The cost of auto insurance is a topic that is often discussed by professionals, and for good reason. It is an important aspect of car ownership, as it provides financial protection in the event of an accident or other damages. However, navigating the world of auto insurance can be overwhelming, particularly when it comes to understanding the factors that influence rates. In this post, we'll take a look at some of the key factors that can impact auto insurance rates and offer some tips for finding the best coverage at an affordable price.

Cheapest Car Insurance for a Bad Driving Record

If you have a bad driving record, getting affordable car insurance can be a challenge. However, it's not impossible. There are steps you can take to find coverage that fits your needs and budget. One of the first things you should do is shop around. Auto insurance rates can vary widely from one provider to the next, so it's important to get quotes from several different companies. Additionally, consider adjusting your coverage limits or raising your deductibles to save money on premiums.

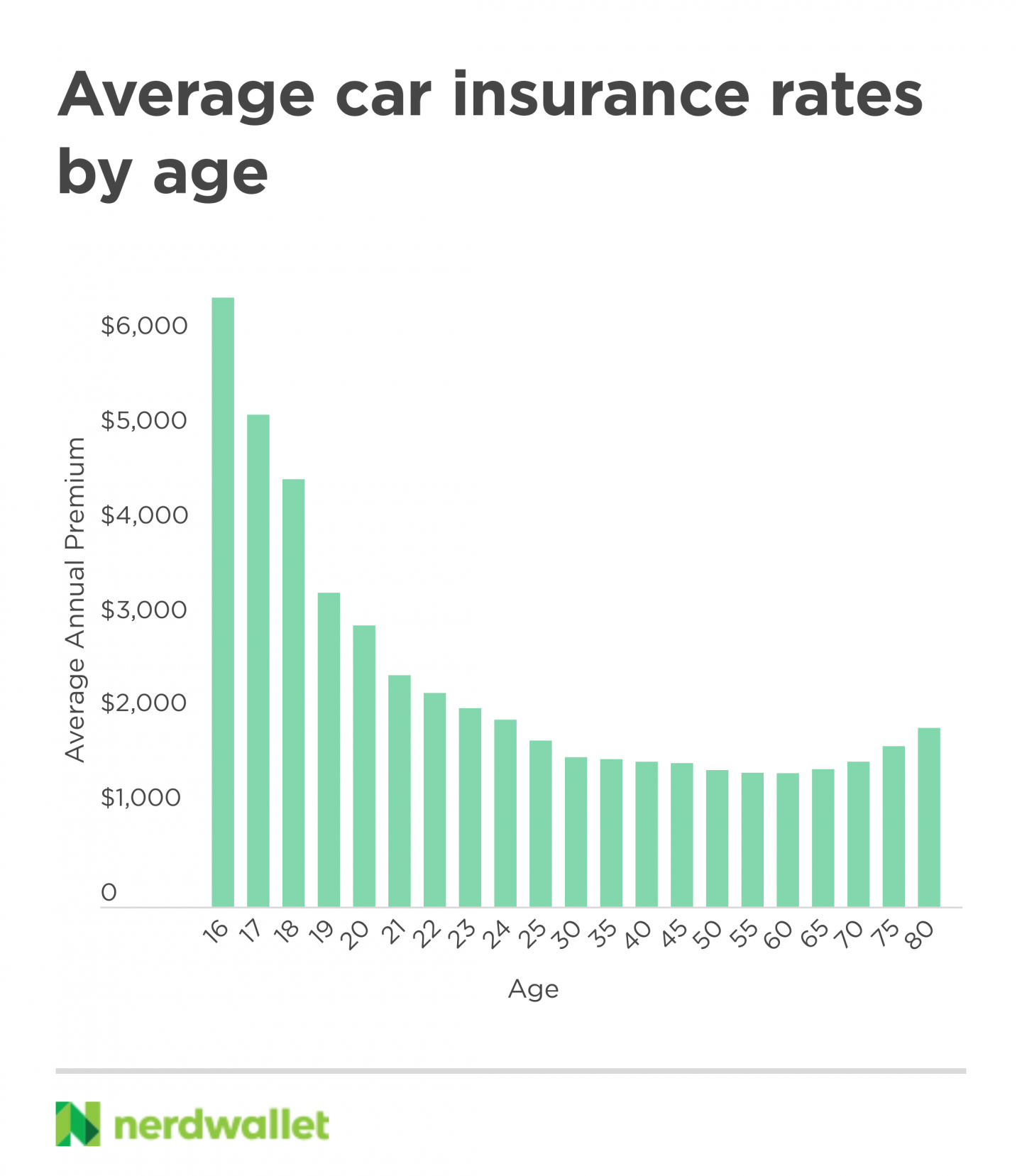

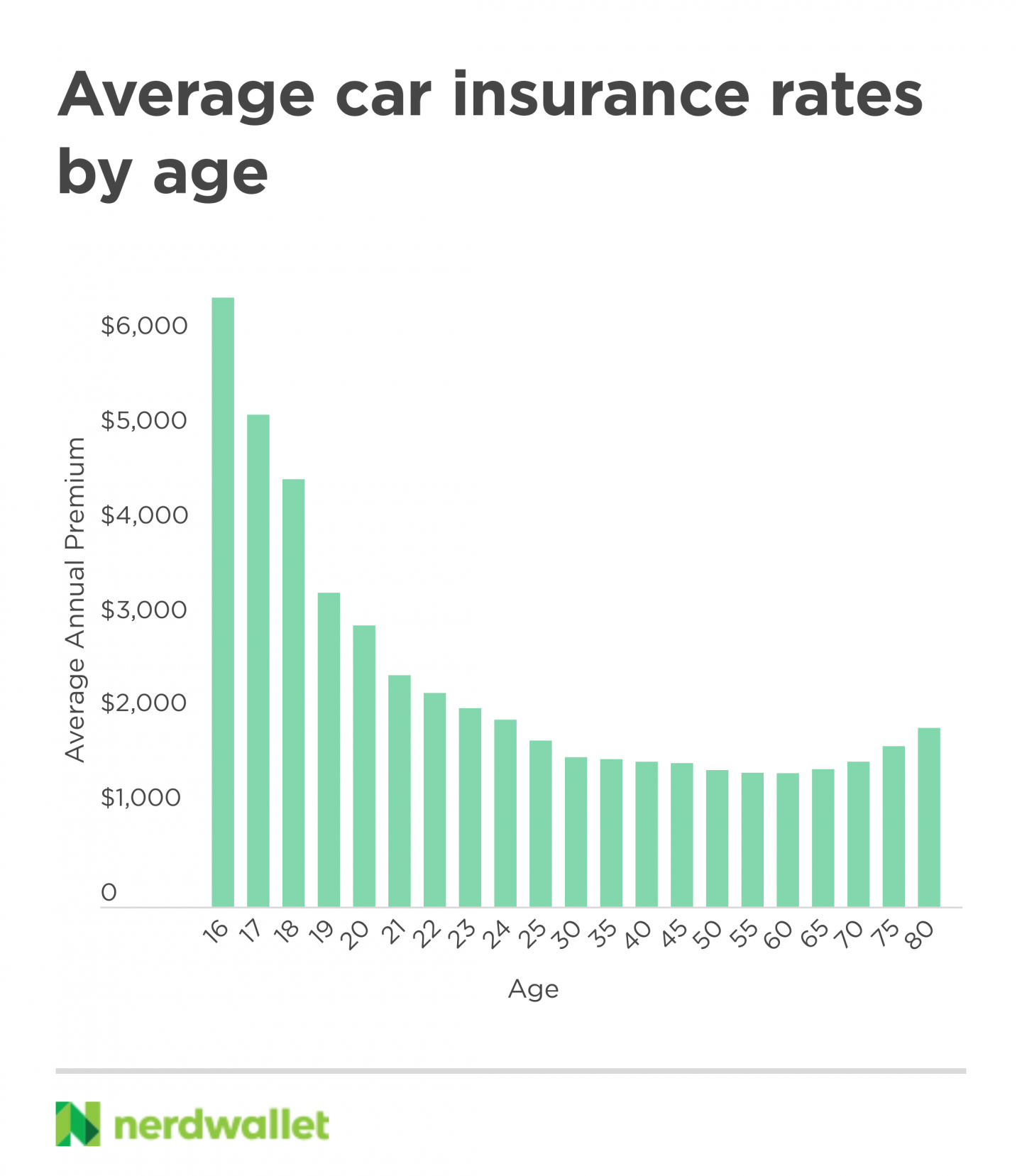

2021 Car Insurance Rates by Age and Gender

Your age and gender can also impact your car insurance rates. Insurance companies use statistical data to assess risk, and certain age and gender groups may be viewed as higher risk than others. For example, younger drivers who are considered to be inexperienced are often charged higher rates, as are males who tend to be involved in more accidents than females. However, there are ways to mitigate these factors and find affordable coverage. Consider taking a safe driving course or purchasing a vehicle with advanced safety features to help lower your rates.

Average Cost of Car Insurance

The average cost of car insurance can vary depending on a number of factors, including your location, driving record, and the type of vehicle you drive. According to data from the National Association of Insurance Commissioners, the average cost of car insurance in the United States is around $1,000 per year. However, rates can vary widely from state to state, and within different regions of the same state. It's important to shop around and compare rates from multiple providers to ensure you're getting the best coverage at an affordable price.

The Best Car Insurance Rates

Finding the best car insurance rates requires some research and analysis. One of the first things you should do is determine the type of coverage you need. There are several different types of coverage available, including liability, collision, and comprehensive coverage. Each type of coverage has its own set of benefits and drawbacks, so it's important to understand what you're getting before making a decision. Additionally, look for providers that offer discounts for safe driving, multiple policies, or other factors that may impact your rates.

What Affects Car Insurance Rates? 4 Surprising Factors That Increase Rates

There are many factors that can impact car insurance rates, some of which may be surprising. One of the most significant factors is your credit score. Insurance companies use credit scores as a way to predict risk, with those who have lower scores being viewed as higher risk. Additionally, the type of car you drive can impact your rates. Vehicles that are expensive to repair or replace may be charged higher rates, as are vehicles that are considered to be high performance or high risk.

Auto Insurance Rates Increases in Florida

If you live in Florida, you may have noticed that auto insurance rates have been on the rise in recent years. This is due in part to the state's no-fault insurance system, which requires drivers to carry personal injury protection coverage. However, there are steps you can take to keep your rates from skyrocketing. For example, consider raising your deductibles, reducing your coverage limits, or taking advantage of discounts offered by your provider.

Why should you invest in Car Insurance Rate Comparison Websites?

Car insurance rate comparison websites can be a valuable tool for finding the best coverage at the most affordable price. These websites allow you to compare rates from multiple providers side by side, making it easier to identify the most competitive rates. Additionally, many comparison websites offer additional tools and resources to help you make informed decisions about coverage and pricing. When using a comparison website, be sure to provide accurate and complete information to ensure that you're getting an accurate quote.

Auto Insurance Rates by Regions in America

Auto insurance rates can vary widely depending on where you live. Factors such as population density, crime rates, and weather patterns can all impact rates. For example, drivers who live in urban areas may be charged higher rates due to increased risk of accidents and theft, while drivers in rural areas may be charged lower rates. Additionally, drivers in areas that are more prone to natural disasters, such as hurricanes or tornadoes, may be charged higher rates to account for the increased risk of damage to their vehicles.

In conclusion, auto insurance rates can be influenced by a wide range of factors, from your driving record and age to the type of vehicle you drive and where you live. However, by taking the time to understand these factors and comparing rates from multiple providers, you can find coverage that fits your needs and budget. Consider factors such as coverage limits and deductibles, as well as any available discounts or savings opportunities. By being proactive and informed, you can get the coverage you need at a price you can afford.

If you are searching about 2021 Car Insurance Rates by Age and Gender - NerdWallet you've visit to the right page. We have 8 Pics about 2021 Car Insurance Rates by Age and Gender - NerdWallet like 2021 Car Insurance Rates by Age and Gender - NerdWallet, Auto Insurance Rates by Regions in America - 480-246-1930 In the midst and also The Best Car Insurance Rates - Automotive Car Center. Here it is:

2021 Car Insurance Rates By Age And Gender - NerdWallet

www.nerdwallet.com

www.nerdwallet.com nerdwallet

Cheapest Car Insurance For A Bad Driving Record (2022)

quotewizard.com

quotewizard.com cheapest accidents quotewizard

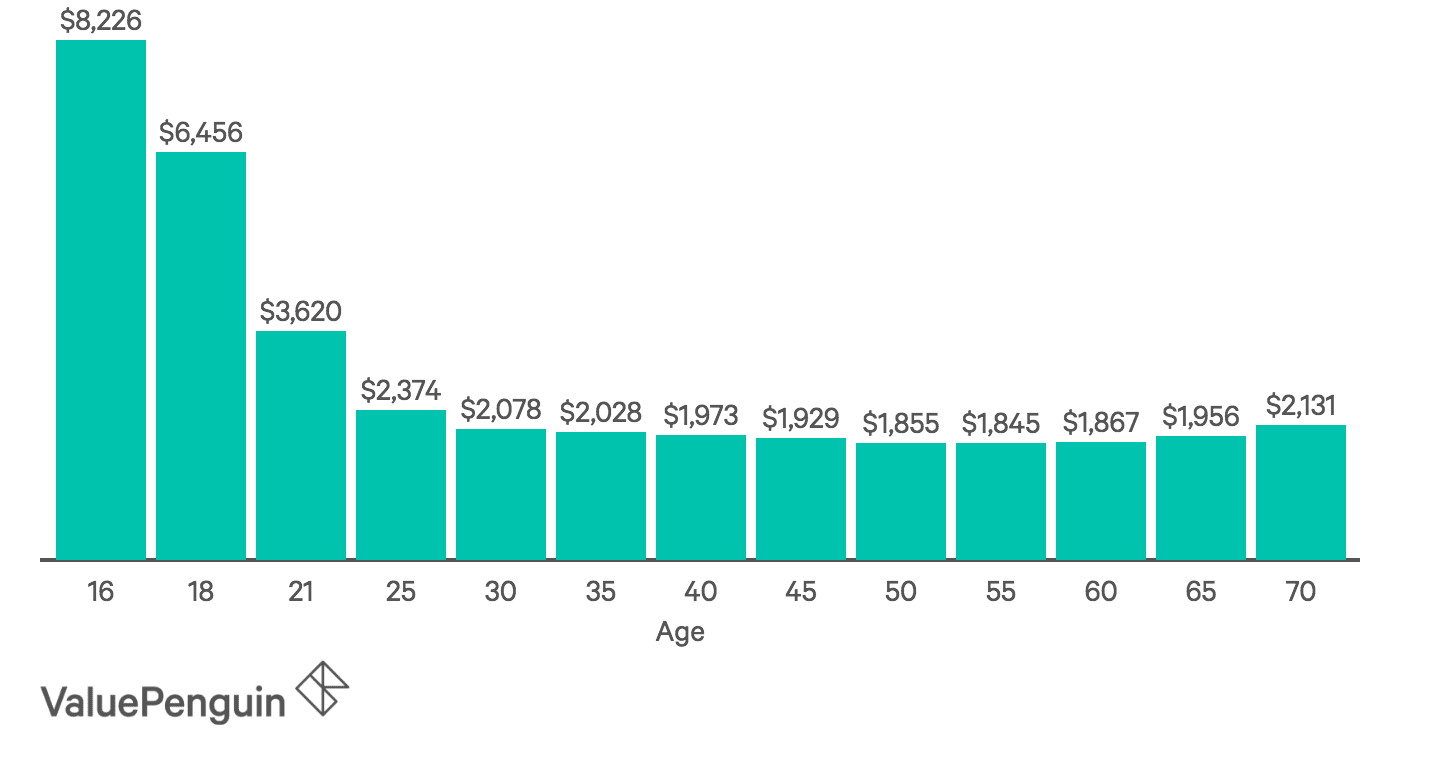

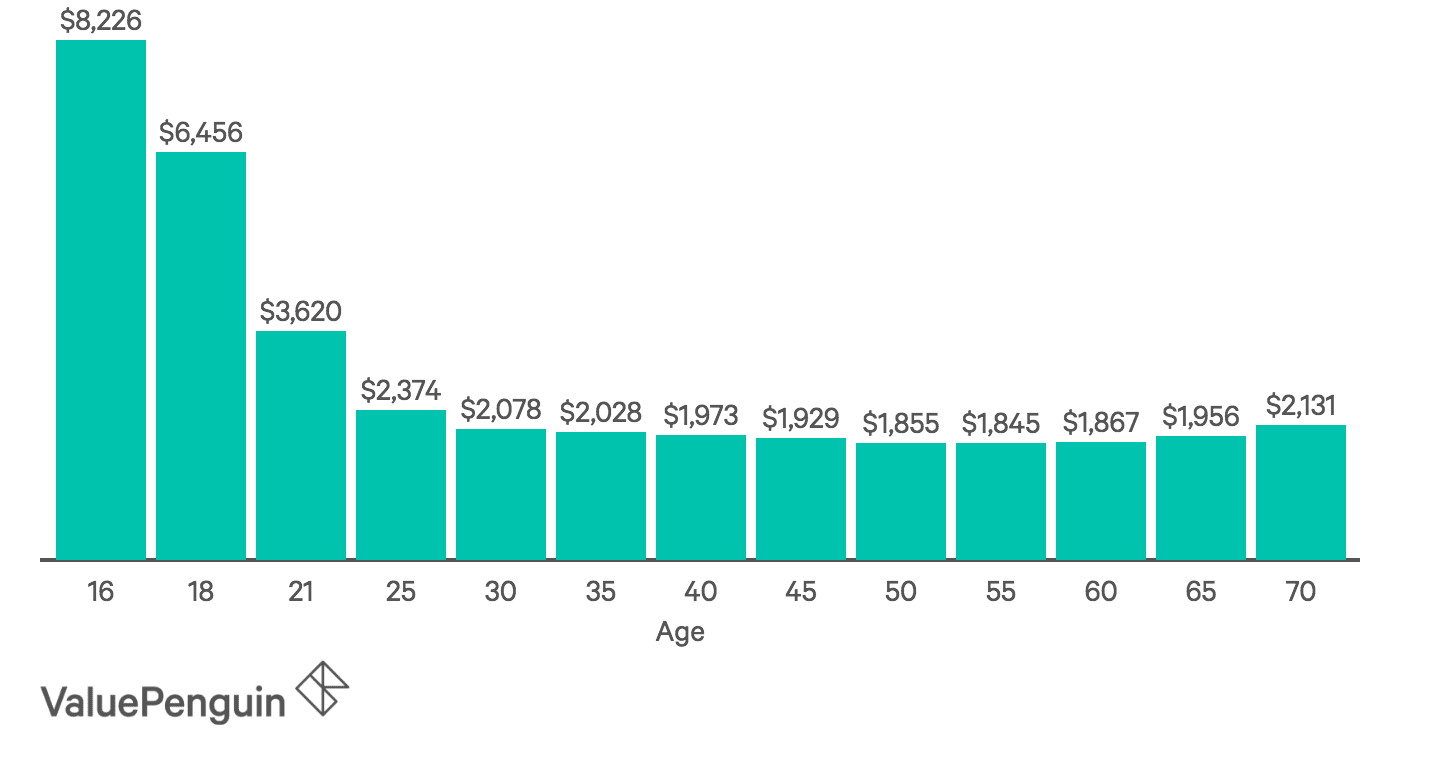

Average Cost Of Car Insurance (2018) | Average Cost Of Insurance

www.valuepenguin.com

www.valuepenguin.com insurance car rates age cost average auto graph gender value

The Best Car Insurance Rates - Automotive Car Center

automotive-car-center.blogspot.com

automotive-car-center.blogspot.com quotesgram

Auto Insurance Rates By Regions In America - 480-246-1930 In The Midst

regions

Why Should You Invest In Car Insurance Rate Comparison Websites? - APK

apkhumble.com

apkhumble.com websites brokers

What Affects Car Insurance Rates? 4 Surprising Factors That Increase

www.youfixcars.com

www.youfixcars.com Auto Insurance Rates Increases In Florida - ValuePenguin

increases hikes valuepenguin

Websites brokers. The best car insurance rates. Auto insurance rates increases in florida

0 Comments