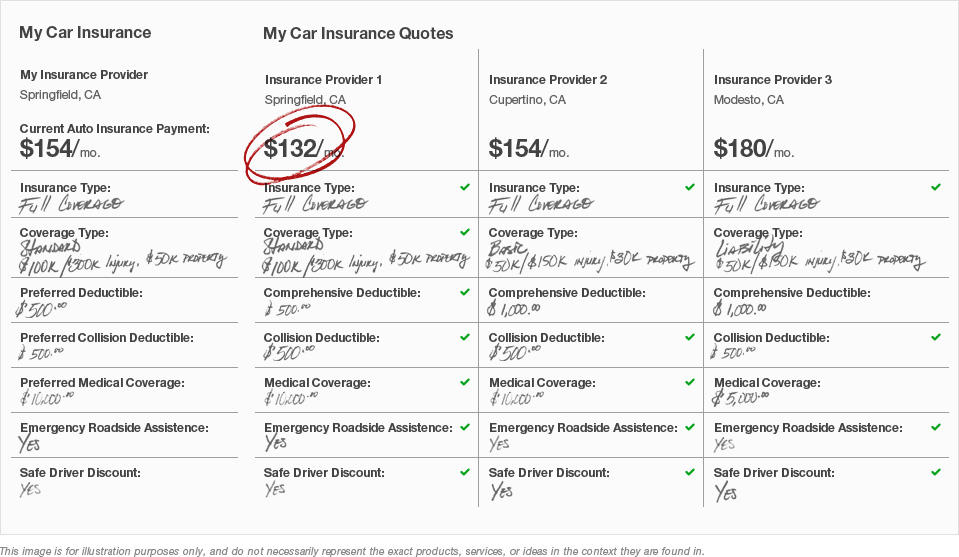

Car insurance prices can vary greatly depending on where you live, your driving history, and the type of car you own. If you're looking for the best car insurance rates, it's important to shop around and compare quotes from multiple providers. In this post, we'll take a look at some resources that can help you find affordable car insurance in your area.

Cleveland, OH

If you live in Cleveland, OH, there are several factors that can influence the cost of your car insurance. Ohio is an at-fault state, which means that the driver who is found to be at fault in an accident is responsible for paying for any damages or injuries that result. This means that drivers in Ohio may be required to carry more insurance coverage than drivers in other states.

Additionally, factors like your age, gender, and driving record can all impact your car insurance rates. Men, young drivers, and drivers with a history of accidents or tickets are all considered higher-risk drivers and may be charged higher rates as a result.

However, there are ways to lower your car insurance costs in Cleveland. One option is to take advantage of discounts that may be available to you. For example, some insurance providers offer discounts to drivers who have completed a defensive driving course or belong to certain organizations.

Another way to save on car insurance is to choose a higher deductible. This means that you'll have to pay more out of pocket if you're in an accident, but your monthly premiums will be lower as a result.

Atlanta, GA

If you're looking for affordable car insurance in Atlanta, GA, there are several factors to consider. Georgia is also an at-fault state, which means that drivers are responsible for paying for any damages or injuries that they cause in an accident.

Additionally, factors like your age, gender, and driving record can all impact your car insurance rates. In Georgia, men usually pay more for car insurance than women, and young drivers are typically charged higher rates than older drivers.

However, there are ways to lower your car insurance costs in Atlanta. One option is to take advantage of discounts that may be available to you. For example, some insurance providers offer discounts to drivers who have completed a defensive driving course or belong to certain organizations.

Another way to save on car insurance is to choose a higher deductible. This means that you'll have to pay more out of pocket if you're in an accident, but your monthly premiums will be lower as a result.

Hawaii

If you live in Hawaii, you might be surprised to learn that car insurance rates in the state are generally quite affordable. According to one study, the average cost of car insurance in Hawaii is around $61 per month.

However, the cost of your auto insurance will depend on several factors, including your age, driving record, and the type of car you own. For example, if you're a young driver or have a history of accidents or tickets, you may be charged higher rates.

To find the best car insurance rates in Hawaii, it's important to shop around and compare quotes from multiple providers. You can also take advantage of discounts that may be available to you, such as discounts for good students or drivers who have completed a defensive driving course.

Comparing Car Insurance Quotes

One of the best ways to find affordable car insurance is to compare quotes from multiple providers. There are several websites that can help you do this, including:

- Insurify

- The Zebra

- Gabi

- EverQuote

These websites allow you to enter your information once and receive quotes from multiple insurance providers. This makes it easy to compare rates and find the best deal for your needs.

Other Ways to Save on Car Insurance

In addition to shopping around for car insurance and taking advantage of discounts, there are other steps you can take to lower your car insurance costs:

- Drive safely: Maintaining a safe driving record can help you avoid accidents and keep your insurance rates low.

- Choose a car that's less expensive to insure: Some cars are more expensive to insure than others. Before purchasing a new vehicle, consider the cost of insurance.

- Bundle your insurance: If you have multiple insurance policies, such as home and auto insurance, you may be able to save money by bundling them with one company.

- Pay your premiums in full: If you can afford it, paying your car insurance premiums in full rather than in installments can save you money in the long run.

- Consider usage-based insurance: Some insurance providers offer usage-based insurance programs that use technology to track your driving habits. If you're a safe driver, you may be able to save money with this type of insurance.

Top Car Insurance Rates for 2019

If you're looking for the best car insurance rates, it's important to compare quotes from multiple providers. However, some insurance providers consistently offer competitive rates. According to one study, the top 10 car insurance providers for 2019 were:

- NJM Insurance

- USAA

- Erie Insurance

- Amica Mutual

- Auto-Owners Insurance

- Nationwide

- The Hartford

- State Farm

- Geico

- Travelers

Keep in mind that the best car insurance provider for you will depend on several factors, including your location, driving history, and the type of coverage you need.

Conclusion

When it comes to finding affordable car insurance, there's no one-size-fits-all solution. The cost of car insurance can vary greatly depending on several factors, including where you live, your driving record, and the type of car you own.

However, by shopping around and comparing quotes from multiple providers, taking advantage of discounts, and making smart choices about your coverage, you can find car insurance that fits your needs and your budget. Remember to also consider other factors, such as customer service and claims handling, when choosing an insurance provider.

By doing your research and being proactive about finding the best car insurance rates, you can save money and have peace of mind on the road.

If you are searching about Learn The Truth About Best Car Insurance Rates In The Next 7 Seconds you've came to the right page. We have 8 Pics about Learn The Truth About Best Car Insurance Rates In The Next 7 Seconds like Car Insurance Quotes Comparison - Security Guards Companies, Average Cost Car Insurance ~ news word and also Factors Influencing the Cost of Car Insurance in Cleveland, OH. Here it is:

Learn The Truth About Best Car Insurance Rates In The Next 7 Seconds

insurance car rates truth learn comparison next

Average Cost Car Insurance ~ News Word

rates equity hurul

Car Insurance Quotes Comparison - Security Guards Companies

ho6 templet quotesgram bmwclub

Hawaii Cheapest Car Insurance (from $61/mo) Compare Quotes!

autoinsuresavings minimum

Who Has The Best Car Insurance Rates In Atlanta? - ValuePenguin

insurance car atlanta rates auto cheapest prices who area quotes find

How To Get Some Of The Best Car Insurance Rates? | Everything Finance

Factors Influencing The Cost Of Car Insurance In Cleveland, OH

insurance car

Top 10 Car Insurance Rates 2019 | EINSURANCE

insurance car rates cars einsurance rate which

Who has the best car insurance rates in atlanta?. Average cost car insurance ~ news word. Ho6 templet quotesgram bmwclub

0 Comments