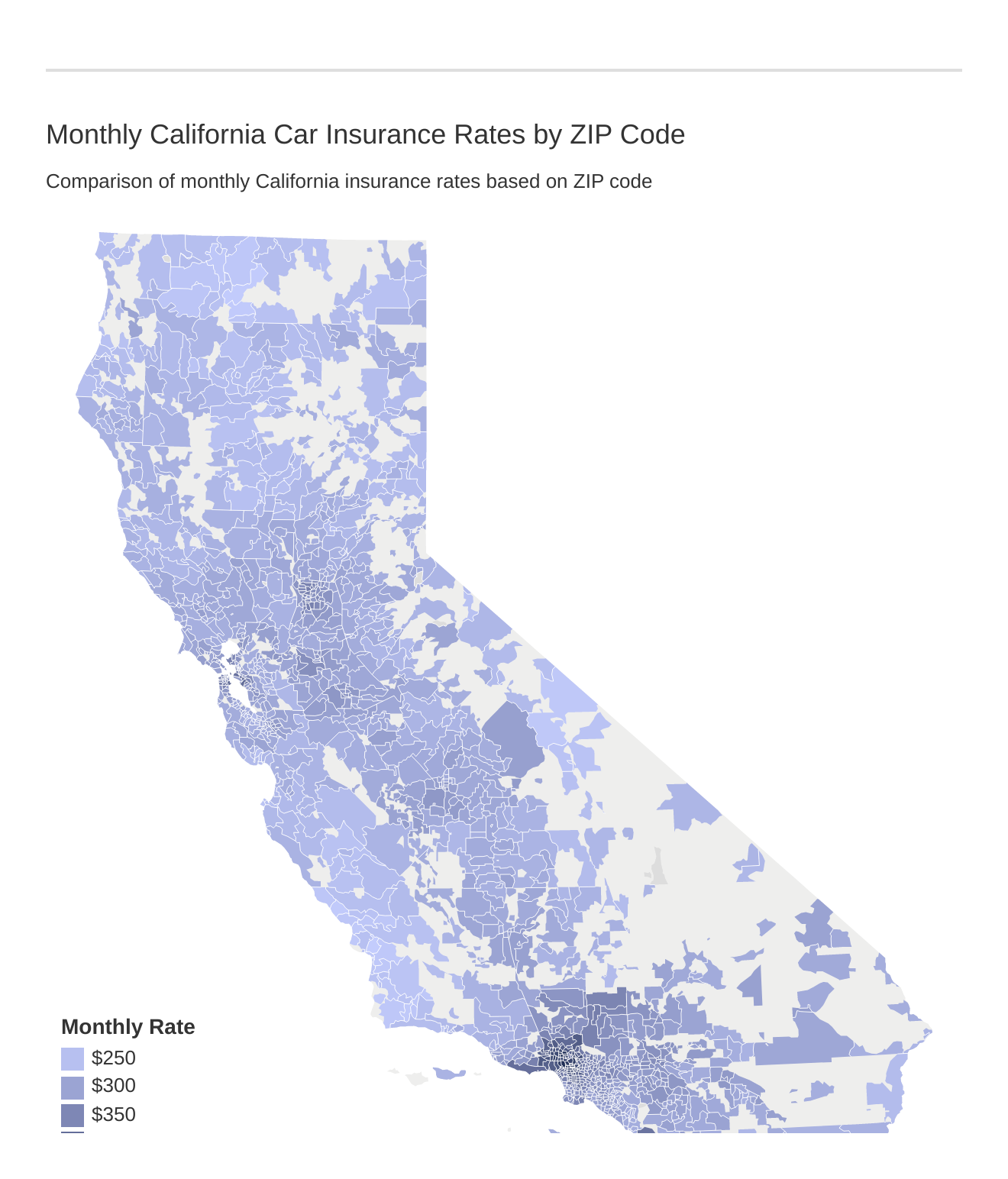

Car Insurance Rates By Zip Code California - New Cars Review

newcarsbd.blogspot.com

newcarsbd.blogspot.com insurance california rates zip code car basics coverages auto

What Are The Average Costs Of California Car Insurance Rates? - IQ

www.insurancequotes.com

www.insurancequotes.com premiums

Why Does Your ZIP Code Matter So Much For Auto Insurance Rates?

www.insurancepanda.com

www.insurancepanda.com California Insurance: September 2017

californiainsurancenikanyo.blogspot.com

californiainsurancenikanyo.blogspot.com california insurance louisiana car rates auto national automobile consumer bill rights personal zip code highway administration traffic safety source fatality

California Insurance: California Car Insurance Rates By Zip Code

californiainsurancenikanyo.blogspot.com

californiainsurancenikanyo.blogspot.com california insurance rates zip car code los county mental health angeles cal medi services regulatory system angles state

Car Insurance Zip Code Calculator / Average Car Insurance Rates By ZIP

furiouslyseeinggreen.blogspot.com

furiouslyseeinggreen.blogspot.com brstatic iscoupon

Insurance california rates zip code car basics coverages auto. California insurance rates zip car code los county mental health angeles cal medi services regulatory system angles state. California insurance louisiana car rates auto national automobile consumer bill rights personal zip code highway administration traffic safety source fatality

www.ticketsnipers.com

www.ticketsnipers.com  www.carinsurance.org

www.carinsurance.org  newcarsbd.blogspot.com

newcarsbd.blogspot.com  www.insurancequotes.com

www.insurancequotes.com  www.insurancepanda.com

www.insurancepanda.com  furiouslyseeinggreen.blogspot.com

furiouslyseeinggreen.blogspot.com

0 Comments