When it comes to driving in Florida, having car insurance is an absolute must. Not only is it required by law, but it also provides financial protection in the event of an accident. However, with so many different car insurance companies and policies available, it can be hard to know which one to choose. That's why we've put together this guide to help you compare car insurance rates in Florida and find the best coverage for you. First, let's take a look at the average car insurance rates in Florida. According to recent data, the average cost of car insurance in Florida is around $1,500 per year. However, this can vary depending on a number of factors, including your age, driving record, and the type of car you drive. One way to lower your car insurance rates in Florida is to choose a higher deductible. This is the amount you'll have to pay out of pocket before your insurance kicks in. While choosing a higher deductible may mean you pay more if an accident does occur, it can also significantly lower your monthly premiums. Another way to save money on car insurance in Florida is to take advantage of discounts offered by insurance companies. Some common discounts include safe driver discounts, multi-car discounts, and low mileage discounts. Be sure to ask your insurance provider about any discounts that may be available to you. Now that we've covered some basics about car insurance rates in Florida, let's take a closer look at how rates vary by zip code. As you can see from the chart below, car insurance rates can vary significantly depending on where you live in the state. [Insert image 1 with alt tag: "Florida Auto Insurance Rates By Zip Code"] For example, if you live in the 33109 zip code in Miami Beach, you can expect to pay an average of $4,284 per year for car insurance. On the other hand, if you live in the 32303 zip code in Tallahassee, you can expect to pay an average of just $1,657 per year. So why do car insurance rates vary so much by zip code? One reason is that certain areas may have more accidents or higher rates of auto theft, which can increase insurance premiums. Additionally, some zip codes may have higher levels of uninsured drivers, which can also lead to higher insurance rates. If you're looking for the cheapest car insurance in Florida, it's important to shop around and compare quotes from multiple providers. One tool you can use to do this is a car insurance comparison website like CheapCarInsuranceQuotes.com. Simply enter your zip code and other information, and you'll be able to see quotes from multiple insurance companies side by side. Another important factor to consider when choosing car insurance in Florida is the level of coverage you need. Florida requires drivers to carry both personal injury protection (PIP) and property damage liability (PDL) insurance. PIP insurance covers medical expenses and lost wages for you and your passengers in the event of an accident, while PDL insurance covers damage to another person's property if you are at fault in an accident. While these are the minimum requirements for car insurance in Florida, it's important to consider whether you might need additional coverage. For example, collision coverage can help pay for repairs to your own car if you are in an accident, while comprehensive coverage can protect your car from things like theft, vandalism, and natural disasters. When choosing car insurance in Florida, it's also important to consider the reputation of the insurance provider. One way to do this is to look at customer reviews and ratings on websites like J.D. Power and Consumer Reports. You'll want to choose an insurer with a good reputation for customer service and claims handling. Another important factor to consider when choosing car insurance in Florida is the financial strength of the insurance provider. You can check the financial strength rating of an insurer by referring to ratings agencies like A.M. Best, which rates insurers based on their ability to pay claims. Overall, there are many factors to consider when choosing car insurance in Florida. By comparing quotes from multiple providers, choosing a higher deductible, and taking advantage of discounts, you can save money on your car insurance premiums. Additionally, by choosing a reputable insurer with strong financial ratings, you can feel confident that you'll be protected in the event of an accident. [Insert image 2 with alt tag: "Cheapest Car Insurance In Florida For Young Drivers"] If you're a young driver in Florida, finding affordable car insurance can be particularly challenging. According to recent data, the average cost of car insurance for a 21-year-old driver in Florida is around $3,700 per year. One way to save money on car insurance as a young driver is to take advantage of discounts offered by insurance companies. For example, many insurers offer discounts for good grades, so be sure to let your provider know if you're a student with a high GPA. Another way to save money on car insurance as a young driver is to choose a car that's less expensive to insure. Cars with smaller engines and good safety ratings are typically cheaper to insure than sports cars or luxury vehicles. Finally, consider taking a defensive driving course. Not only can this help you become a safer driver, but it can also lead to lower insurance premiums. [Insert image 3 with alt tag: "Florida Car Insurance Rates By Zip Code / Car Insurance Quotes Compare"] Because car insurance rates vary so much by zip code in Florida, it's important to know what to expect before you choose an insurance provider. By using a car insurance comparison website like CarInsuranceQuotesCompare.com, you can easily compare rates from multiple providers based on your specific zip code. When comparing car insurance quotes in Florida, keep in mind that the cheapest policy might not always be the best option. Look at the level of coverage offered, as well as the reputation of the insurance provider and any discounts that may be available. [Insert image 4 with alt tag: "Car Insurance in Florida - Find Best & Cheapest Car Insurance in FL for"] Finally, if you're still unsure about how to choose the best car insurance in Florida, consider working with an independent insurance agent. An independent agent can help you compare policies from multiple providers and choose the one that best fits your needs and budget. Overall, choosing the right car insurance policy in Florida requires careful consideration of many factors. By comparing quotes from multiple providers, choosing a higher deductible, and taking advantage of discounts, you can save money on your premiums. Additionally, by choosing a reputable insurer with strong financial ratings and a good reputation for customer service and claims handling, you can feel confident that you'll be protected on the road.

If you are looking for Why Are Florida Auto Insurance Rates High? | InsuranceQuotes you've visit to the right web. We have 8 Images about Why Are Florida Auto Insurance Rates High? | InsuranceQuotes like Auto Insurance Rates Increases in Florida - ValuePenguin, Why Are Florida Auto Insurance Rates High? | InsuranceQuotes and also Car Insurance Premium Comparison of Florida Counties - Online Auto. Here it is:

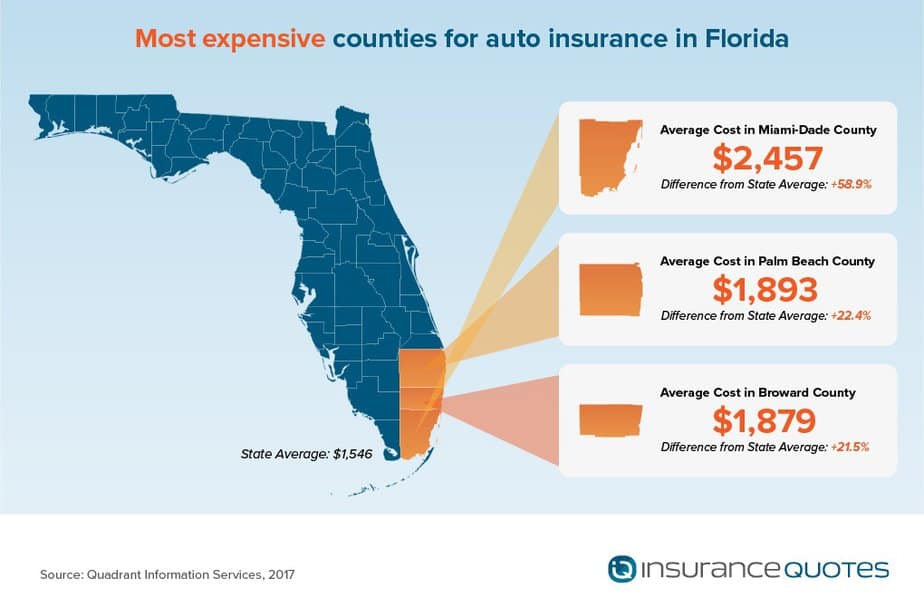

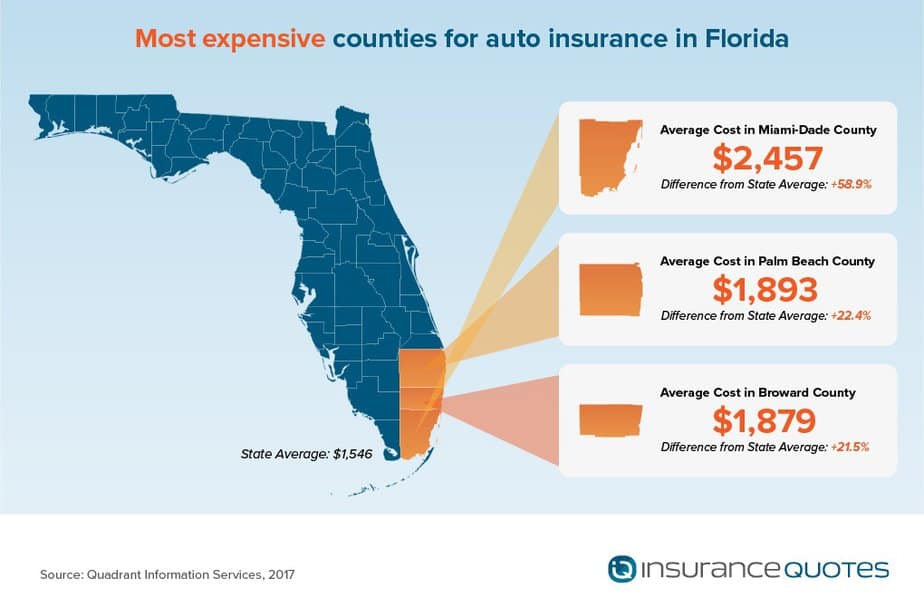

Why Are Florida Auto Insurance Rates High? | InsuranceQuotes

www.insurancequotes.com

www.insurancequotes.com insurance insurancequotes vary savings

Florida Car Insurance Rates By Zip Code / Car Insurance Quotes Compare

tucsonlatest.blogspot.com

tucsonlatest.blogspot.com Auto Insurance Rates Increases In Florida - ValuePenguin

www.valuepenguin.com

www.valuepenguin.com increases hikes valuepenguin

Cheapest Car Insurance In Florida For Young Drivers – Simple Zetb

simplezetb.blogspot.com

simplezetb.blogspot.com Compare Car IIsurance: Florida Auto Insurance Rates By Zip Code

dcomparecarinsuran.blogspot.com

dcomparecarinsuran.blogspot.com florida insurance car rates auto zip code compare name

Personal Injury Attorney Tampa FL | Car Insurance Guide

mattlaw.com

mattlaw.com insurance car florida tampa rates zip code cost average annual premium

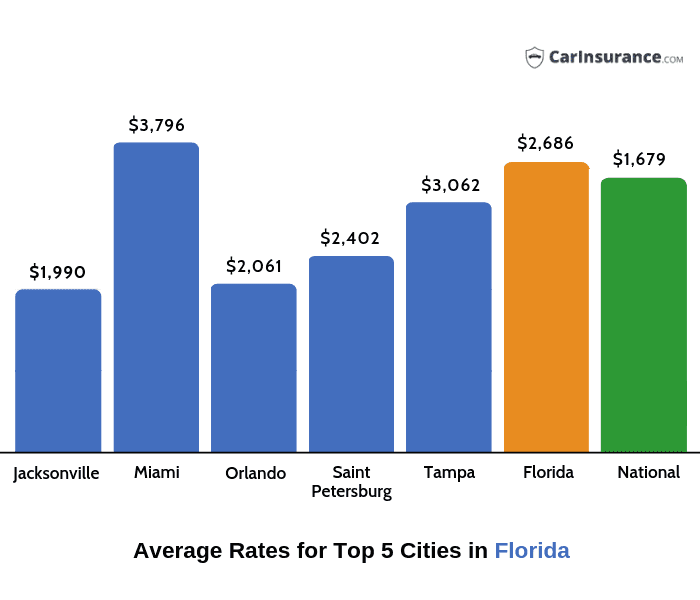

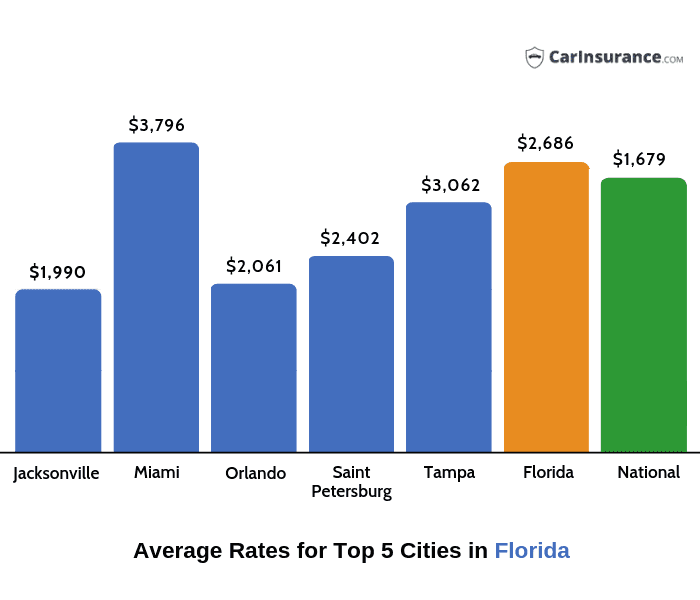

Car Insurance In Florida - Find Best & Cheapest Car Insurance In FL For

www.carinsurance.com

www.carinsurance.com florida insurance car rates average liability

Car Insurance Premium Comparison Of Florida Counties - Online Auto

www.onlineautoinsurance.com

www.onlineautoinsurance.com florida insurance car auto counties comparison county rates premium infographic price dari disimpan

Florida insurance car rates auto zip code compare name. Personal injury attorney tampa fl. Florida car insurance rates by zip code / car insurance quotes compare

www.insurancequotes.com

www.insurancequotes.com  tucsonlatest.blogspot.com

tucsonlatest.blogspot.com  simplezetb.blogspot.com

simplezetb.blogspot.com  dcomparecarinsuran.blogspot.com

dcomparecarinsuran.blogspot.com  mattlaw.com

mattlaw.com  www.carinsurance.com

www.carinsurance.com

0 Comments