Florida Auto Insurance: The Ultimate Guide for Finding the Best Rates in 2021 If you're a Florida driver, you probably know that car insurance can be expensive in our state. But did you know that you don't have to pay top dollar for coverage? By doing your research and shopping around, you can find affordable auto insurance that meets your needs. To help you get started on your search for the best car insurance rates in Florida, we've compiled a list of resources and tips. From understanding minimum coverage requirements to knowing what factors affect your premiums, this guide has everything you need to know about auto insurance in the Sunshine State. Understanding Florida Auto Insurance Requirements As a Florida driver, it's important to understand the minimum auto insurance requirements. According to Florida law, all drivers must carry two types of coverage: - Property Damage Liability (PDL): This coverage pays for damage you cause to someone else's property in a car accident. The minimum PDL coverage in Florida is $10,000. - Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages if you're injured in a car accident, regardless of who is at fault. The minimum PIP coverage in Florida is $10,000. While PIP and PDL are the only types of coverage required by law, most drivers choose to purchase additional coverage for added protection. Here are some of the most common types of optional coverage you may want to consider: - Bodily Injury Liability (BIL): This coverage pays for injuries you cause to another person in a car accident. It's important to note that BIL is not required by law in Florida, but it is required in most other states. - Collision Coverage: This coverage pays for damage to your vehicle if you're in an accident. Collision coverage is typically required if you're leasing or financing your car. - Comprehensive Coverage: This coverage pays for damage to your vehicle from non-accident-related incidents, such as theft, vandalism, or severe weather. - Uninsured Motorist Coverage: This coverage protects you if you're in an accident with someone who doesn't have insurance. It can also provide coverage if you're the victim of a hit-and-run accident. Factors that Affect Your Auto Insurance Premiums When determining your auto insurance premiums, insurance companies consider a variety of factors. Some of the most common factors that can affect your rates include: - Driving Record: Your driving history is one of the most significant factors that can impact your auto insurance rates. Drivers with clean driving records are typically rewarded with lower premiums. - Age: Young drivers are statistically more likely to be involved in car accidents, so they typically pay higher premiums than older drivers. - Car Model: The make and model of your car can also affect your auto insurance rates. High-end luxury cars typically cost more to insure than standard sedans. - Location: Where you live can also impact your auto insurance rates. If you live in a high-crime area or an area prone to natural disasters, you may pay higher premiums. - Credit Score: In most states, including Florida, insurance companies are allowed to use your credit score to determine your auto insurance rates. Drivers with higher credit scores typically pay lower premiums. Tips for Finding Affordable Auto Insurance in Florida Now that you understand the basics of Florida auto insurance, here are some tips that can help you find affordable coverage: - Shop Around: The best way to find the lowest auto insurance rates is to shop around and compare quotes from multiple insurance companies. - Bundle Your Policies: Many insurance companies offer discounts if you bundle your auto insurance with other types of coverage, such as homeowners or renters insurance. - Raise Your Deductible: A higher deductible means you'll pay more out of pocket if you're in an accident, but it also means you'll pay lower monthly premiums. - Ask for Discounts: Many insurance companies offer discounts for good driving habits, safe vehicles, and other factors. Don't be afraid to ask your insurance agent about potential discounts. - Maintain Good Credit: As we mentioned earlier, maintaining a good credit score can help you save money on auto insurance. Take steps to improve your credit score, such as paying off debt and avoiding late payments. Final Thoughts While car insurance can be expensive in Florida, there are plenty of ways to find affordable coverage. By understanding the minimum coverage requirements, knowing what factors impact your rates, and shopping around for quotes, you can find the best car insurance rates in Florida that meet your budget and needs. Remember to review your policy periodically to ensure you're still getting the best deal and coverage for your money.

If you are looking for Average Cost Car Insurance ~ news word you've visit to the right page. We have 8 Pics about Average Cost Car Insurance ~ news word like Auto Insurance Rates Increases in Florida - ValuePenguin, 10 Best car insurance rates in Florida | Cheap Car Insurance Tampa and also Auto Insurance Rates Increases in Florida - ValuePenguin. Here it is:

Average Cost Car Insurance ~ News Word

lovewordssss.blogspot.com

lovewordssss.blogspot.com rates equity hurul

Who Has The Cheapest Auto Insurance Quotes In Florida?

www.valuepenguin.com

www.valuepenguin.com cheapest

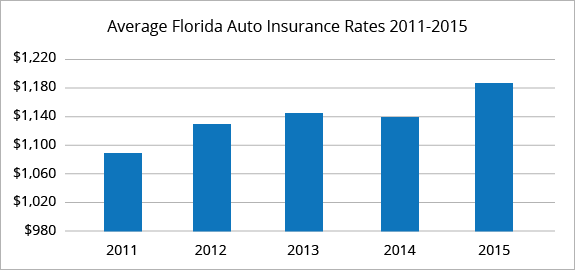

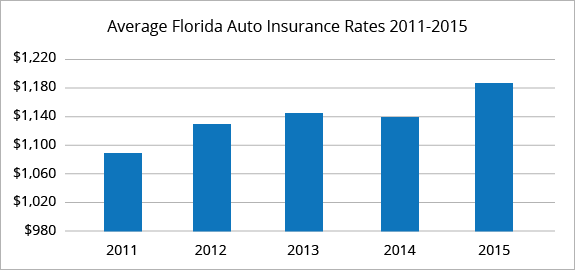

Auto Insurance Rates Increases In Florida - ValuePenguin

www.valuepenguin.com

www.valuepenguin.com increases hikes valuepenguin

10 Best Car Insurance Rates In Florida | Cheap Car Insurance Tampa

cheapcarinsurancetampa.net

cheapcarinsurancetampa.net List Of Car Insurance Companies In Miami Fl - Classic Car Walls

classiccarwalls.blogspot.com

classiccarwalls.blogspot.com insurance car rates miami fl quotewizard companies list florida

Best Cheap Car & Auto Insurance In Florida 2020

www.johnnyjet.com

www.johnnyjet.com insurance florida car cheap auto

How To Get Some Of The Best Car Insurance Rates? | Everything Finance

everythingfinanceblog.com

everythingfinanceblog.com Best Car Insurance Rates In Florida | Car Insurance, Cheap Car

www.pinterest.com

www.pinterest.com Rates equity hurul. Increases hikes valuepenguin. Average cost car insurance ~ news word

lovewordssss.blogspot.com

lovewordssss.blogspot.com  www.valuepenguin.com

www.valuepenguin.com  cheapcarinsurancetampa.net

cheapcarinsurancetampa.net  classiccarwalls.blogspot.com

classiccarwalls.blogspot.com  www.johnnyjet.com

www.johnnyjet.com  everythingfinanceblog.com

everythingfinanceblog.com  www.pinterest.com

www.pinterest.com

0 Comments