Hey, my peeps! How's everyone doing? Today, I want to talk to y'all about something that affects all of us - car insurance rates. Now, we all know that car insurance is a necessary expense for all of us who own cars, but did you know that the rates can vary based on your zip code? That's right, the rates can change depending on where you live.

Auto Insurance Rates By Zip Code

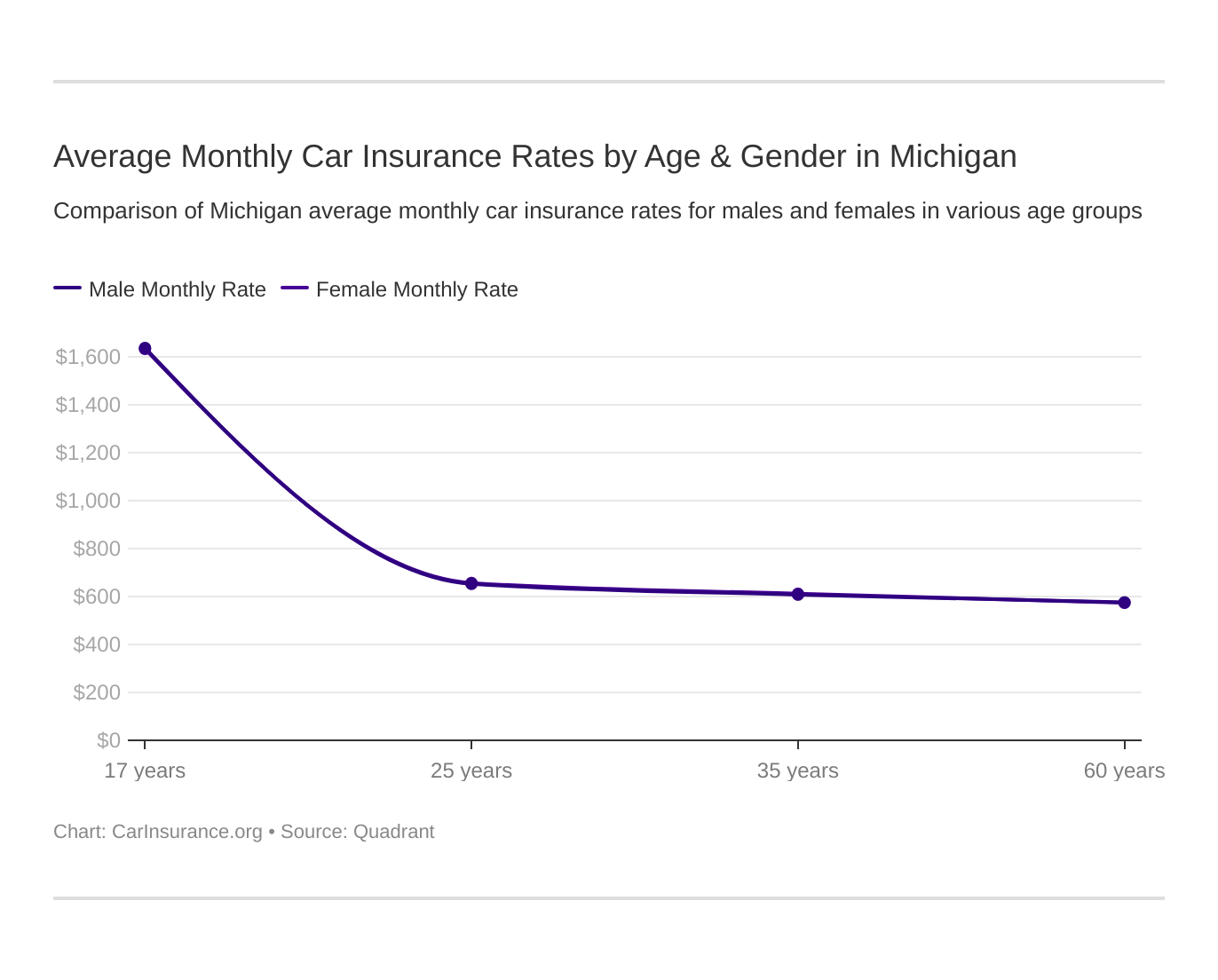

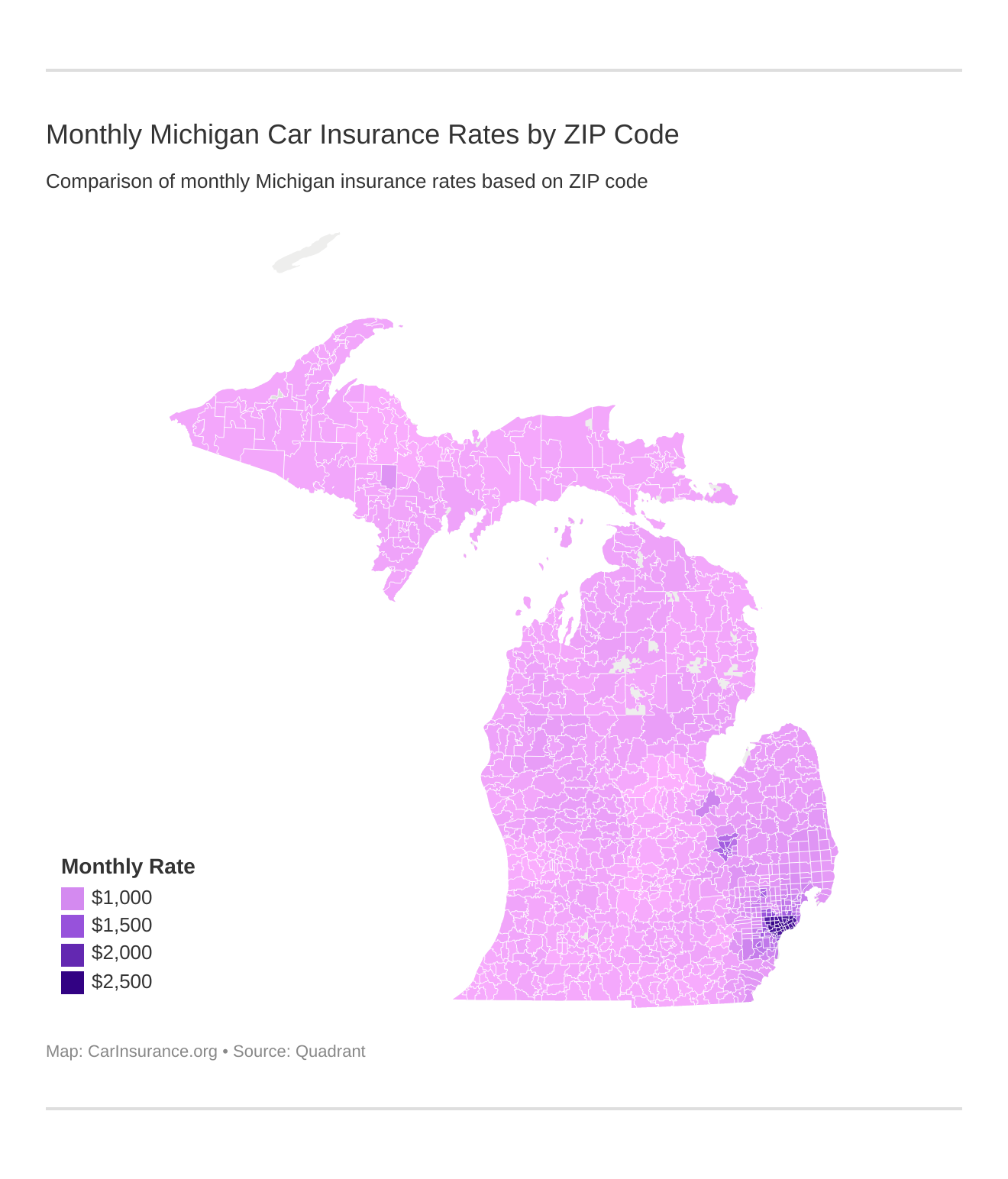

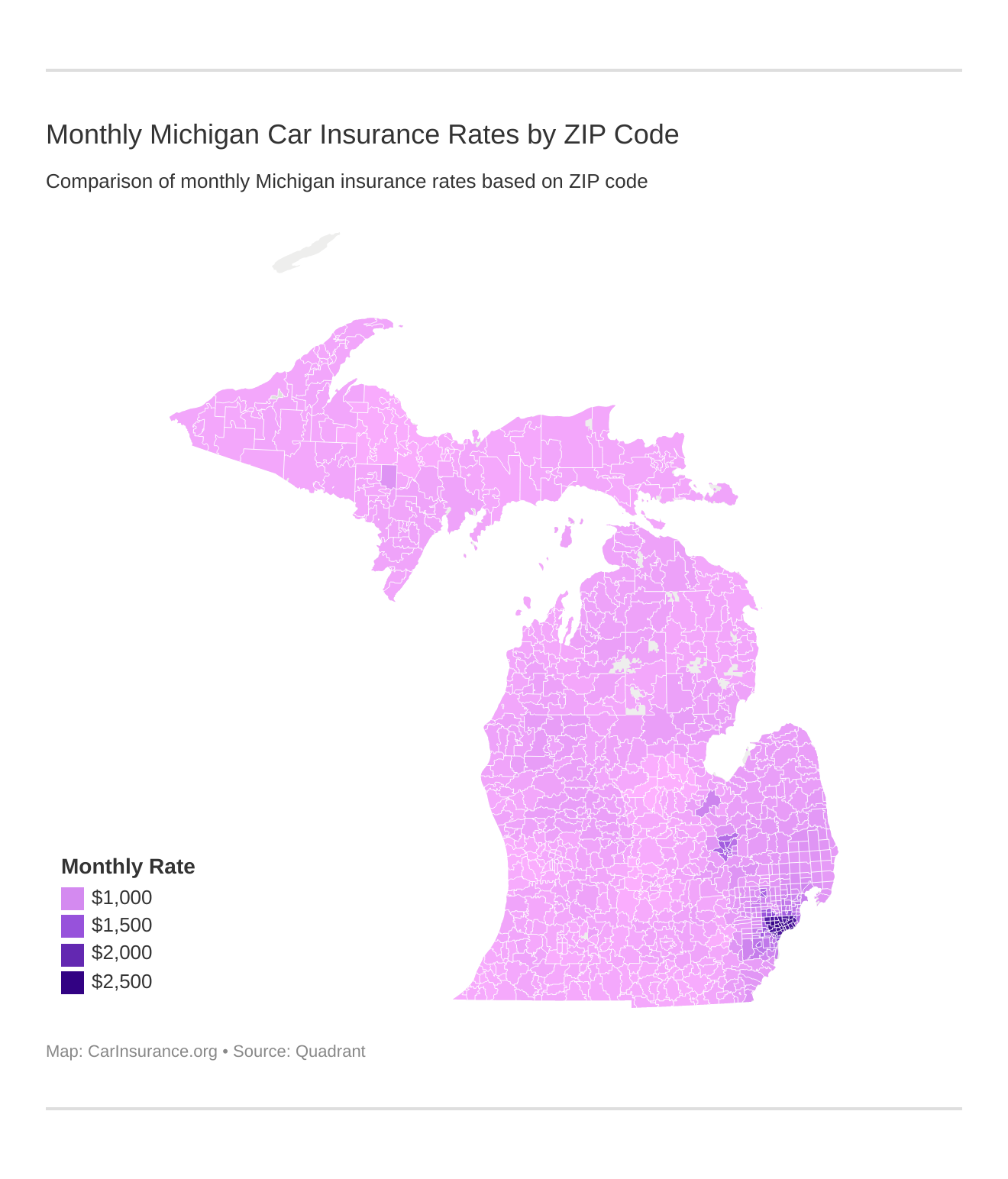

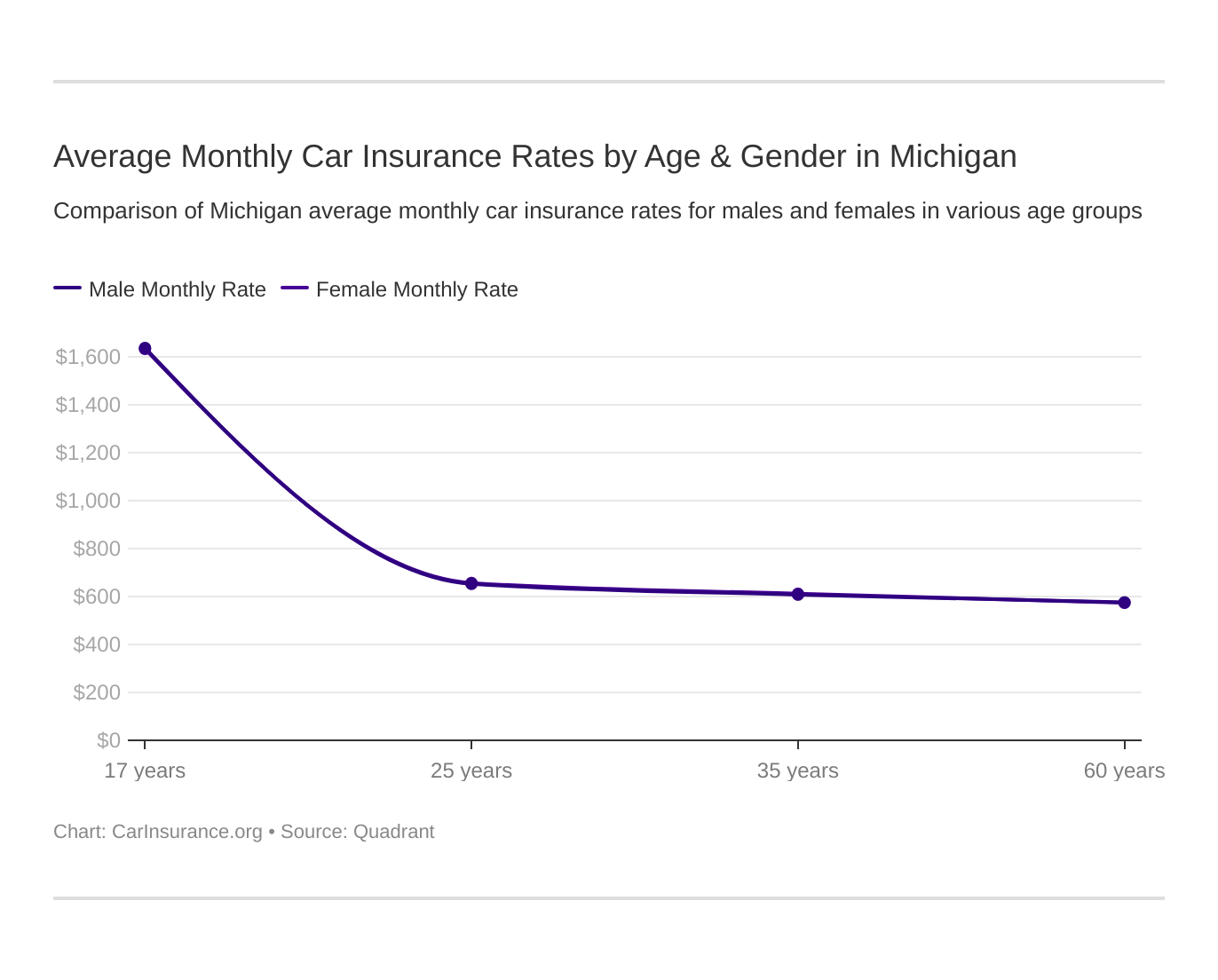

Let's talk about why this happens. You see, insurance rates are determined by a lot of factors, such as age, gender, driving record, and the type of car you drive. But one other major factor that comes into play is where you live. This is because the accident rate, the crime rate, and the number of uninsured drivers can vary drastically from one zip code to another.

For example, if you live in a zip code where there are a lot of accidents, your insurance rates will be higher. This is because insurance companies know that they are more likely to have to pay out claims in those areas. Similarly, if you live in a zip code where there is a high crime rate, your car is more likely to be stolen or damaged, which means that your insurance rates will be higher.

Michigan Car Insurance Rates

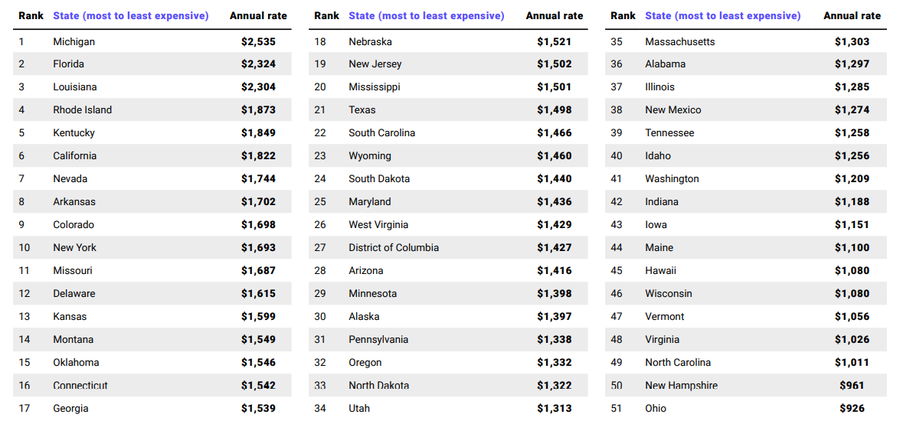

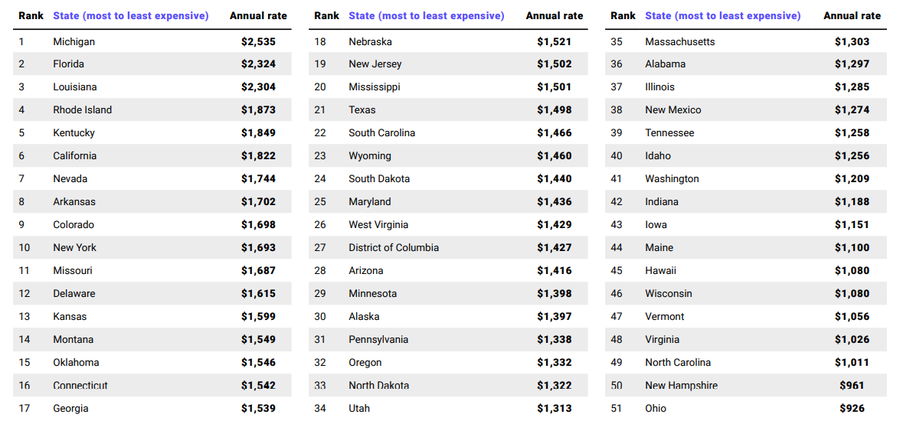

Now, let's talk about the specific case of Michigan. If you live in Michigan, you might have noticed that your car insurance rates are some of the highest in the country. In fact, Michigan has consistently ranked as the state with the highest car insurance rates in the US.

So, why is this? Well, the main reason is that Michigan is a no-fault state, which means that insurance companies are required to pay out unlimited personal injury protection benefits to anyone who is injured in a car accident, regardless of who is at fault. As you can imagine, this can get very expensive for the insurance companies, and they pass that cost onto the consumers in the form of higher premiums.

Cape Coral Car Insurance

But Michigan is not the only place where insurance rates can vary drastically based on the zip code. Let's take a look at Cape Coral in Florida, for example. If you live in Cape Coral, you might be paying more for your car insurance than people who live in neighboring towns. Why is that?

Well, one reason is that Cape Coral has a higher than average number of accidents per capita. This means that insurance companies are more likely to have to pay out claims in that area, and they pass that cost onto the consumers. Additionally, Cape Coral has a high number of uninsured drivers, which means that if you get into an accident with one of those drivers, your insurance company might have to pay out more than if the other driver was insured.

Michigan Car Insurance Rates Decline by 18%

Now, it's not all bad news. If you live in Michigan, you might be happy to learn that car insurance rates have been declining in recent years. In fact, according to a recent report, car insurance rates in Michigan have declined by 18% since 2018. This is great news for all of us who have been struggling to pay those high premiums.

But even with this decline, Michigan still has some of the highest car insurance rates in the country, so it's important to shop around and compare prices if you're looking for a better deal.

30 Day Car Insurance In Michigan

So, what can you do to lower your car insurance rates? Well, one option is to look for short-term policies. For example, you might consider getting a 30-day car insurance policy instead of a full year policy. This can be a good option if you don't drive very often or if you're only in Michigan temporarily.

Another option is to look for discounts. Many insurance companies offer discounts for things like good driving habits, multiple cars, or bundling your car insurance with other types of insurance, such as homeowner's insurance.

Which ZIP Codes Have the Cheapest Auto Insurance Rates?

Finally, it's important to remember that not all zip codes are created equal when it comes to car insurance rates. Some zip codes have much cheaper rates than others. If you're looking for the cheapest car insurance rates, you might want to consider moving to one of these zip codes.

Now, I know that moving just to save on car insurance rates might not be the most practical option for everyone. But if you're already planning on moving, it's definitely something to keep in mind.

Why Does Your ZIP Code Matter So Much for Auto Insurance Rates?

So, why does your zip code matter so much when it comes to auto insurance rates? Well, as I mentioned earlier, it all comes down to risk. Insurance companies use complex algorithms to determine how much of a risk you are based on a variety of factors, including your zip code.

So, if you live in a zip code with a high risk of accidents, crime, or uninsured drivers, your rates will be higher. On the other hand, if you live in a zip code with a low risk of those things, you might be able to get cheaper rates.

At the end of the day, car insurance is never going to be cheap, but there are things you can do to lower your rates. By understanding how insurance companies determine your rates and shopping around for the best deals, you can save yourself a lot of money in the long run.

Thanks for reading, my friends. Stay safe out there on the roads!

If you are looking for Michigan Car Insurance Rates Decline by 18% But Are Still the Highest you've came to the right web. We have 8 Pictures about Michigan Car Insurance Rates Decline by 18% But Are Still the Highest like Why Does Your ZIP Code Matter So Much for Auto Insurance Rates?, Report: Michigan still has highest car insurance rates in US... and also Which ZIP Codes Have the Cheapest Auto Insurance Rates?. Here you go:

Michigan Car Insurance Rates Decline By 18% But Are Still The Highest

wdet.org

wdet.org insurance michigan rates car decline highest still country but wdet thezebra

30 Day Car Insurance In Michigan : Best Cheap Car Insurance In Michigan

motogp-news-hot.blogspot.com

motogp-news-hot.blogspot.com Cape Coral Car Insurance - Get A Quote From Your Local Cape Coral Agent

lncinsuranceproviders.com

lncinsuranceproviders.com insurance car coral cape zip florida rates codes code

Report: Michigan Still Has Highest Car Insurance Rates In US...

www.clickondetroit.com

www.clickondetroit.com Why Does Your ZIP Code Matter So Much For Auto Insurance Rates?

www.insurancepanda.com

www.insurancepanda.com Michigan Car Insurance (Rates + Companies) – CarInsurance.org

www.carinsurance.org

www.carinsurance.org insurance car auto michigan rates california ohio dakota north carinsurance gender average monthly age autoinsurance

Which ZIP Codes Have The Cheapest Auto Insurance Rates?

www.insurancepanda.com

www.insurancepanda.com insurance zip cheapest codes auto rates which premiums impacts code car

Auto Insurance Rates By Zip Code - Auto Insurance How Rates Vary By Zip

epaaderr.blogspot.com

epaaderr.blogspot.com insurance average brstatic

Insurance car auto michigan rates california ohio dakota north carinsurance gender average monthly age autoinsurance. Michigan car insurance (rates + companies) – carinsurance.org. Report: michigan still has highest car insurance rates in us...

0 Comments