Car insurance is a necessary expense that comes with owning a car. However, the cost of car insurance can vary greatly depending on a multitude of factors, such as age, gender, location, and driving record. In this post, we take a look at the average cost of car insurance across these factors, and provide some tips on how to save money on car insurance.

Age and Gender

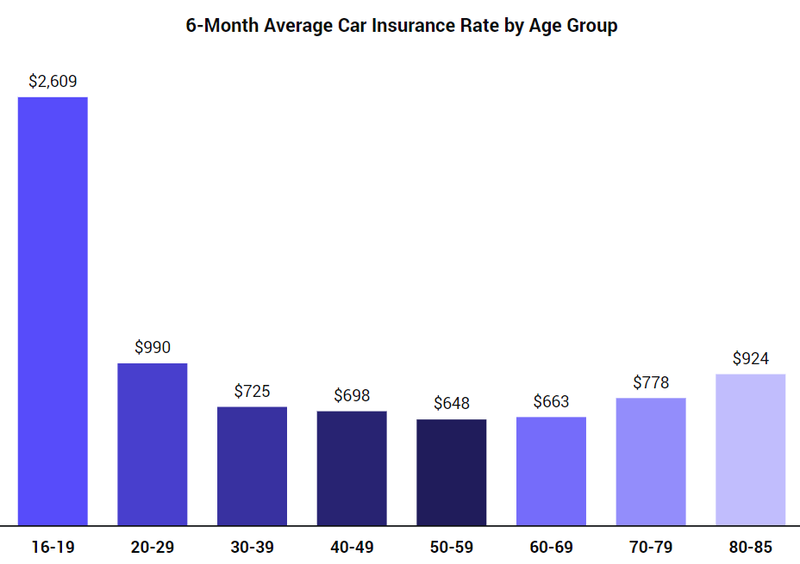

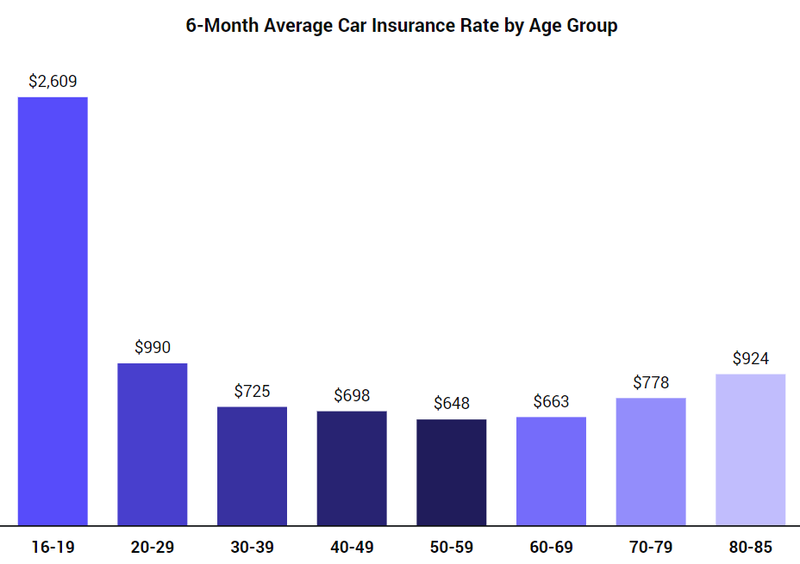

Age and gender are two of the most important factors that affect the cost of car insurance. According to a study conducted by ValuePenguin, the average cost of car insurance in 2018 was $1,365 per year. However, this cost varies based on age and gender.

Teenagers are the most expensive group to insure, with an average cost of $5,535 per year. This is because they are considered high-risk drivers due to their lack of driving experience. On the other end of the spectrum, drivers over the age of 70 pay an average of $1,052 per year, as they are considered low-risk drivers due to their years of experience.

Gender also plays a role in the cost of car insurance. On average, men pay $200 more per year than women for car insurance. This is because men are statistically more likely to get into accidents and make claims on their insurance.

Location

Your location also plays a big role in the cost of car insurance. Urban areas tend to have higher car insurance rates than rural areas. This is because urban areas have more traffic and higher rates of car theft and vandalism, which increase the risk of accidents and insurance claims.

According to the same study by ValuePenguin, the average cost of car insurance varies by state. Michigan has the highest average cost of car insurance at $2,611 per year, while Maine has the lowest average cost at $902 per year.

Driving Record

Your driving record is one of the biggest factors that affect the cost of car insurance. Insurance companies use your driving record to determine your risk level, and drivers with a history of accidents and traffic violations are considered high-risk and will pay higher premiums.

Drivers with a clean driving record can save money on car insurance by taking advantage of safe driver discounts and accident forgiveness programs. Safe driver discounts reward drivers for good driving habits, such as avoiding speeding tickets and accidents. Accident forgiveness programs waive the first accident on your record, so it doesn't affect your insurance rates.

How to Save Money on Car Insurance

Fortunately, there are many ways to save money on car insurance. Here are some tips:

- Shop around and compare prices from different insurance companies. Prices can vary significantly, so it's important to get quotes from multiple sources before making a decision.

- Consider raising your deductible. A higher deductible means that you will pay more out-of-pocket in the event of an accident, but it also means that your monthly premiums will be lower.

- Take advantage of safe driver discounts and accident forgiveness programs.

- Bundle your insurance policies. Many insurance companies offer discounts to customers who have multiple policies with them, such as car and home insurance.

Conclusion

Car insurance can be a significant expense, but it's necessary for protecting yourself and your car. The cost of car insurance varies depending on a variety of factors, including age, gender, location, and driving record. However, there are many ways to save money on car insurance, such as shopping around, raising your deductible, and taking advantage of discounts and programs.

By being aware of these factors and taking advantage of cost-saving measures, you can ensure that you have the coverage you need without breaking the bank.

Remember, car insurance is not an area where you want to skimp on coverage. It's important to have enough coverage to protect yourself and your assets in the event of an accident. However, by being mindful of the factors that affect the cost of car insurance and taking steps to save money, you can find a policy that works for your budget and your needs.

If you are searching about Average Cost of Car Insurance (2018) | Average Cost of Insurance you've came to the right place. We have 8 Pics about Average Cost of Car Insurance (2018) | Average Cost of Insurance like How Much Does Car Insurance Cost on Average? | The Zebra, Average Car Insurance Cost Per Month By Age And State – Epsilonbeg and also New insurance law’s effects set to be 'sudden and dramatic' - Covered. Here it is:

Average Cost Of Car Insurance (2018) | Average Cost Of Insurance

www.valuepenguin.com

www.valuepenguin.com insurance car rates age cost average auto graph gender value

New Insurance Law’s Effects Set To Be 'sudden And Dramatic' - Covered

insurance car male sudden dramatic effects prices average gocompare drivers law set female aged gap between young

Teenage Car Insurance Average Cost Per Month ~ Artfirstdesign

artfirstdesign.blogspot.com

artfirstdesign.blogspot.com Average Car Insurance For 18 Year Old Female Per Month Https://goo.gl

www.pinterest.com

www.pinterest.com Average Price Of Car Insurance Per Month - Designby4d

designby4d.blogspot.com

designby4d.blogspot.com businessinsider premiums

Average Cost Of Car Insurance (2019) | Average Cost Of Insurance

www.valuepenguin.com

www.valuepenguin.com insurance car average cost much auto costs paying gender graph old year health company companies

How Much Does Car Insurance Cost On Average? | The Zebra

www.thezebra.com

www.thezebra.com geico nationwide cheapest

Average Car Insurance Cost Per Month By Age And State – Epsilonbeg

epsilonbeg.blogspot.com

epsilonbeg.blogspot.com thezebra zebra mymissiontodoinlife

Insurance car rates age cost average auto graph gender value. Thezebra zebra mymissiontodoinlife. Teenage car insurance average cost per month ~ artfirstdesign

0 Comments