Auto insurance rates across the country have been a constant topic of discussion among drivers and policyholders. The cost of car insurance is influenced by a variety of factors, including the driver's age, driving history, and the type of vehicle being insured. However, other variables such as location, weather, and vehicle theft rates can also affect the cost of auto insurance and premiums.

Auto Insurance Rates Increases in Florida

Florida has the highest auto insurance rates in the country, with drivers paying an average of $2,639 a year. The high rate is due to the state's no-fault insurance system, which requires drivers to carry personal injury protection (PIP) coverage. PIP coverage can be costly, and drivers often end up paying more for auto insurance as a result.

Do You Know What Determines Your Auto Insurance Rates?

There are several factors that determine auto insurance rates, including the driver's age, driving record, and the type of vehicle being insured. However, other variables such as credit score, location, and the time of day the vehicle is driven can also impact premiums. Therefore, it is important for drivers to be aware of the factors that contribute to their auto insurance rates and take steps to reduce costs.

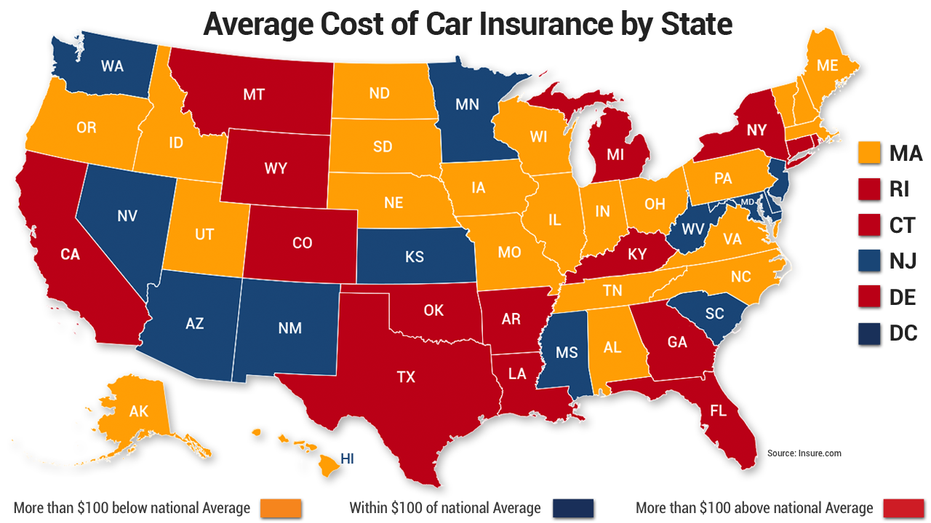

Car Insurance Costs by State

The cost of car insurance can vary significantly from state to state, with some states having much higher rates than others. According to a recent survey, Michigan has the highest auto insurance rates in the country, with drivers paying an average of $2,878 per year. Other states with high rates include Louisiana, Florida, and New York.

Car Insurance Rate Ranges Between $693-$1604 in Milwaukee, WI

The cost of car insurance in Milwaukee, Wisconsin varies widely, with drivers paying anywhere from $693 to $1604 per year. The cost of insurance is influenced by a variety of factors, including the driver's age, driving record, and vehicle type. However, other factors such as location, weather, and the prevalence of vehicle theft in the area can also impact premiums.

What Is 6 Month Premium Car Insurance

6-month premium car insurance is a type of insurance policy that lasts for six months rather than the typical 12-month term. This type of policy is available in some states and can be a good option for drivers who have a temporary need for insurance. However, 6-month policies can often be more expensive than 12-month policies and may not offer the same level of coverage.

Car Insurance Prices Highest In History

Car insurance prices in the United States are currently at an all-time high, with rates increasing for two-thirds of drivers. The increase is largely due to the rising cost of auto repairs and medical care, as well as an increase in the number of accidents on the road. However, there are steps drivers can take to reduce their insurance rates, such as opting for a higher deductible or taking a defensive driving course.

Auto Insurance Rates by Regions in America

The cost of auto insurance can vary significantly by region in the United States. For example, drivers in the West tend to pay more for insurance than those in other regions. This is due in part to the higher cost of repairs and medical care in the West. Other factors that can impact insurance rates by region include weather patterns, traffic congestion, and the prevalence of auto theft in the area.

Trump calls out Louisiana's high car insurance rates

President Trump recently called out Louisiana's high car insurance rates and urged the state to take steps to reduce costs. Louisiana has some of the highest insurance rates in the country, with drivers paying an average of $2,300 per year. The state's high rate is due in part to the prevalence of uninsured drivers and a legal system that allows for large insurance payouts in the event of an accident. However, there are steps the state can take to reduce costs, such as cracking down on uninsured drivers and implementing tort reform.

If you are looking for Auto Insurance Rates Increases in Florida - ValuePenguin you've visit to the right web. We have 8 Pictures about Auto Insurance Rates Increases in Florida - ValuePenguin like Do You Know What Determines Your Auto Insurance Rates? - Velox® Insurance, What Is 6 Month Premium Car Insurance - momodesignsaus and also Do You Know What Determines Your Auto Insurance Rates? - Velox® Insurance. Read more:

Auto Insurance Rates Increases In Florida - ValuePenguin

increases hikes valuepenguin

Car Insurance Rate Ranges Between $693-$1604 In Milwaukee, WI

insurance car rate 1604 milwaukee ranges wi between cost

Auto Insurance Rates By Regions In America - 480-246-1930 In The Midst

regions

What Is 6 Month Premium Car Insurance - Momodesignsaus

howmuch

Car Insurance Costs By State | Money

insurance car costs auto state money states rate premiums

Do You Know What Determines Your Auto Insurance Rates? - Velox® Insurance

Trump Calls Out Louisiana's High Car Insurance Rates | Fox Business

insurance car rates louisiana high fox calls trump business state clicking go

Car Insurance Prices Highest In History, Up For Two Thirds Of Drivers

insurance thezebra thirds drivers highest prices history two car zebra downloaded roll credit used assets

Insurance car rate 1604 milwaukee ranges wi between cost. Insurance thezebra thirds drivers highest prices history two car zebra downloaded roll credit used assets. Do you know what determines your auto insurance rates?

0 Comments