In today's world, we all want to save some extra bucks on our expenses and car insurance is no different. We all yearn for the cheapest possible car insurance rates, but what factors actually affect those rates? One of the most intriguing factors is our gender. Yes, my dear friend, car insurance can be affected by gender. In this article, we will be discussing some fascinating facts about car insurance rates and how age and gender play a significant role in determining those rates. Let's begin with some basics; car insurance is a legal requirement in most states in the US. It not only protects you but also other drivers on the road in case of an accident. Now, when it comes to determining the car insurance rates, some crucial factors come into play, such as your driving history, age, gender, marital status, credit score, and type of car you own. Among all of these factors, gender and age are often deemed to be the most controversial ones. Speaking of gender, the first thing that comes to mind is that men are more likely to be involved in an accident than women. Statistically speaking, men have a higher chance of getting into an accident as compared to women, and thus it was believed that men should pay a higher car insurance rate. However, in recent years, the tables have turned, and more and more insurance companies have started to offer gender-neutral car insurance rates. The primary reason why this change has come about is due to the law. Lawsuits were filed claiming that gender-based car insurance rates were gender discrimination. Several states in the US declared gender-based car insurance rates illegal practices, and since then, more and more insurance companies have started offering gender-neutral rates to comply with the law. So, if gender-based car insurance rates are illegal, how do insurance companies determine the rates? Well, the next crucial factor that comes into play is age. Insurance companies use a statistical model and your driving history to determine your car insurance rate. Age is a crucial factor in the statistical model. Young drivers aged between 18 to 25 are considered high-risk drivers, and thus they are charged higher rates. This is because younger drivers tend to have less experience on the road, and they are more likely to engage in risky driving behavior. On the other hand, older drivers aged 55 and above are considered less risky drivers, and thus they are often charged lower rates. Now the question arises, what about the drivers who fall between the age group of 25 and 55 years? Well, the car insurance rates for drivers in this age group mainly depend on the type of car they own, their driving history, and other factors such as their credit score and marital status. Although age is still a significant factor, your driving history plays a crucial role in determining your car insurance rate. So, does that mean that if you are a young driver, you will always be charged higher rates? Not necessarily. There are ways to bring down your car insurance rates, even if you are a young driver. Here are some tips to help you save on your car insurance rates: 1. Drive safely: Your driving record is one of the most important factors in determining your car insurance rate. If you have a clean driving history, you are more likely to get a lower rate. 2. Choose a safe car: The type of car you own can also affect your car insurance rate. If you own a car that is considered safe and has a high safety rating, you are more likely to get a lower rate. 3. Take a defensive driving course: Taking a defensive driving course can help you improve your driving skills and can also help you save on your car insurance rates. 4. Increase your deductible: Increasing your deductible can help you save on your car insurance rates. However, make sure that you can afford to pay the deductible in case of an accident. 5. Compare rates: Always compare car insurance rates from different insurance companies before choosing one. This will help you find the cheapest possible rate. In conclusion, age and gender do play a significant role in determining car insurance rates. However, with the changing laws and practices of insurance companies, gender-based car insurance rates are slowly becoming a thing of the past. Age remains a crucial factor, but your driving history, type of car you own, and other factors such as marital status and credit score also come into play. So, always drive safely, choose a safe car, and compare rates to find the cheapest possible car insurance rate.

If you are looking for Does age or gender affect my car insurance rate? - EZ Insurance Agency you've came to the right page. We have 8 Pictures about Does age or gender affect my car insurance rate? - EZ Insurance Agency like The surprising impact of age, gender and marriage on car insurance, Which Gender Pays More for Car Insurance? and also Does age or gender affect my car insurance rate? - EZ Insurance Agency. Here it is:

Does Age Or Gender Affect My Car Insurance Rate? - EZ Insurance Agency

ezinsuranceagency.com

ezinsuranceagency.com car insurance bill gender affect rate age does calculator due consider factors affordable looking main when admin sep

Which Gender Pays More For Car Insurance?

clovered.com

clovered.com Gender Equality For Drivers In Massachusetts May Mean Higher Premiums

www.tapinjury.com

www.tapinjury.com gender equality massachusetts premiums drivers higher mean some

2022 Car Insurance Rates By Age And Gender - NerdWallet

www.nerdwallet.com

www.nerdwallet.com nerdwallet marder

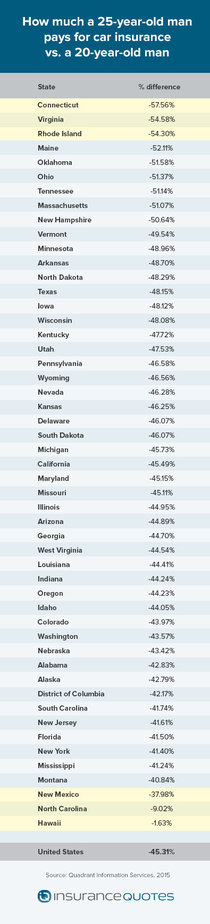

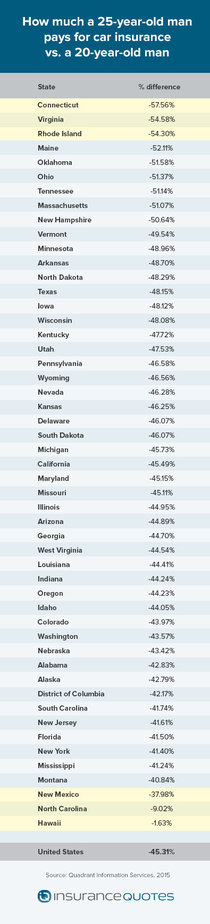

The Surprising Impact Of Age, Gender And Marriage On Car Insurance

www.insurancequotes.com

www.insurancequotes.com insurancequotes premiums

Gender And Car Insurance [infographic] | Car Insurance Uk, Car

![Gender and car insurance [infographic] | Car insurance uk, Car](https://i.pinimg.com/originals/ac/e7/0b/ace70bb068b75e65b08fcf6c143c3f24.jpg) www.pinterest.com

www.pinterest.com diyetyemekleri autoinsurance

In California, Gender Can No Longer Be Considered In Setting Car

www.nytimes.com

www.nytimes.com Does Gender Affect Car Insurance?

www.quoteme.ie

www.quoteme.ie affect callaghan

Nerdwallet marder. Gender equality for drivers in massachusetts may mean higher premiums. Gender equality massachusetts premiums drivers higher mean some

ezinsuranceagency.com

ezinsuranceagency.com  clovered.com

clovered.com  www.tapinjury.com

www.tapinjury.com  www.nerdwallet.com

www.nerdwallet.com  www.insurancequotes.com

www.insurancequotes.com ![Gender and car insurance [infographic] | Car insurance uk, Car](https://i.pinimg.com/originals/ac/e7/0b/ace70bb068b75e65b08fcf6c143c3f24.jpg) www.pinterest.com

www.pinterest.com  www.nytimes.com

www.nytimes.com  www.quoteme.ie

www.quoteme.ie

0 Comments