Are you tired of paying too much for your car insurance? It seems like every year the rates go up and up, leaving you with less and less money in your pocket. Well, it doesn't have to be that way. There are plenty of ways to save money on car insurance, and we've got 13 of them right here.

1. Shop around

The first and most obvious way to save money on car insurance is to shop around. Don't just settle for the first quote you get - take the time to compare rates from different providers. You might be surprised at how much you can save by switching to a different company.

2. Take a defensive driving course

Taking a defensive driving course can not only make you a safer driver, but it can also lower your car insurance rates. Many insurance companies offer discounts to drivers who have completed an approved defensive driving course, so it's definitely worth looking into.

3. Increase your deductible

Another way to save money on car insurance is to increase your deductible. Your deductible is the amount you pay out of pocket before your insurance kicks in. By raising your deductible, you can lower your monthly premiums. Just be sure you can afford to pay the higher deductible if you do get into an accident.

4. Drive a safer car

Cars with good safety ratings can often get lower insurance rates. If you're in the market for a new car, consider one with a 5-star safety rating. And if you already have a car with a lower safety rating, consider making some safety upgrades to your vehicle. Not only will it provide peace of mind, but it could also save you money on insurance.

5. Bundle your policies

If you have multiple insurance policies - such as home, auto, and life insurance - consider bundling them with one provider. Many insurance companies offer a discount for bundling multiple policies, which can add up to big savings over time.

6. Maintain a good credit score

Believe it or not, your credit score can actually impact your car insurance rates. Insurance companies view individuals with good credit scores as less of a risk, so they often offer lower rates to those with good credit. Make sure you're managing your credit responsibly and keep a close eye on your credit score.

7. Ask about discounts

Many car insurance providers offer discounts that you might not even be aware of. Ask your insurance agent about any discounts that you might qualify for. Some common discounts include:

- Safe driver discounts

- Good student discounts

- Membership discounts (such as AAA or AARP)

- Low mileage discounts

8. Set up automatic payments

Some insurance companies offer discounts for setting up automatic payments. Not only can it save you money, but it can also ensure that you never miss a payment.

9. Review your coverage regularly

It's important to review your car insurance coverage on a regular basis. As your car gets older, you may be able to lower your coverage and save money on your premiums. On the other hand, if you've recently added a new driver to your policy or made other changes, you may need to increase your coverage.

10. Drive less

The less you drive, the less you pay for car insurance. Consider carpooling, taking public transportation, or walking/biking whenever possible. Not only will it save you money on insurance, but it will also be good for your health and the environment.

11. Avoid accidents and tickets

This one might seem obvious, but it's worth mentioning anyway. The more accidents and tickets you have on your driving record, the higher your car insurance rates will be. So drive carefully, obey traffic laws, and avoid distractions while driving.

12. Consider pay-per-mile insurance

For those who don't drive very much, pay-per-mile insurance can be a great option. You pay a base rate plus a few cents per mile, so you only pay for the miles you actually drive. This can be a great way to save money if you don't drive very often.

13. Compare rates annually

Finally, be sure to compare car insurance rates on an annual basis. Your rates can change from year to year, and you might be able to save money by switching providers. Take the time to shop around and see if you can find a better deal.

So there you have it - 13 ways to save money on car insurance. By following these tips, you can lower your premiums and keep more money in your pocket. Happy driving!

If you are searching about 13 Ways to Save On Car Insurance - Dale Adams Automotive you've visit to the right web. We have 8 Pics about 13 Ways to Save On Car Insurance - Dale Adams Automotive like Comparing Car Insurance Rates using the CAA calculator and other, Comparing Car Insurance Rates using the CAA calculator and other and also Insurance Rate Calculator Bc - Mortgage Calculator Canada App for iOS. Read more:

13 Ways To Save On Car Insurance - Dale Adams Automotive

www.daleadams.com

www.daleadams.com insurance car private ways average plan premiums gisa ibc msa insurers source data

Insurance Rate Calculator Bc - Mortgage Calculator Canada App For IOS

ineedudear.blogspot.com

ineedudear.blogspot.com insurance

BC's Long Struggle For Better, More Affordable Car Insurance

www.bcndp.ca

www.bcndp.ca icbc

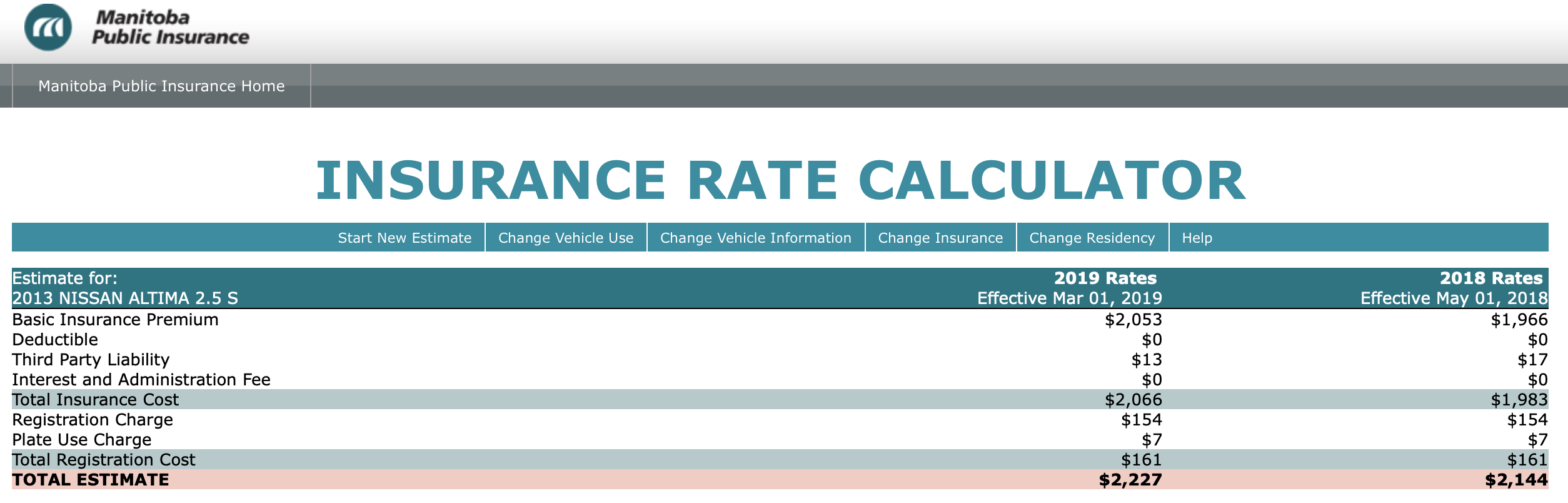

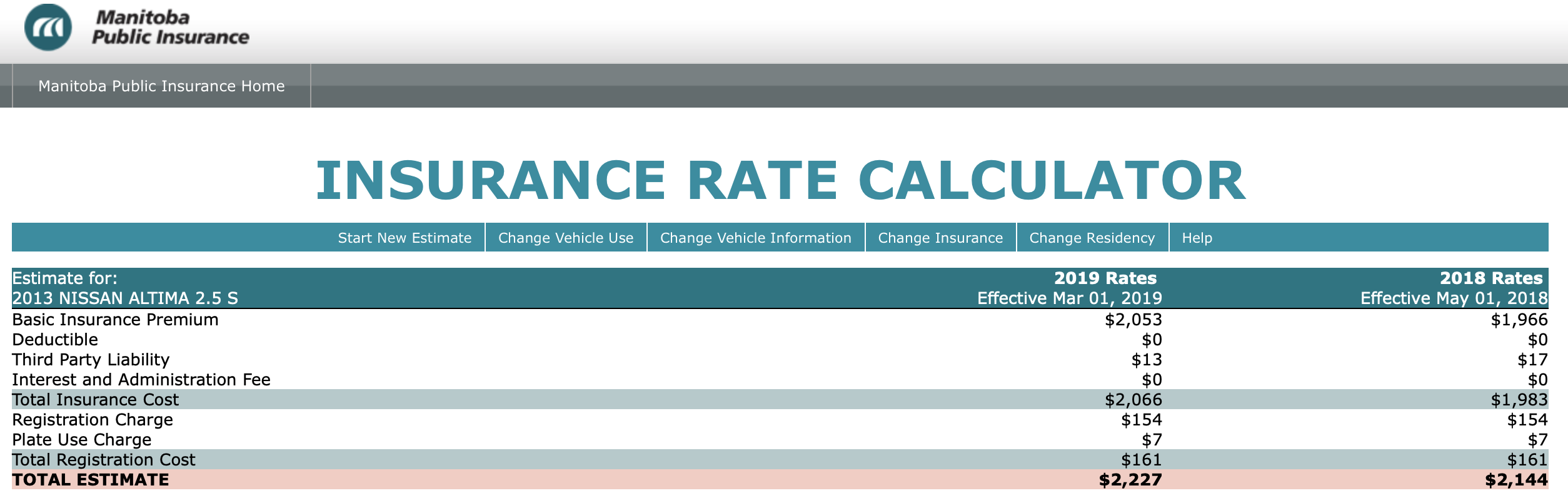

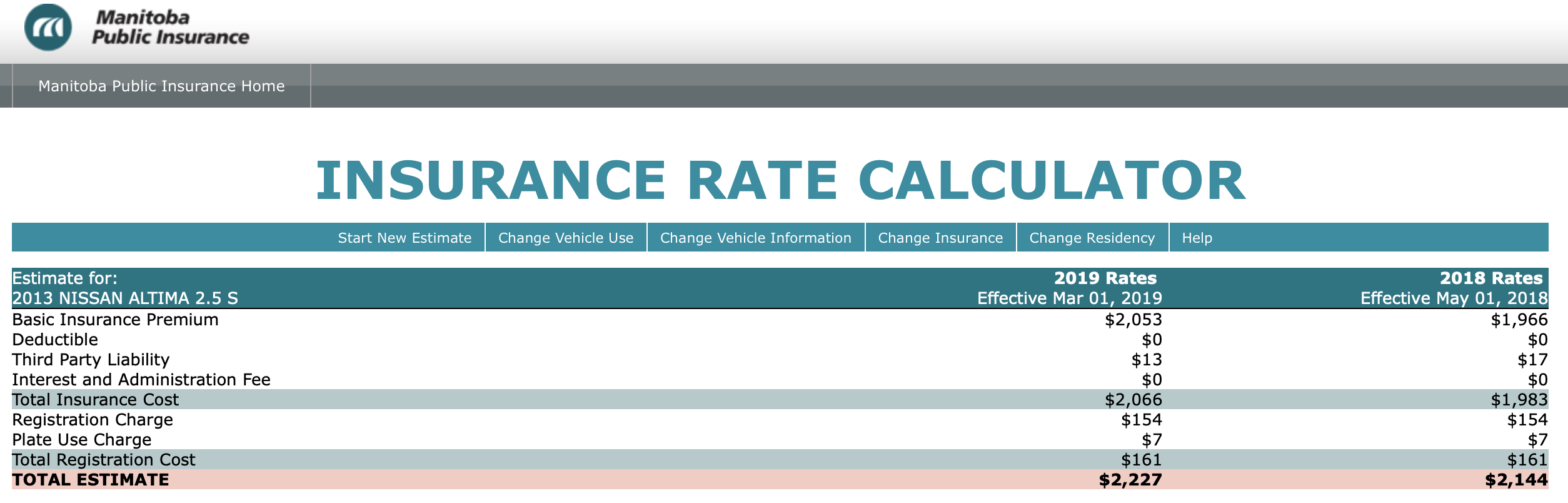

Comparing Car Insurance Rates Using The CAA Calculator And Other

chrisalemany.ca

chrisalemany.ca calculator rates caa sources

Comparing Car Insurance Rates Using The CAA Calculator And Other

chrisalemany.ca

chrisalemany.ca calculator rates caa sources emmt

Awasome Car Insurance Calculator Bc References - SPB

starphoenixbase.com

starphoenixbase.com Car Insurance Calculator Bc - All Insurances

allinsurancesforyou.blogspot.com

allinsurancesforyou.blogspot.com rates

How To Calculate Car Insurance Premium Formula : Pdf Do We Need A New

amandarecord83.blogspot.com

amandarecord83.blogspot.com insurance calculate calculation excel

Insurance car private ways average plan premiums gisa ibc msa insurers source data. Car insurance calculator bc. Bc's long struggle for better, more affordable car insurance

0 Comments