If you're a young adult or a parent of one, you've probably heard about the high cost of car insurance for teenagers. It's true that insurance rates can be quite steep at this age, largely due to the lack of experience and the increased risk of accidents. However, the average cost of car insurance varies considerably depending on a number of other factors as well. In this article, we'll be discussing some of the key factors and how they affect insurance rates for different age groups and genders.

Age:

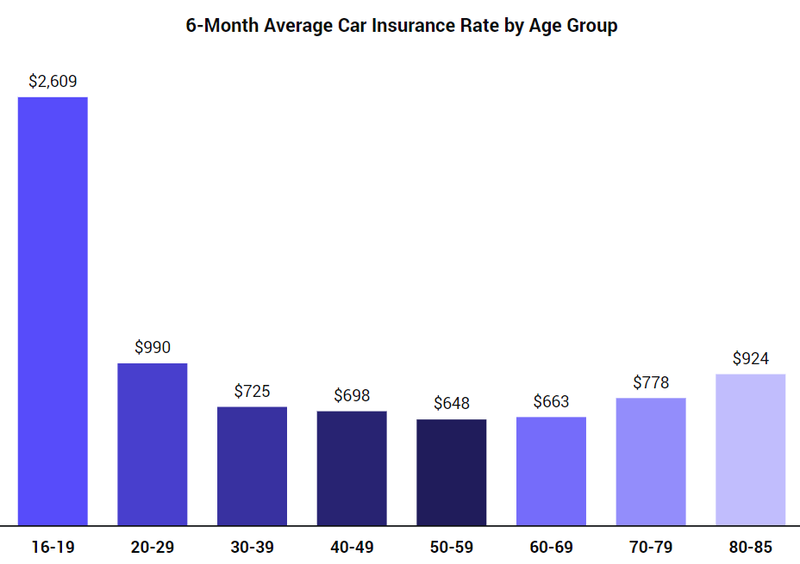

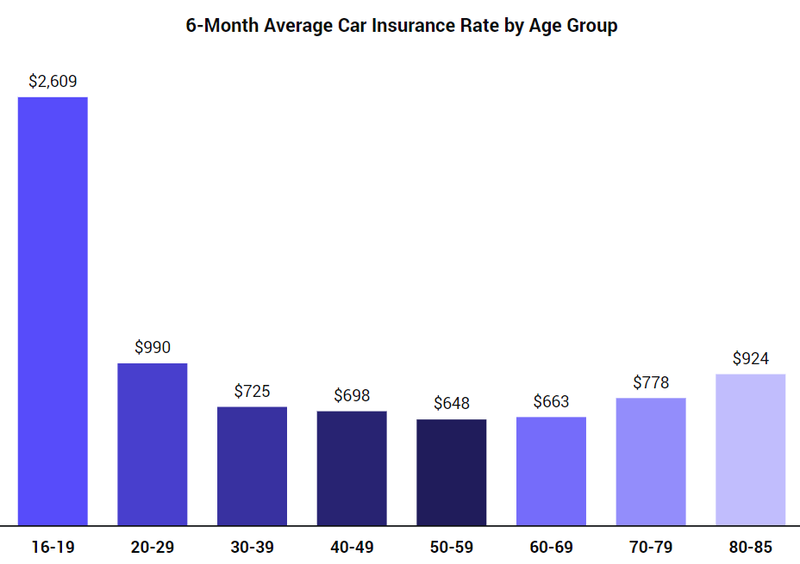

Age is one of the key factors that insurers look at when determining car insurance rates. Generally speaking, the younger you are, the more you'll pay for insurance. This is because younger drivers have less experience and are statistically more likely to be involved in accidents. According to data from 2020, the average cost of car insurance in the US is around $1,674 per year, but younger drivers can expect to pay significantly more.

Specifically, teenage drivers (aged 16-19) pay the highest rates of any age group, with an average cost of around $438 per month for males and $381 per month for females. This is several times higher than the average for older drivers. However, there are some ways to reduce these costs.

For example, one option is to add teenage drivers to an existing family policy rather than getting a separate one. This can often be much more affordable, and many insurers offer discounts for multiple drivers on a single policy. Additionally, some insurers offer discounts for students with good grades, as they are seen as less risky drivers.

Gender:

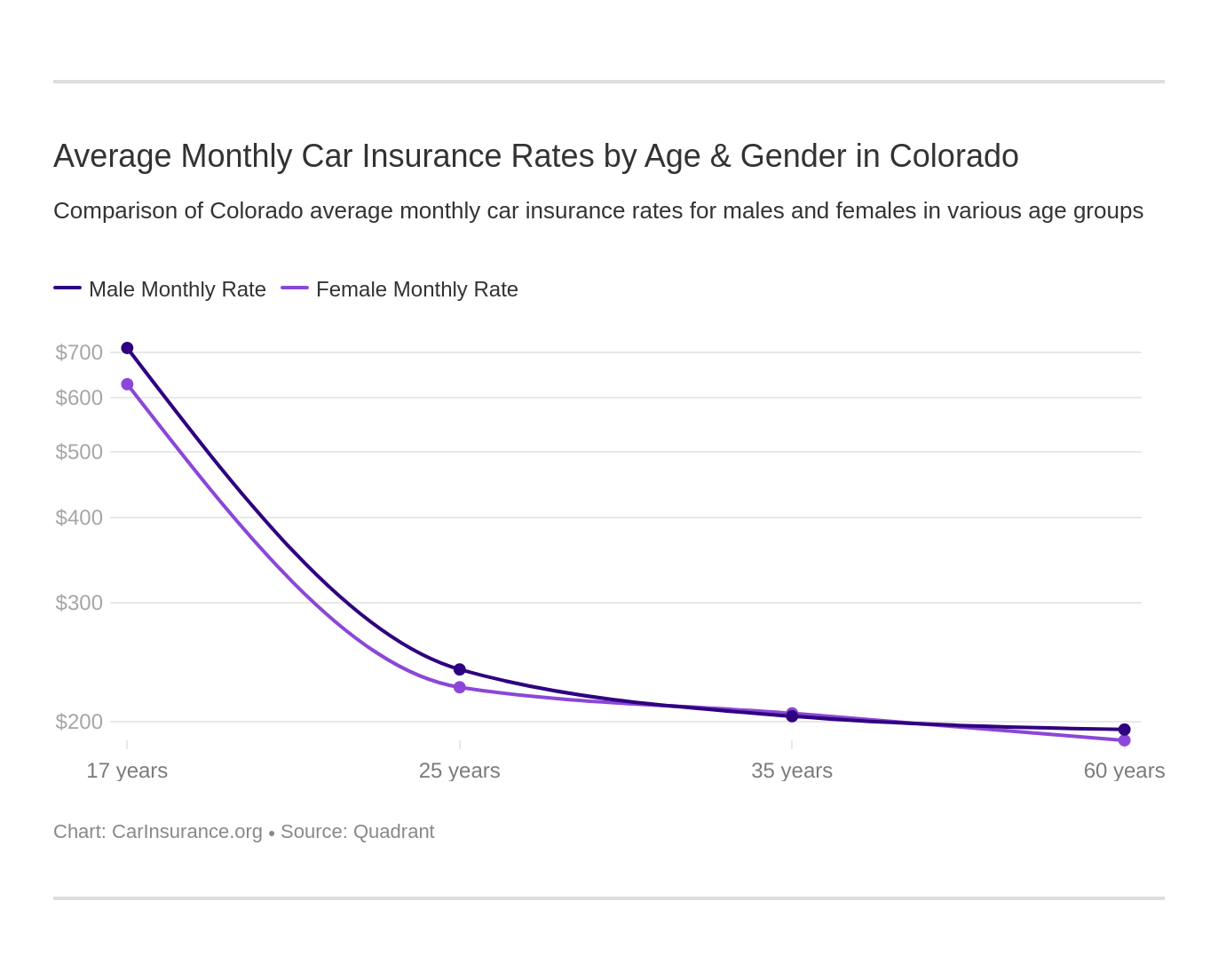

Another factor that can affect car insurance rates is gender. Historically, male drivers have paid higher rates than females due to the perceived higher risk of accidents. However, in recent years this gap has started to close somewhat, and in some states, it is now illegal to charge different rates based on gender. Nevertheless, on average, men still pay slightly more than women.

According to the same 2020 data referenced earlier, the average cost for male drivers is around $1,679 per year, while female drivers pay an average of $1,585 per year. This difference is relatively small compared to some other factors, but it can still add up over time.

Driving Record:

One of the most significant factors that can affect car insurance rates is your driving history. If you've been involved in accidents or received traffic violations in the past, insurers will see you as a higher risk and charge you accordingly. Conversely, if you have a clean driving record, you can expect to pay less for insurance.

Many insurers will look at your driving history for the past three to five years when determining your rates. Some insurers may also offer additional discounts for drivers who complete defensive driving courses or other safe driving programs.

Location:

The location where you live can also have a significant impact on your car insurance rates. If you live in an area with high traffic density or a lot of accidents, you can expect to pay more for insurance. Additionally, factors such as crime rates and weather patterns can also affect rates.

For example, according to data from CarInsurance.org, drivers in Colorado pay an average of $160 per month for insurance, which is higher than the national average. This is due in part to the high rate of accidents and severe weather in the state. Similarly, drivers in major urban areas such as New York and Los Angeles often pay more due to the high volume of traffic and increased risk of accidents.

Vehicle Type:

The type of car you drive can also affect your insurance rates. Generally speaking, more expensive or high-performance cars will cost more to insure, as they are more costly to repair or replace in the event of an accident. Additionally, some vehicles are more likely to be stolen or involved in accidents, which can also increase rates.

On the other hand, if you drive a more affordable or family-friendly car, you can expect to pay less for insurance. Additionally, some insurers offer discounts for vehicles with certain safety features, such as airbags or anti-lock brakes.

Conclusion:

As you can see, there are many factors that can affect car insurance rates. While age and gender are often the most well-known, other factors like driving record, location, and vehicle type can also play a significant role. If you're looking for a way to reduce your insurance costs, it's important to shop around and compare quotes from multiple insurers. Additionally, you may want to consider adjusting your coverage levels or taking advantage of any available discounts or programs.

If you are searching about Average Car Insurance Rates By Age And Gender - Insurance Noon you've came to the right place. We have 8 Images about Average Car Insurance Rates By Age And Gender - Insurance Noon like Review Of Are Car Insurance Rates Higher In California 2022 - SPB, Average Car Insurance Rates By Age And Gender - Insurance Noon and also What Factors Affect My Car Insurance Rates? Age, Gender, Marital Status. Here it is:

Average Car Insurance Rates By Age And Gender - Insurance Noon

insurancenoon.com

insurancenoon.com Average Price Of Car Insurance Per Month - Designby4d

designby4d.blogspot.com

designby4d.blogspot.com businessinsider premiums

Typical UK Insurance Rates By Age And Gender | Auto Advisor

Teenage Car Insurance Average Cost Per Month ~ Artfirstdesign

artfirstdesign.blogspot.com

artfirstdesign.blogspot.com What Factors Affect My Car Insurance Rates? Age, Gender, Marital Status

www.brighthub.com

www.brighthub.com marital

Review Of Are Car Insurance Rates Higher In California 2022 - SPB

starphoenixbase.com

starphoenixbase.com Colorado – CarInsurance.org

www.carinsurance.org

www.carinsurance.org insurance car colorado carinsurance rates arkansas texas gender average monthly age quotes

2022 Car Insurance Rates By Age And Gender - NerdWallet

www.nerdwallet.com

www.nerdwallet.com nerdwallet marder

Typical uk insurance rates by age and gender. Average price of car insurance per month. 2022 car insurance rates by age and gender

0 Comments