Car insurance is a necessary expense for most people who own a vehicle. It provides financial protection against accidents, theft, and other unexpected events that can cause property damage or bodily harm. The cost of car insurance can vary widely depending on a number of factors, including the driver's age, driving record, location, and type of car. In this post, we'll take a closer look at car insurance rates by state and explore some of the factors that affect the cost of car insurance.

Car Insurance Rates by State

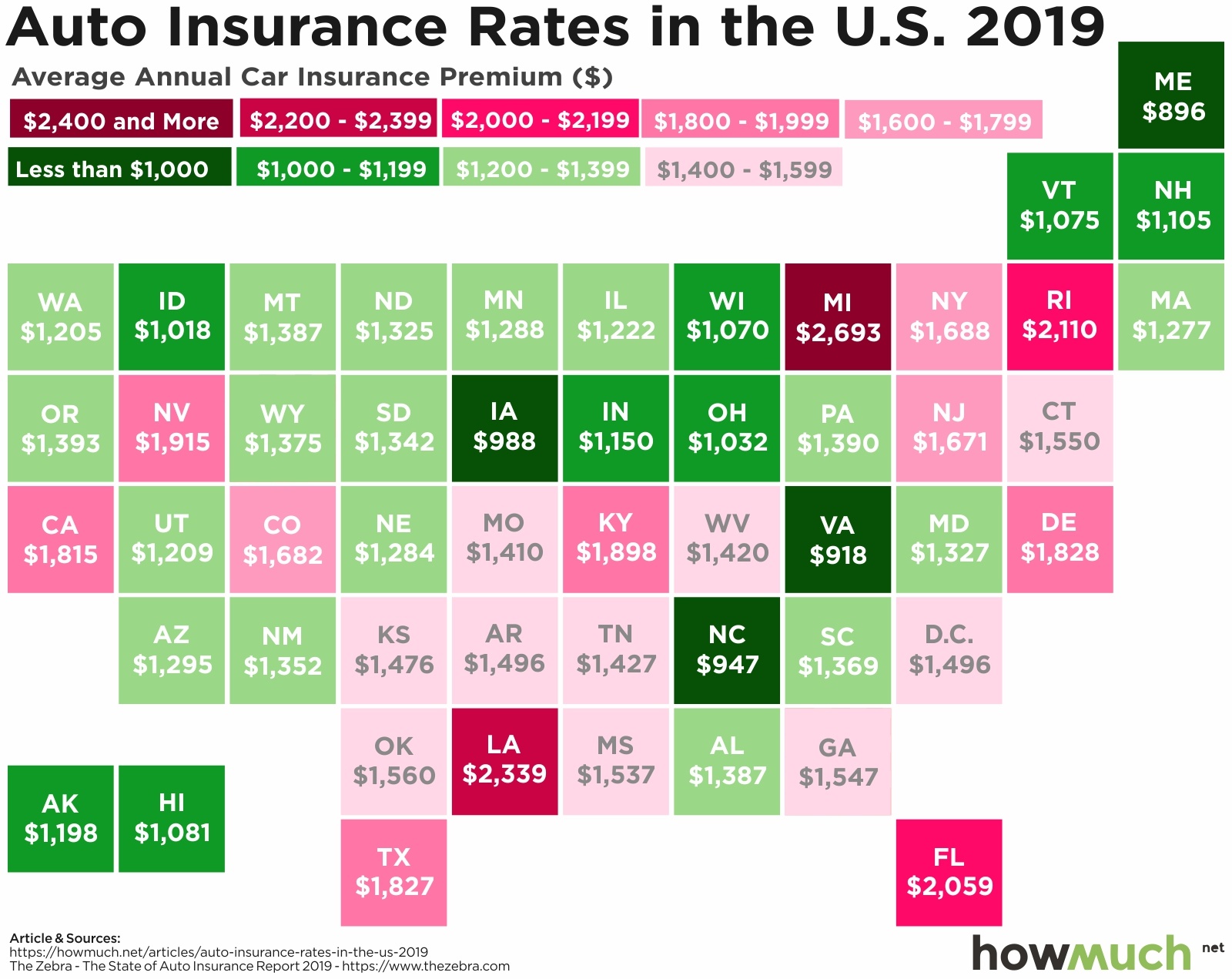

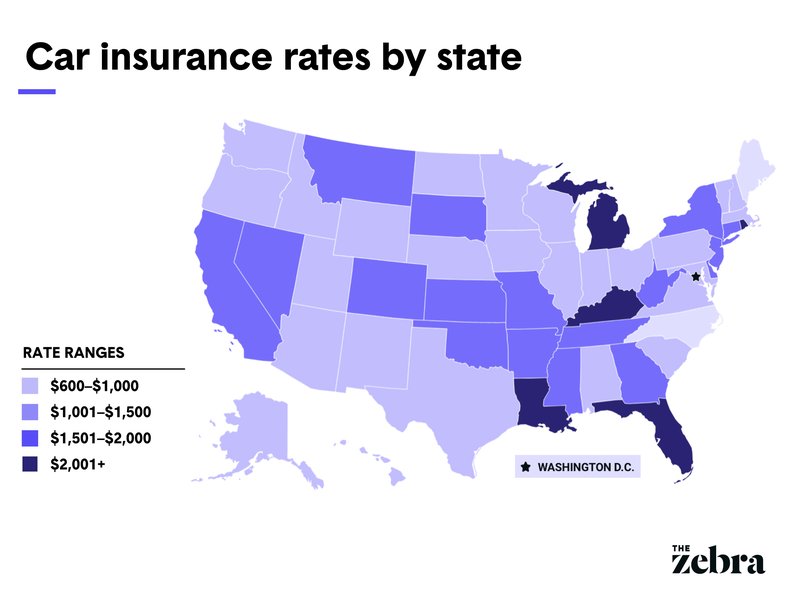

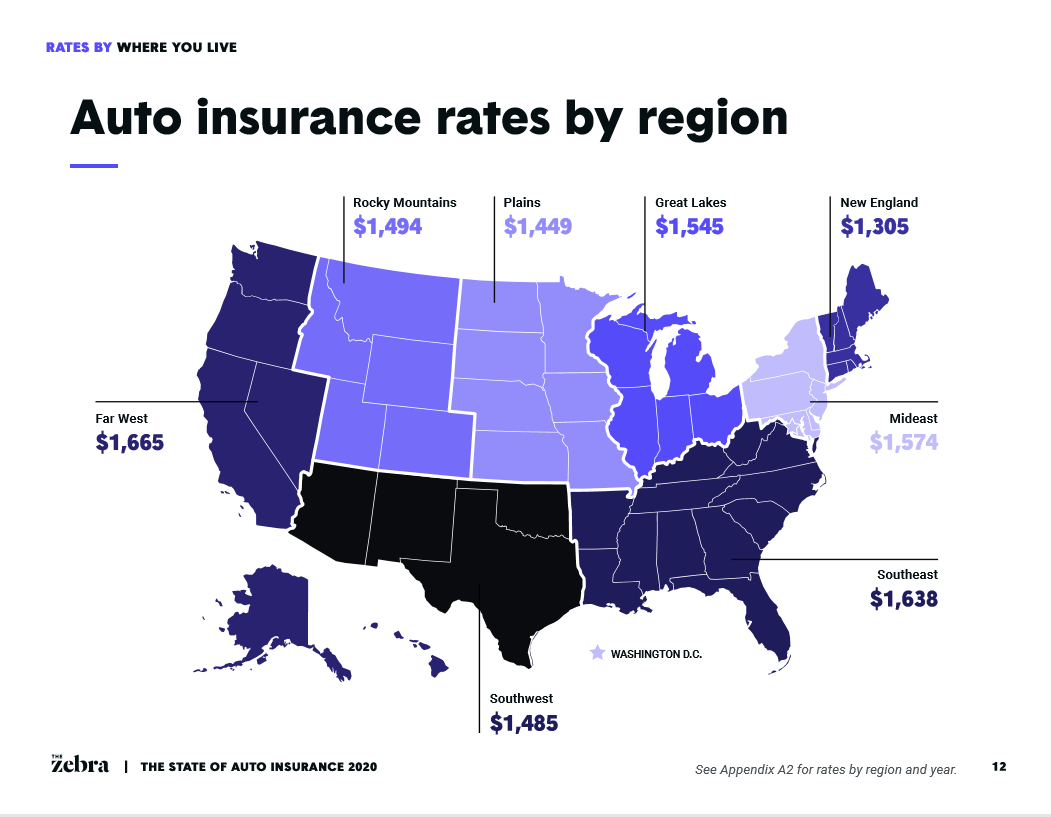

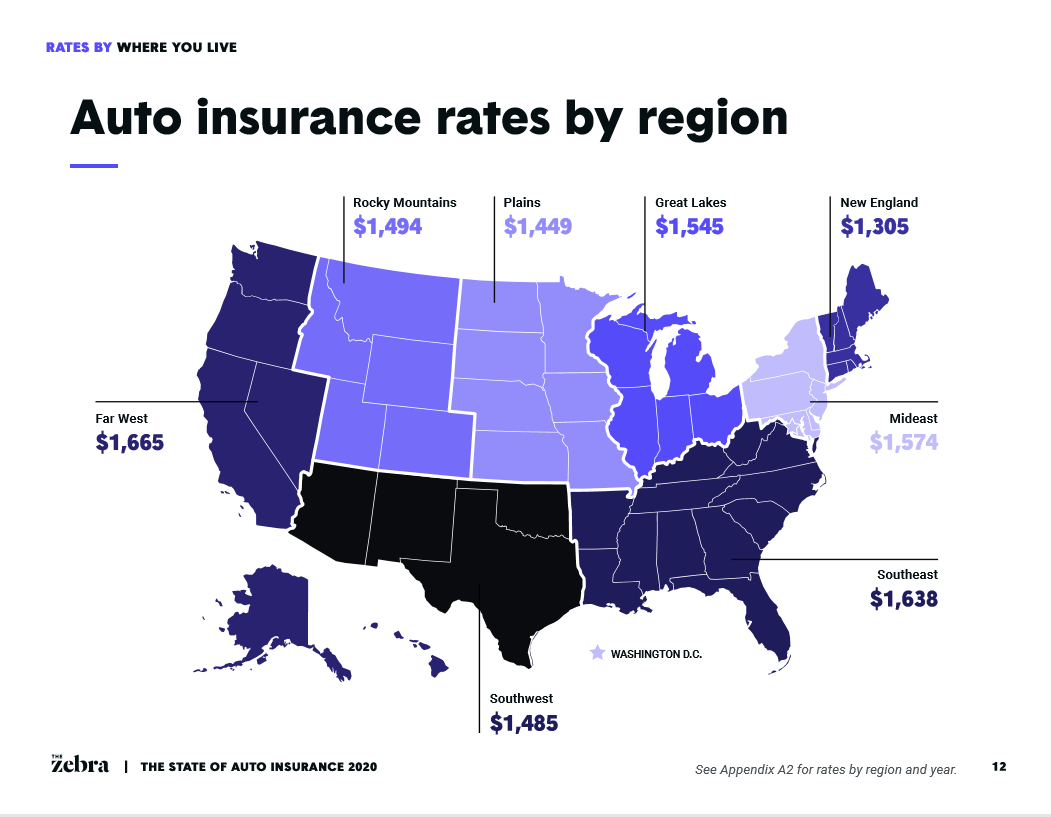

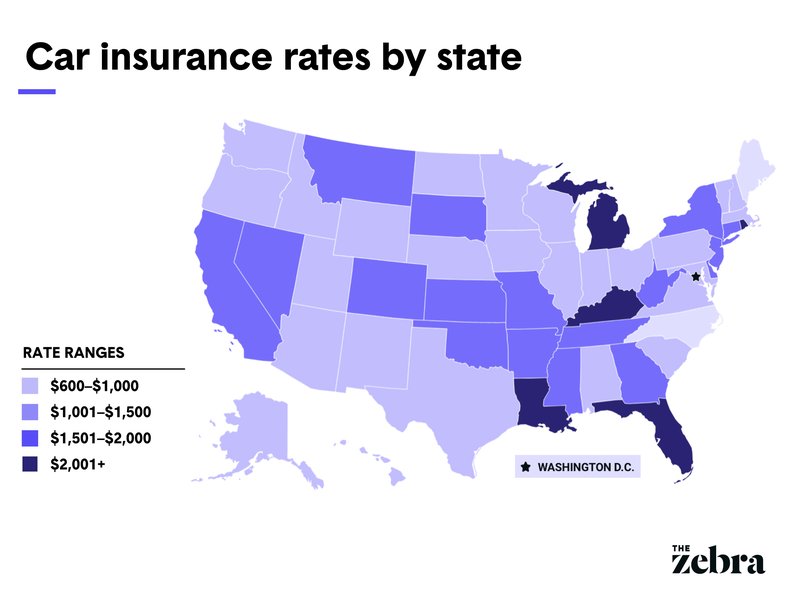

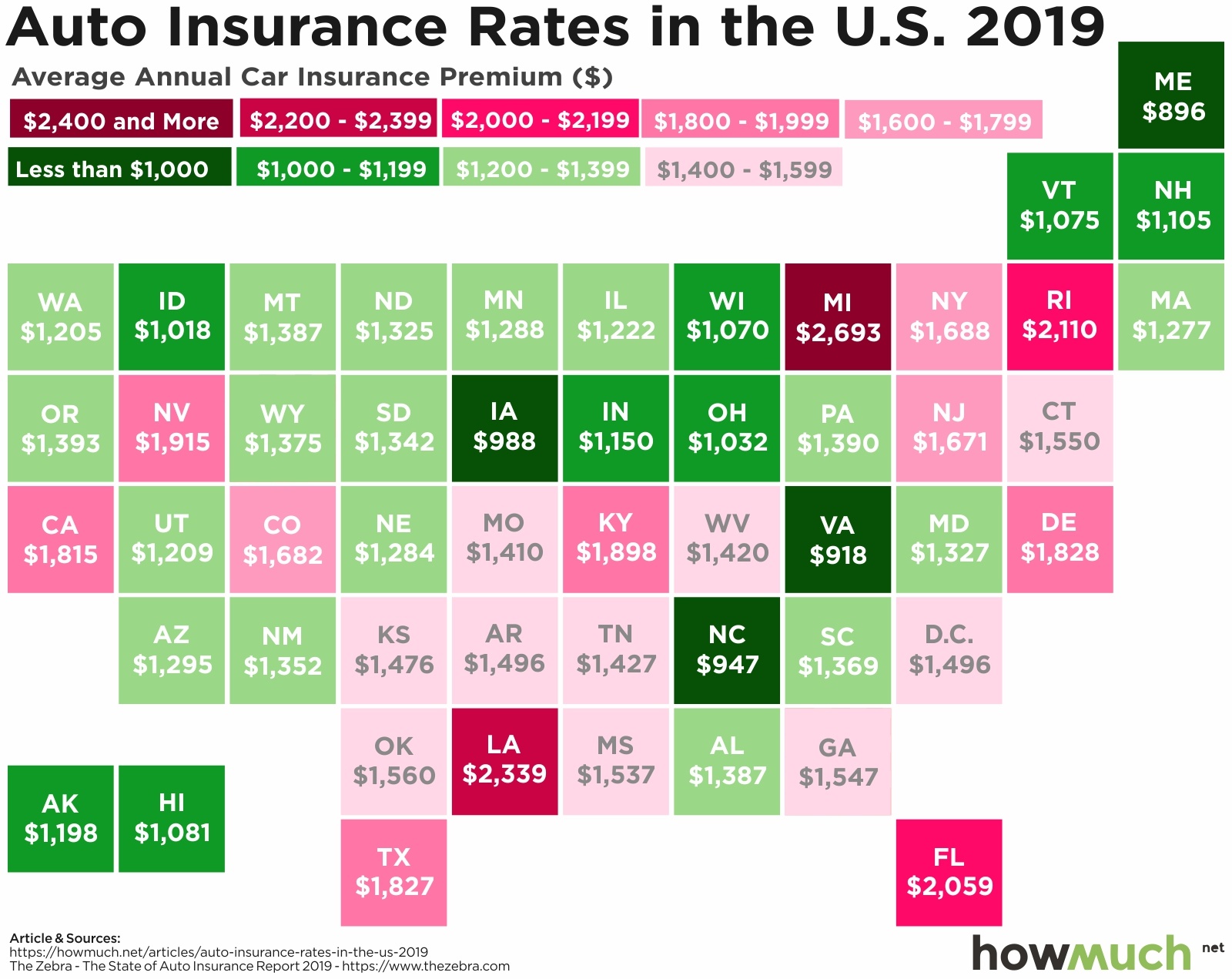

One of the biggest factors that affects the cost of car insurance is the state where you live. Some states have significantly higher car insurance rates than others, due to factors like population density, accident rates, and state regulations. Here's a closer look at car insurance rates by state:

California

California is known for having some of the highest car insurance rates in the country. The average cost of car insurance in California is $1,731 per year, which is significantly higher than the national average of $1,311. Factors that contribute to higher car insurance rates in California include high population density, elevated crime rates in some areas, and state regulations that require higher levels of coverage.

Florida

Florida is another state that's known for having high car insurance rates. The average cost of car insurance in Florida is $2,059 per year, which is significantly higher than the national average. Some factors that contribute to higher car insurance rates in Florida include high population density, a high number of uninsured drivers, and a higher incidence of fraud and staged accidents.

Texas

Texas is one of the largest states in the country, with a diverse population and a range of driving conditions. The average cost of car insurance in Texas is $1,589 per year, which is slightly higher than the national average. Some factors that can contribute to higher car insurance rates in Texas include higher accident rates in some areas, a higher number of uninsured drivers, and state regulations that require higher levels of coverage.

Virginia

Virginia is one of the few states where car insurance rates are actually lower than the national average. The average cost of car insurance in Virginia is $1,276 per year, which is significantly below the national average. Factors that contribute to lower car insurance rates in Virginia include a lower population density, lower accident rates in some areas, and state regulations that allow drivers to opt for lower levels of coverage.

Michigan

Michigan is another state where car insurance rates are significantly higher than the national average. The average cost of car insurance in Michigan is $2,878 per year, which is more than double the national average. Factors that contribute to higher car insurance rates in Michigan include high accident rates, no-fault insurance laws that drive up costs, and a high number of uninsured drivers.

Other Factors That Affect Car Insurance Rates

While the state where you live is one of the biggest factors that affects the cost of car insurance, there are other factors that can also have a significant impact on your rates. Here are some of the most important factors to consider:

Driving Record

If you have a history of accidents or moving violations on your driving record, you can expect to pay higher car insurance rates. Insurance companies view these types of incidents as an increased risk factor, and may charge you more for coverage as a result. On the other hand, if you have a clean driving record, you may be eligible for lower car insurance rates and other discounts.

Type of Car

The type of car you drive can also have a significant impact on your car insurance rates. Cars that are more expensive or have high-performance features are generally more expensive to insure, because they are more expensive to repair or replace in the event of an accident. On the other hand, cars that are known for safety and reliability may qualify for lower car insurance rates.

Deductible

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Generally, higher deductibles result in lower monthly premiums, because you are assuming more of the risk yourself. However, if you have a high deductible and are involved in an accident, you may end up paying more out-of-pocket than you would with a lower deductible. It's important to find a deductible that strikes a balance between your monthly premium and your potential out-of-pocket costs in the event of an accident.

In Conclusion

Car insurance rates vary widely depending on a number of factors, including where you live, your driving record, the type of car you drive, and your deductible. While these factors can all have a significant impact on your car insurance rates, there are steps you can take to reduce your costs and secure the coverage you need. By shopping around for the best rates, maintaining a clean driving record, and choosing a car that is known for safety and reliability, you can find the right car insurance policy for your needs and budget.

If you are searching about Auto Insurance Rates by Regions in America - 480-246-1930 In the midst you've visit to the right web. We have 8 Pictures about Auto Insurance Rates by Regions in America - 480-246-1930 In the midst like 137 reference of Auto Insurance Rates By State | Car insurance, Car, Car Insurance Prices Highest In History, Up For Two Thirds of Drivers and also Car Insurance Costs by State | Money. Here you go:

Auto Insurance Rates By Regions In America - 480-246-1930 In The Midst

2passdd.com

2passdd.com require

Auto Insurance Rates Increases In Florida - ValuePenguin

increases hikes valuepenguin

Cheapest Car Insurance For A Bad Driving Record (2022)

quotewizard.com

quotewizard.com cheapest accidents quotewizard

Compare Car Insurance Rates Online [April 2020]

![Compare Car Insurance Rates Online [April 2020]](https://promoneysavings.com/wp-content/uploads/2019/12/compare-car-insurance-rates-states1-640x336.png) promoneysavings.com

promoneysavings.com Car Insurance Costs By State | Money

money.com

money.com insurance car costs auto state money states rate premiums

137 Reference Of Auto Insurance Rates By State | Car Insurance, Car

www.pinterest.ca

www.pinterest.ca huffingtonpost

Car Insurance Prices Highest In History, Up For Two Thirds Of Drivers

www.thezebra.com

www.thezebra.com insurance thezebra drivers highest thirds prices history two car zebra downloaded roll credit used assets

What Do Americans Pay For Car Insurance In 2019? – Investment Watch

www.investmentwatchblog.com

www.investmentwatchblog.com insurance car state auto cost rates average pay costs states highest americans premiums digg

Auto insurance rates increases in florida. Car insurance costs by state. 137 reference of auto insurance rates by state

0 Comments