Hey there friend, have you ever been driving down the road and suddenly realized how ridiculously expensive your car insurance is? Well fear not, because I've compiled a list of tips to help you save some serious cash on your insurance premiums!

Tip 1: Shop Around

Don't stick with the same insurance company just because it's what you've always done. Take the time to shop around and compare rates from different providers. You never know, you could end up finding a better deal elsewhere!

Source: Mortgage refinance

Tip 2: Increase Your Deductible

Increasing your deductible can significantly lower your monthly premiums. However, make sure you have enough money in savings to cover the cost of your deductible if you do ever need to file a claim.

Source: Buy Here Pay Here Dealers RI

Tip 3: Drive Safely

This might seem like a no-brainer, but maintaining a good driving record can lower your insurance premiums. So put down that phone, buckle up, and stay alert on the road!

Tip 4: Bundle Your Insurance Policies

If you have multiple insurance policies (such as home and auto), consider bundling them together with the same provider. Many insurance companies offer discounts for bundling policies together.

Source: Money Compare

Tip 5: Take Advantage of Discounts

Insurance companies often offer discounts for things like safe driving, good grades, and even being a member of certain organizations. Be sure to ask your provider about any available discounts!

Source: Live Insurance News

Tip 6: Consider Your Vehicle

The type of car you drive can affect your insurance premiums. Generally, newer and more expensive cars are more expensive to insure. So if you're in the market for a new vehicle, consider the potential insurance costs before making a purchase.

Source: Family Fun Journal

Tip 7: Shop Around (Again!)

Just like with any other purchase, it's important to shop around for the best deal. Even if you're already with a certain provider, it's worth checking out other options to make sure you're getting the most bang for your buck.

Source: Meet RV

Tip 8: Drive Less

If you're able to, driving less can lower your insurance premiums. Many providers offer discounts for drivers who don't put as many miles on their car.

Source: Express

Tip 9: Stay Informed

Insurance providers can change their rates and policies at any time. Make sure you stay informed about any changes that could impact your premiums and coverage.

Source: Pdx Auto Glass

So there you have it, nine tips to help you save some serious cash on your car insurance. Do your research, stay safe on the road, and don't forget to shop around for the best deal!

If you are searching about What is class 1 car insurance and why should one but it? | Pdx Auto Glass you've came to the right web. We have 8 Images about What is class 1 car insurance and why should one but it? | Pdx Auto Glass like Saving Money on Car Insurance | Buy Here Pay Here Dealers RI, Is Car Insurance Comparison Worth Your Time & Effort? and also What is class 1 car insurance and why should one but it? | Pdx Auto Glass. Here you go:

What Is Class 1 Car Insurance And Why Should One But It? | Pdx Auto Glass

pdxautoglass.com

pdxautoglass.com Auto Insurance Comparison Habits Ignored Brands During Pandemic: Study

www.liveinsurancenews.com

www.liveinsurancenews.com habits ignored

Is Car Insurance Comparison Worth Your Time & Effort?

www.meetrv.com

www.meetrv.com insurance car comparison effort worth time

7 Useful Car Insurance Tips Money Saving Expert - Mortgage Refinance

mortgage-insurance-refinance.blogspot.com

mortgage-insurance-refinance.blogspot.com Saving Money On Car Insurance | Buy Here Pay Here Dealers RI

www.shannonmotors.com

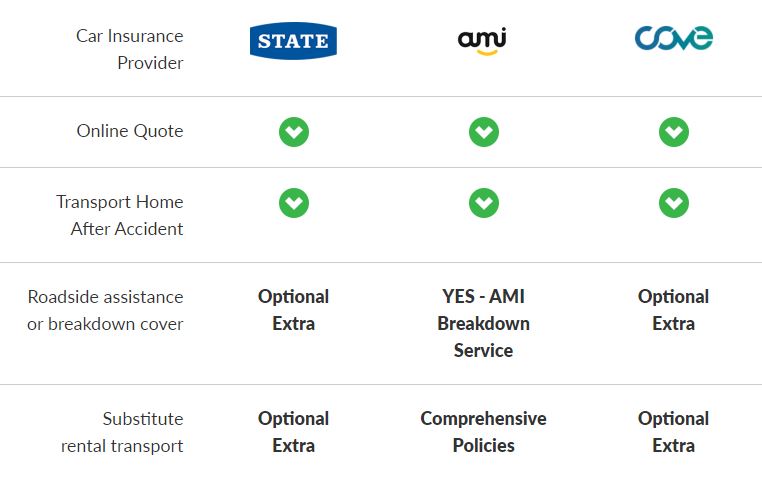

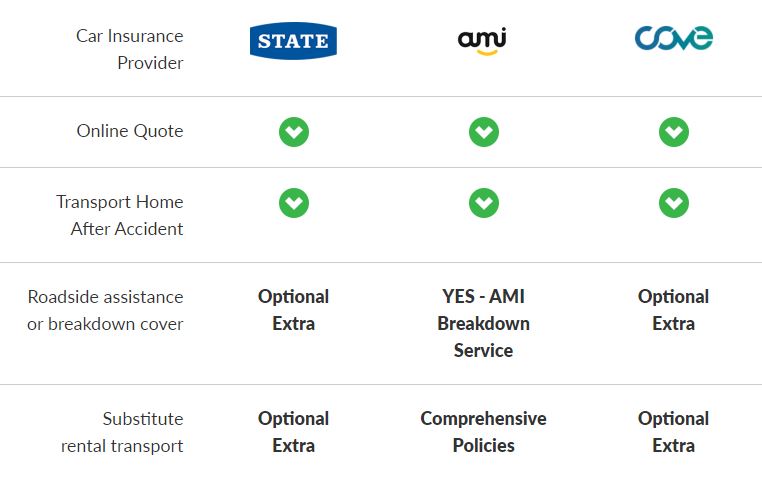

www.shannonmotors.com Compare Car Insurance, Contents Insurance And More | Money Compare

www.nzcompare.com

www.nzcompare.com comparison

Canonprintermx410: 25 Luxury Auto Insurance Quotes Comparison Tool

cheap familyfunjournal renters rituals flowernifty

Car Insurance: Money Saving Expert Reveals How To Save Over £500 On

www.express.co.uk

www.express.co.uk tax sarra mistake avoid drivers

7 useful car insurance tips money saving expert. Canonprintermx410: 25 luxury auto insurance quotes comparison tool. Habits ignored

0 Comments