Car insurance is an important aspect of owning a car. It’s not just about protecting your vehicle, it’s also about protecting yourself and others on the road. But did you know that car insurance rates vary by state and even by region? In this article, we’ll take a closer look at the different factors that affect car insurance rates and how you can find the best rates in your area.

Auto Insurance Rates by Regions in America

If you’re looking for the best auto insurance rates, it’s important to understand the different factors that can affect your premiums. One of the biggest factors is your location. Auto insurance rates vary from state to state and even from region to region. For example, auto insurance rates in New York City are typically higher than rates in upstate New York, due to the higher risk of accidents in crowded urban areas.

Another factor that can affect your auto insurance rates is your age. New drivers and young drivers typically pay higher rates than older, more experienced drivers. This is because they are more likely to get into accidents and file claims.

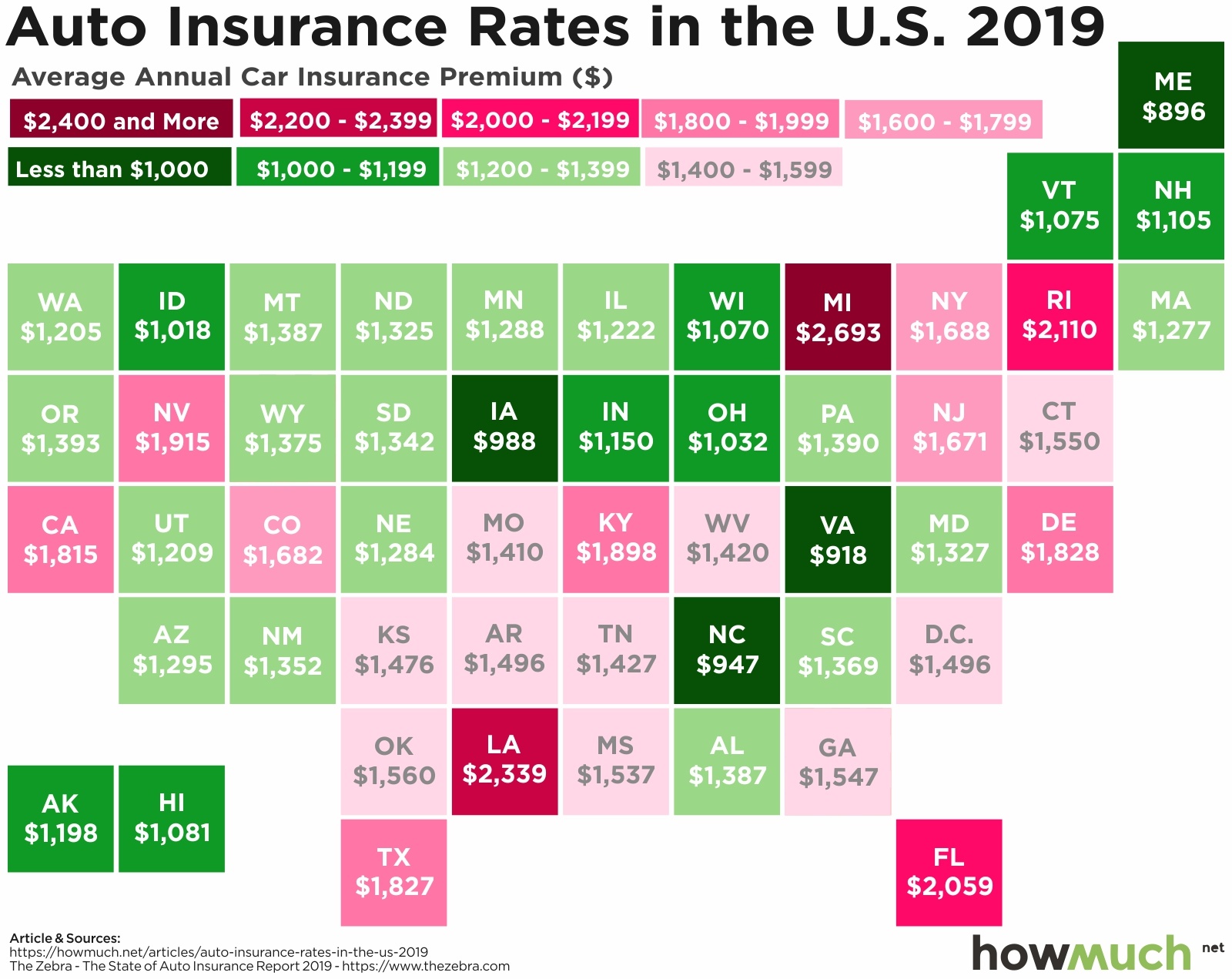

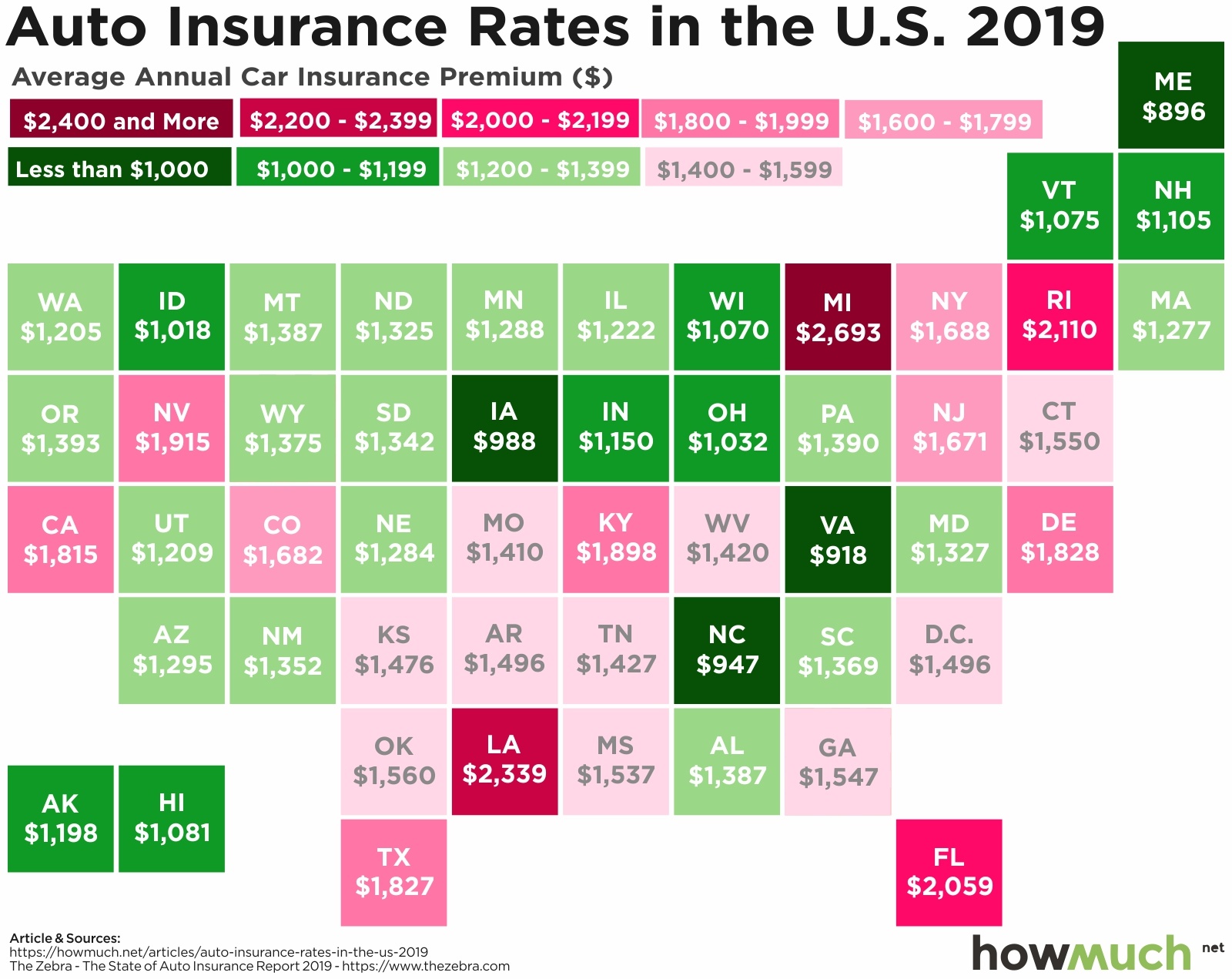

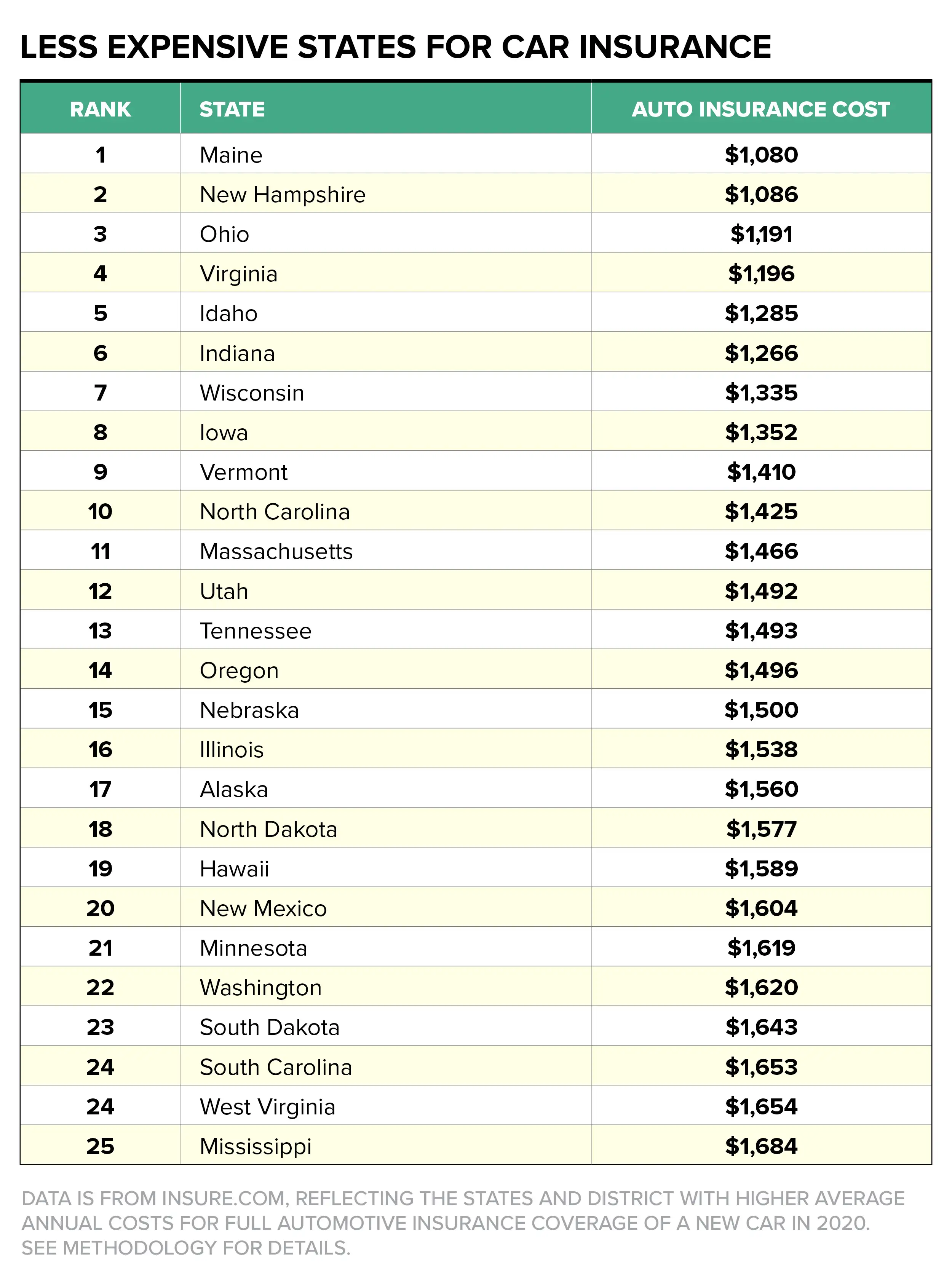

Compare Car Insurance Rates by State in 2020

Before you start shopping for car insurance, it’s important to understand the average rates in your state. Some states have much higher auto insurance rates than others. For example, Michigan has the highest auto insurance rates in the country, with an average annual premium of over $2,500. On the other hand, Maine has some of the lowest rates in the country, with an average annual premium of around $800.

There are several reasons why Michigan’s auto insurance rates are so high. One of the biggest factors is the state’s no-fault car insurance system. Under this system, all drivers are required to carry personal injury protection (PIP) coverage, which can be very expensive. In addition, Michigan has a high number of uninsured drivers, which can drive up rates for everyone else.

Auto Insurance Rate Increases in Pennsylvania

Pennsylvania is another state where auto insurance rates have been on the rise. In fact, rates have increased by 22% since 2011. This is due to a number of factors, including an increase in the number of accidents and a rise in the cost of car repairs.

One of the biggest contributors to the rising cost of car repairs is the increasing use of technology in modern vehicles. As cars become more advanced, they also become more expensive to repair. In addition, there has been a rise in the number of distracted driving accidents, which can also drive up auto insurance rates.

What do Americans Pay for Car Insurance in 2019?

According to a recent study, the average annual auto insurance premium in the United States is $1,427. However, this number can vary significantly depending on where you live. For example, drivers in Louisiana pay an average of $2,631 per year for car insurance, while drivers in Maine pay just $808 per year.

There are several reasons why Louisiana’s auto insurance rates are so high. One of the biggest factors is the state’s high number of uninsured drivers. Louisiana also has a high rate of car thefts and accidents, which can drive up auto insurance rates.

Car Insurance Prices Highest In History

If you’re looking for car insurance right now, you may be in for a bit of sticker shock. According to a recent study by The Zebra, car insurance prices are currently at their highest levels ever. In fact, two-thirds of drivers saw their rates go up last year.

There are several reasons for this recent spike in car insurance rates. One of the biggest factors is the increasing cost of car repairs. As we mentioned earlier, modern cars are more expensive to repair than ever before. In addition, many drivers are choosing more expensive cars and opting for higher levels of coverage, which can also drive up insurance rates.

Best Affordable Car Insurance In Nj

So, what can you do to find affordable car insurance in your area? Here are a few tips:

- Shop Around: Don’t just go with the first auto insurance company you come across. Take the time to compare rates from several different companies to find the best deal.

- Ask for Discounts: Many auto insurance companies offer discounts for things like good driving habits, safety features, and multiple policies.

- Consider Increasing Your Deductible: Your deductible is the amount you pay out of pocket before your insurance kicks in. By increasing your deductible, you can lower your monthly premiums.

- Bundle Your Policies: If you have other insurance policies, such as home or life insurance, consider bundling them with your auto insurance to save money.

By following these tips, you can find the best auto insurance rates in your area. Remember, it’s important to have adequate coverage to protect yourself and others on the road, but that doesn’t mean you have to pay a fortune for it. Shop around, ask for discounts, and consider increasing your deductible to find the best deal.

Car insurance rates vary by state and region, but with a little research and some smart shopping, you can find the best rates in your area. By understanding the factors that affect your auto insurance rates and following our tips for finding affordable coverage, you can protect yourself and your vehicle without breaking the bank.

If you are looking for Auto Insurance Rate Increases in Pennsylvania: Up 22% Since 2011 you've visit to the right page. We have 8 Pics about Auto Insurance Rate Increases in Pennsylvania: Up 22% Since 2011 like Car Insurance Prices Highest In History, Up For Two Thirds of Drivers, Auto Insurance Rates by Regions in America - 480-246-1930 In the midst and also Alberta Car Insurance Premiums Under NDP and UCP Governments : Edmonton. Here it is:

Auto Insurance Rate Increases In Pennsylvania: Up 22% Since 2011

increases hikes valuepenguin

Compare Car Insurance Rates By State In 2020 | Millennial Money

millennialmoney.com

millennialmoney.com state rates insurance car premium

What Do Americans Pay For Car Insurance In 2019? – Investment Watch

www.investmentwatchblog.com

www.investmentwatchblog.com insurance car state auto cost rates average pay costs states highest americans premiums digg

What Is 6 Month Premium Car Insurance - Momodesignsaus

momodesignsaus.blogspot.com

momodesignsaus.blogspot.com howmuch

Auto Insurance Rates By Regions In America - 480-246-1930 In The Midst

regions

Best Affordable Car Insurance In Nj - The Cheapest Car Insurance

mylittlegreendog.blogspot.com

mylittlegreendog.blogspot.com Car Insurance Prices Highest In History, Up For Two Thirds Of Drivers

www.prnewswire.com

www.prnewswire.com zebra thirds prices prnewswire

Alberta Car Insurance Premiums Under NDP And UCP Governments : Edmonton

www.reddit.com

www.reddit.com insurance premiums alberta cheapest ndp ucp cars cheaper governments

Auto insurance rates by regions in america. Alberta car insurance premiums under ndp and ucp governments : edmonton. Insurance car state auto cost rates average pay costs states highest americans premiums digg

0 Comments