Let's talk about car insurance, my friends. It's something that we all need, but it can be a real pain in the you-know-what. The rates can be high, and understanding how they're calculated can be confusing. But don't worry, because I'm here to give you the scoop on how to get the best rates possible.

First Things First: How Are Car Insurance Rates Calculated?

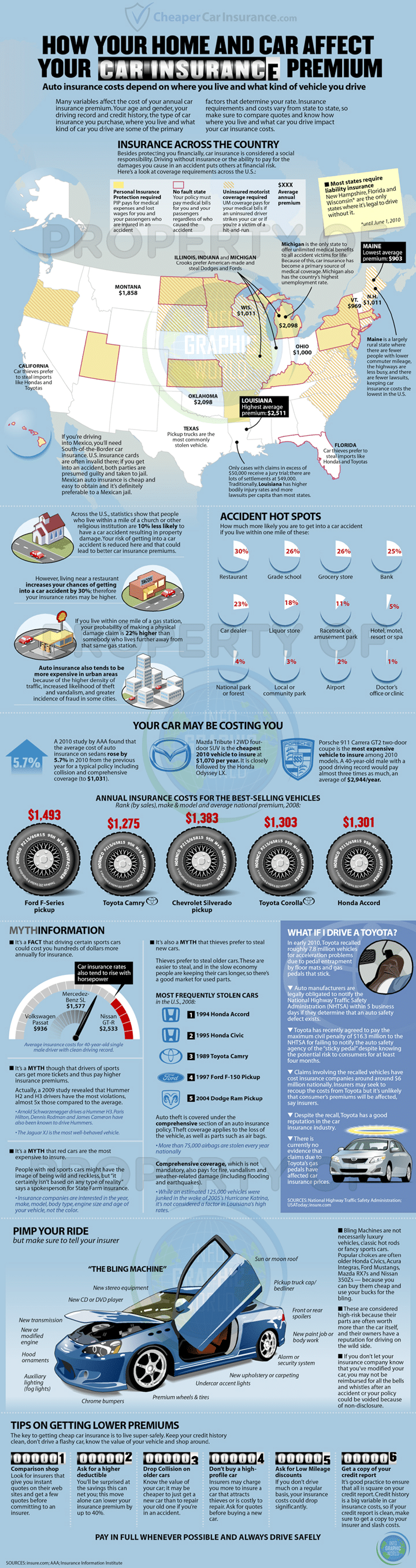

It's important to know how your car insurance rate is determined so that you can figure out how to lower it. Here are some factors that are taken into account:

- Your driving record: If you have a history of accidents or traffic violations, you'll likely have a higher rate.

- Your age and gender: Younger drivers and male drivers typically pay more.

- The type of car you drive: Luxury cars and high-performance cars will cost more to insure.

- The amount of coverage you want: The more coverage you have, the higher your rate.

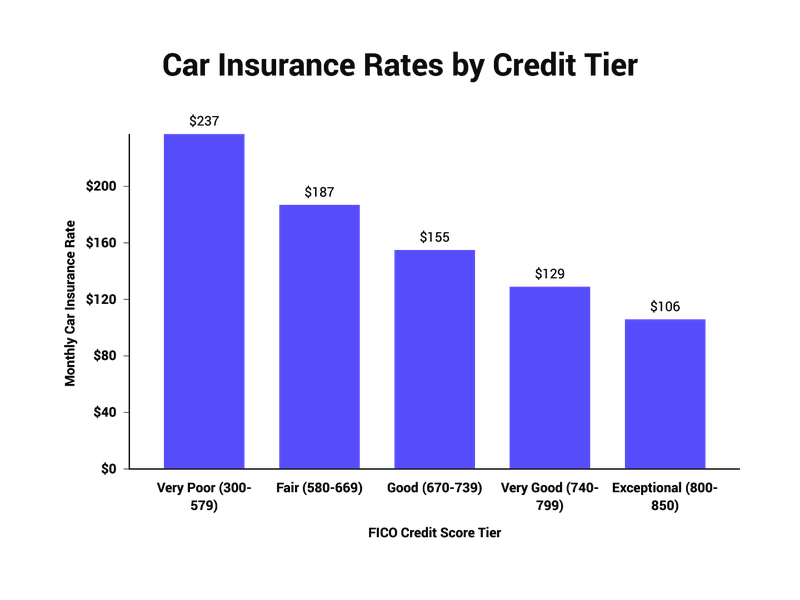

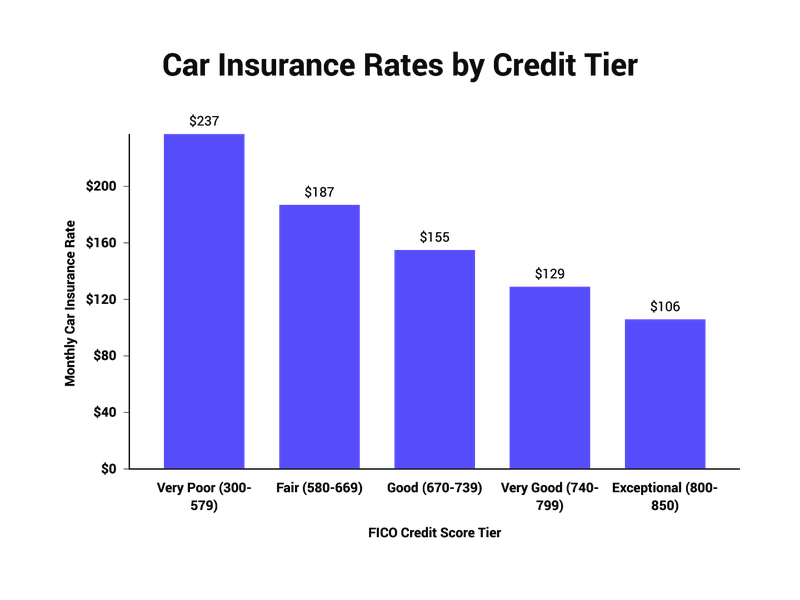

- Your credit score: A lower credit score can mean a higher rate.

Now, let's get to the good stuff. Here are some tips for getting the best car insurance rates:

Tip #1: Shop Around

Don't just settle for the first car insurance company you come across. Do your research and compare rates from different companies. You might be surprised at how much you can save by switching to a different company.

One thing to keep in mind is that the cheapest option might not always be the best. You'll want to make sure you're getting enough coverage for your needs.

Tip #2: Consider Your Deductible

The deductible is the amount you have to pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your monthly rate. Just make sure you have enough money set aside to cover the deductible if you need to make a claim.

Tip #3: Bundle Your Insurance

If you have multiple types of insurance (like home and auto), consider bundling them with the same company. Many insurance companies offer discounts for bundling, which can save you money on both policies.

Tip #4: Take Advantage of Discounts

Many car insurance companies offer discounts for things like:

- Having multiple cars on the same policy

- Completing a defensive driving course

- Being a good student

- Being a military member or veteran

Make sure to ask about discounts when shopping around for car insurance.

Tip #5: Ask About Usage-Based Insurance

Usage-based insurance is a newer type of car insurance that uses telematics (like a GPS system) to track your driving habits. Your rate is then based on how much you drive, how you drive, and when you drive. This can be a good option if you don't drive much or if you're a safe driver. Just be aware that some companies might raise your rate if you have a lot of hard braking or speeding events.

Tip #6: Improve Your Credit Score

As I mentioned earlier, your credit score can have an impact on your car insurance rate. If your credit score isn't great, take steps to improve it (like paying off debt and making payments on time).

Tip #7: Drive Safely

This might seem obvious, but it's worth mentioning. If you have a history of accidents or traffic violations, your rate will be higher. Drive safely and obey traffic laws to keep your rate as low as possible.

Tip #8: Choose The Right Car

The type of car you drive can have a big impact on your car insurance rate. Luxury cars and high-performance cars are more expensive to insure than more practical models. When shopping for a car, consider the cost of insurance in addition to the sticker price.

Tip #9: Pay in Full

Many car insurance companies offer a discount if you pay your entire premium up front (instead of making monthly payments).

Tip #10: Review Your Policy Annually

Your car insurance needs can change over time, so it's important to review your policy annually to make sure you're still getting the best rate possible. Consider factors like changes in your driving habits, changes in your credit score, and changes in your car's value.

Tip #11: Ask Your Insurance Agent

If you're not sure where to start, ask your car insurance agent. They can give you personalized advice on how to lower your rate.

Tip #12: Don't Let Your Policy Lapse

If you let your car insurance policy lapse (even for just a day), you could end up paying more when you renew. Make sure to always have active car insurance.

Tip #13: Compare Rates Regularly

Even if you're happy with your current car insurance company, it's a good idea to compare rates from other companies once a year. You never know when you might find a better deal.

Tip #14: Consider Deductible Waivers

Some car insurance companies offer a deductible waiver program. If you're in an accident and it wasn't your fault, the other driver's insurance will pay for repairs without you having to pay your deductible. This can be a good option if you have a high deductible.

Tip #15: Ask About Loyalty Discounts

If you've been with the same car insurance company for a long time, ask if they offer loyalty discounts. Many companies do.

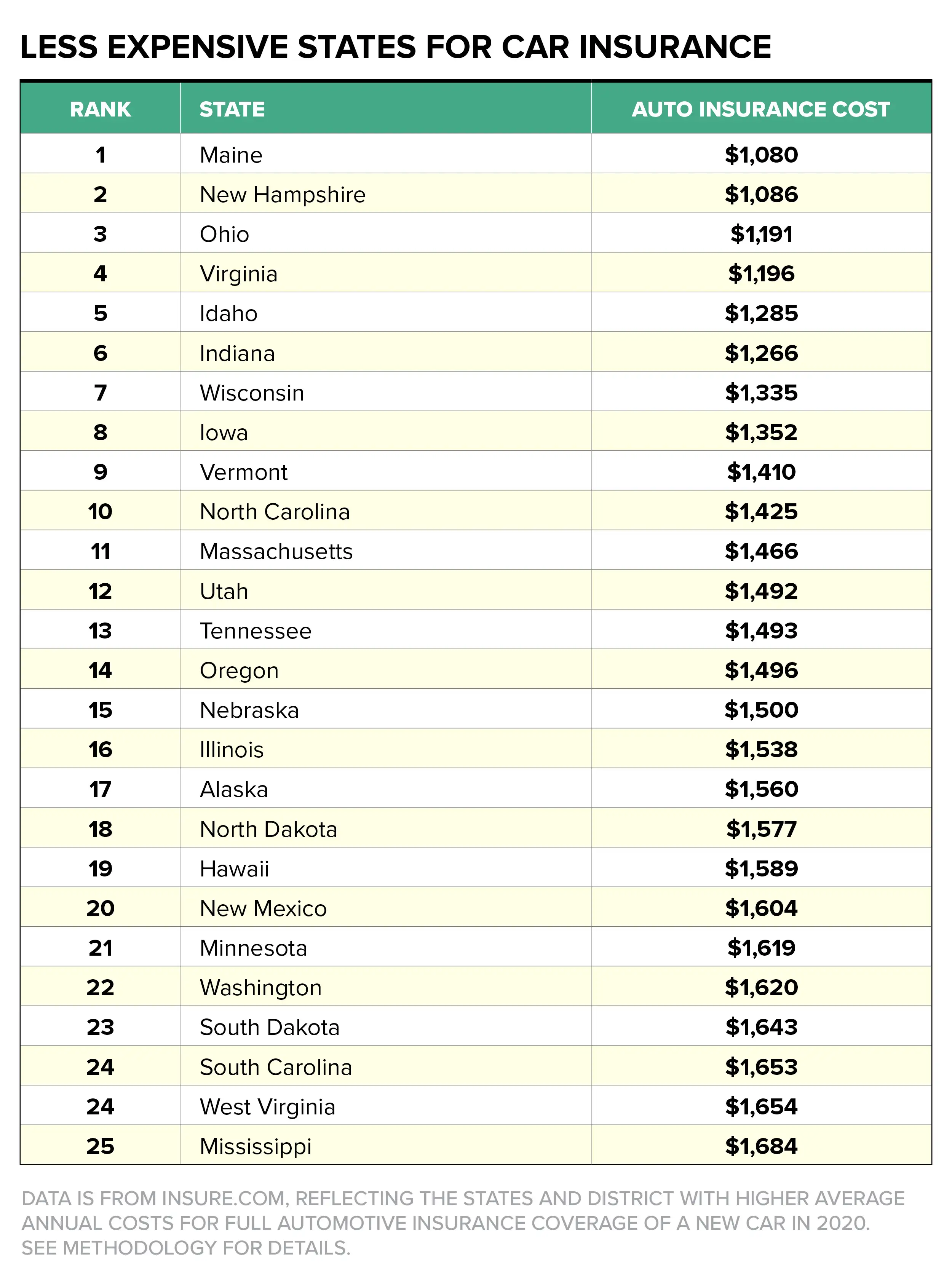

Tip #16: Move to a Lower-Cost Area

This might not be feasible for everyone, but if you're able to move to an area with lower car insurance rates, you could save a significant amount of money.

Tip #17: Drive an Older Car

Newer cars are more expensive to insure than older cars. If you're in the market for a new car, consider buying one that's a few years old instead.

Tip #18: Be Honest About Your Driving Habits

When you apply for car insurance, you'll be asked about your driving habits. It's important to be honest, because if you're caught lying, it could lead to your policy being canceled or your rate being increased.

Tip #19: Consider a Usage-Based Insurance Device

Some car insurance companies offer usage-based insurance devices that you plug into your car's OBD-II port. These devices track things like your speed, acceleration, and braking. If you're a safe driver, you could save money on your car insurance.

Tip #20: Stay Safe on the Road

This one might seem like a no-brainer, but it's worth repeating. If you stay safe on the road and avoid accidents, your car insurance rate will stay as low as possible.

So there you have it, folks. Twenty tips for getting the best car insurance rates possible. By implementing these tips, you can save a significant amount of money each year. Now get out there and start shopping around!

If you are looking for Car Insurance vs. Health Insurance | The Zebra you've came to the right web. We have 8 Images about Car Insurance vs. Health Insurance | The Zebra like Proven Tips How To Get Lowest Car Insurance Rates - Funender.com, 13 Ways to Save On Car Insurance - Dale Adams Automotive and also Your Car Insurance Rate: How It's Calculated. Here it is:

Car Insurance Vs. Health Insurance | The Zebra

www.thezebra.com

www.thezebra.com insurance car health tier credit auto vs premiums factors influence rating learn

Pay Attention! These Can Influence Your Car Insurance Rate – Money DIBS

www.moneydibs.com

www.moneydibs.com influence

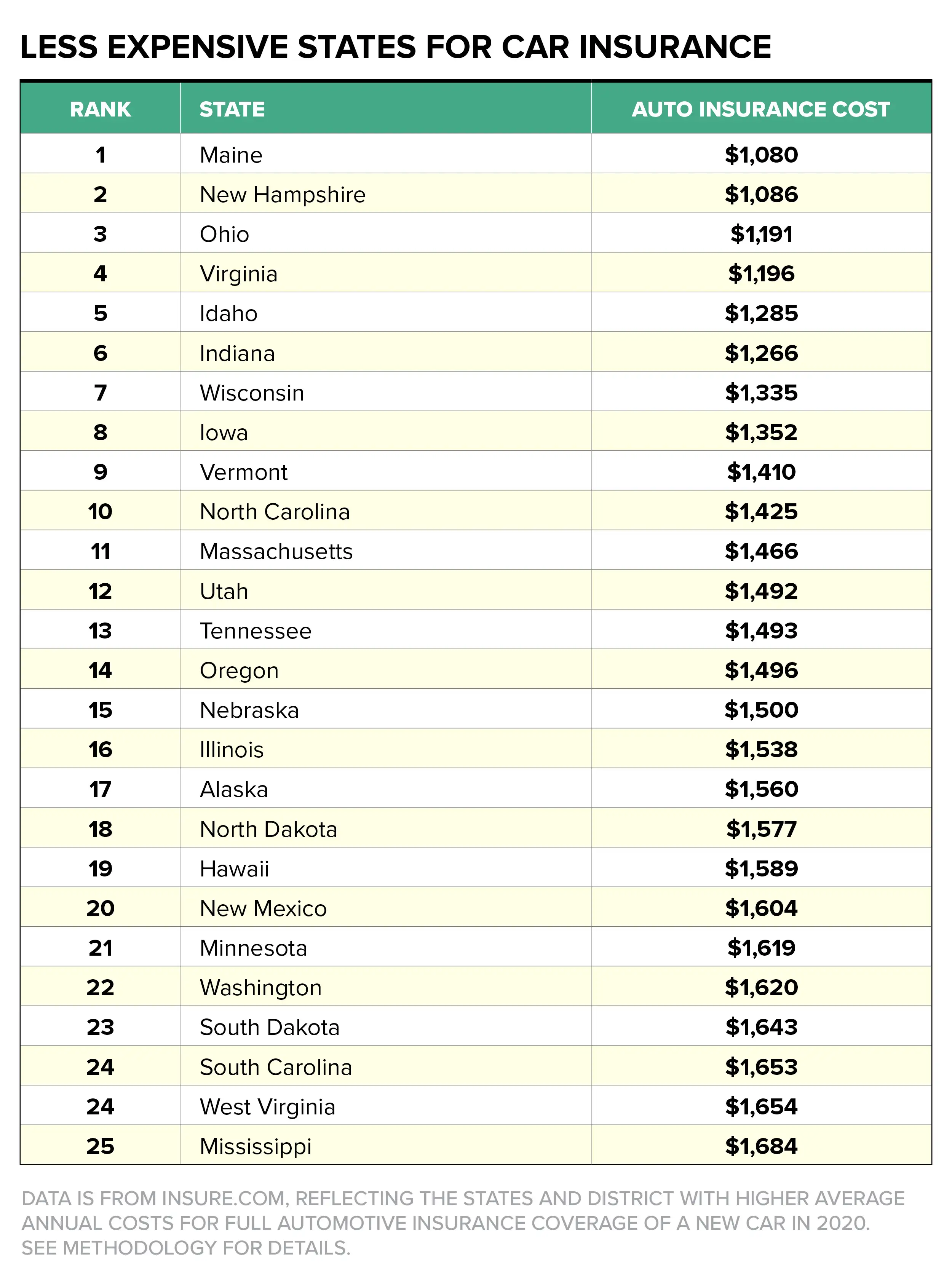

Car Insurance Costs By State | Money

money.com

money.com insurance auto car state money states rates rate

Factors That Affect Car Insurance Rates | FindBestQuote

findbestquote.com

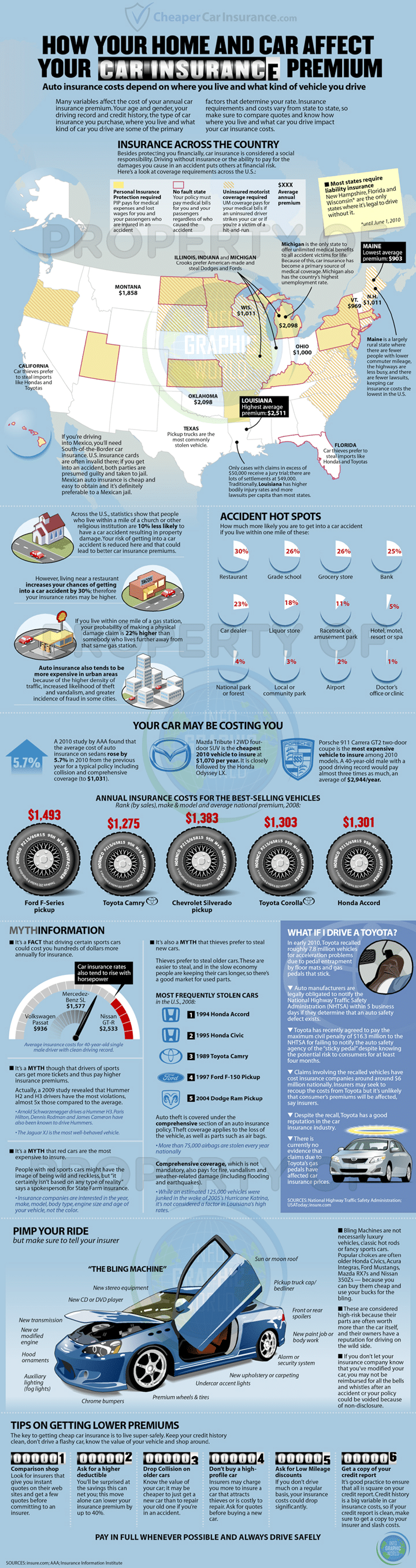

findbestquote.com Your Car Insurance Rate: How It's Calculated

infographicworld.com

infographicworld.com Proven Tips How To Get Lowest Car Insurance Rates - Funender.com

funender.com

funender.com insurance car rates lowest tips proven funender

13 Ways To Save On Car Insurance - Dale Adams Automotive

www.daleadams.com

www.daleadams.com insurance car private ways average plan premiums gisa ibc msa insurers source data

How To Get Some Of The Best Car Insurance Rates? | Everything Finance

everythingfinanceblog.com

everythingfinanceblog.com Proven tips how to get lowest car insurance rates. Car insurance vs. health insurance. Insurance car health tier credit auto vs premiums factors influence rating learn

0 Comments