Driving a car is a major responsibility, and one of the biggest things you need to consider when taking your vehicle out on the road is car insurance. Car insurance can be a major expense and it really adds up. If you are looking for ways to save money on your car insurance, you are not alone. There are a lot of factors that can affect car insurance rates. Some are within your control and some are not, but by understanding these factors you can make informed decisions that help you save money on your insurance coverage. Let's start with a look at car insurance rates across the United States. Did you know that average car insurance rates can vary significantly by state? That's right, car insurance rates can differ dramatically based on where you live. One state known for having relatively low car insurance rates is Minnesota. That's good news for residents of The Gopher State! In fact, Minnesota has some of the lowest insurance rates in the country. You might be wondering why that is. Well, there are a few reasons. First of all, Minnesota is a state with a relatively low population density compared to other states like California or New York. Fewer people on the roads mean fewer chances for accidents to occur, leading to lower insurance rates. Another reason is the fact that Minnesota has relatively good weather conditions for much of the year. In this state, you won't have to worry about winter storms and freezing temperatures for as long a period of time as some other states, making driving much easier and safer. As a result, insurance companies are less likely to have to pay out claims, resulting in lower rates for drivers. If you are a young driver looking for cheap car insurance in Florida, then you are in luck, as there are ways to save money in this state as well. One of the best ways to save money on car insurance as a younger driver is to have a clean driving record. By being a safe and responsible driver, you demonstrate to your insurance company that you are a low-risk driver, and they are more likely to offer you lower rates. Driving a safe car can also help ensure you pay lower rates. This means fewer crashes, which will lead to lower insurance rates. It's important to note that not all cars are created equal in terms of safety. You may also want to consider taking a defensive driving course. This is a great way to not only become a better and safer driver, but it can also help you save money on your car insurance. Many insurance companies offer discounts for completing this type of course, so it's definitely worth considering. But what about car insurance rates in Canada? Are they similar to those in the United States? Generally speaking, car insurance rates in Canada can be quite high compared to other countries. There are a few reasons for this. One factor is the high cost of healthcare in Canada. If someone is injured in a car accident, the costs can add up quickly. As a result, insurance companies may charge more to cover their risk. Additionally, many people in Canada live in urban areas where there is a lot of traffic, both cars, and pedestrians. This can increase the chances of an accident occurring and lead to higher insurance rates. Now, let's talk about one of the most important factors affecting car insurance rates - your driving record. Your driving record is a reflection of how safe and responsible you are behind the wheel, and it plays a major role in how much you will pay for your car insurance. If you have a history of getting into accidents or getting traffic tickets, your insurance company will likely view you as a high-risk driver and may charge you more. On the other hand, if you have a clean driving record and haven't had any accidents or tickets in a while, your insurance company is more likely to view you as a safe bet and offer you lower rates. Another factor that can impact your car insurance rates is the type of car you drive. Insurance companies take into account many aspects of a car when they determine rates, such as the make and model, the age of the car, and its safety features. For example, a newer car with the latest safety features is likely to command a lower insurance rate compared to an older car that lacks safety features. This is simply because newer cars are less likely to get into accidents and are easier to repair in case of an accident. There are many other factors that can also affect car insurance rates, such as your age, your gender, and even your credit score. However, one of the most important things you can do to get the best possible rates is to shop around. Don't just settle for the first insurance company you come across. Take the time to compare rates and policies from multiple companies to find the best deal for you. It can be a bit time-consuming, but the savings can be significant. In conclusion, car insurance is an expense that many people don't enjoy paying, but it is a necessary one if you want to protect yourself and your vehicle while on the road. By understanding the factors that affect car insurance rates and taking steps to keep those rates low, you can save a lot of money over time.

If you are searching about Pay attention! These can influence your car insurance rate – Money DIBS you've came to the right page. We have 8 Pictures about Pay attention! These can influence your car insurance rate – Money DIBS like Car Insurance Rates Across Canada: Who's Paying the Most and Why, Factors that Affect Car Insurance Rates | FindBestQuote and also Factors that Affect Car Insurance Rates | FindBestQuote. Here it is:

Pay Attention! These Can Influence Your Car Insurance Rate – Money DIBS

www.moneydibs.com

www.moneydibs.com influence

Car Insurance Rates Across Canada: Who's Paying The Most And Why

www.autowinnipegcreditsolutions.com

www.autowinnipegcreditsolutions.com cheapest province premiums paying icbc ibc insurers gisa msa

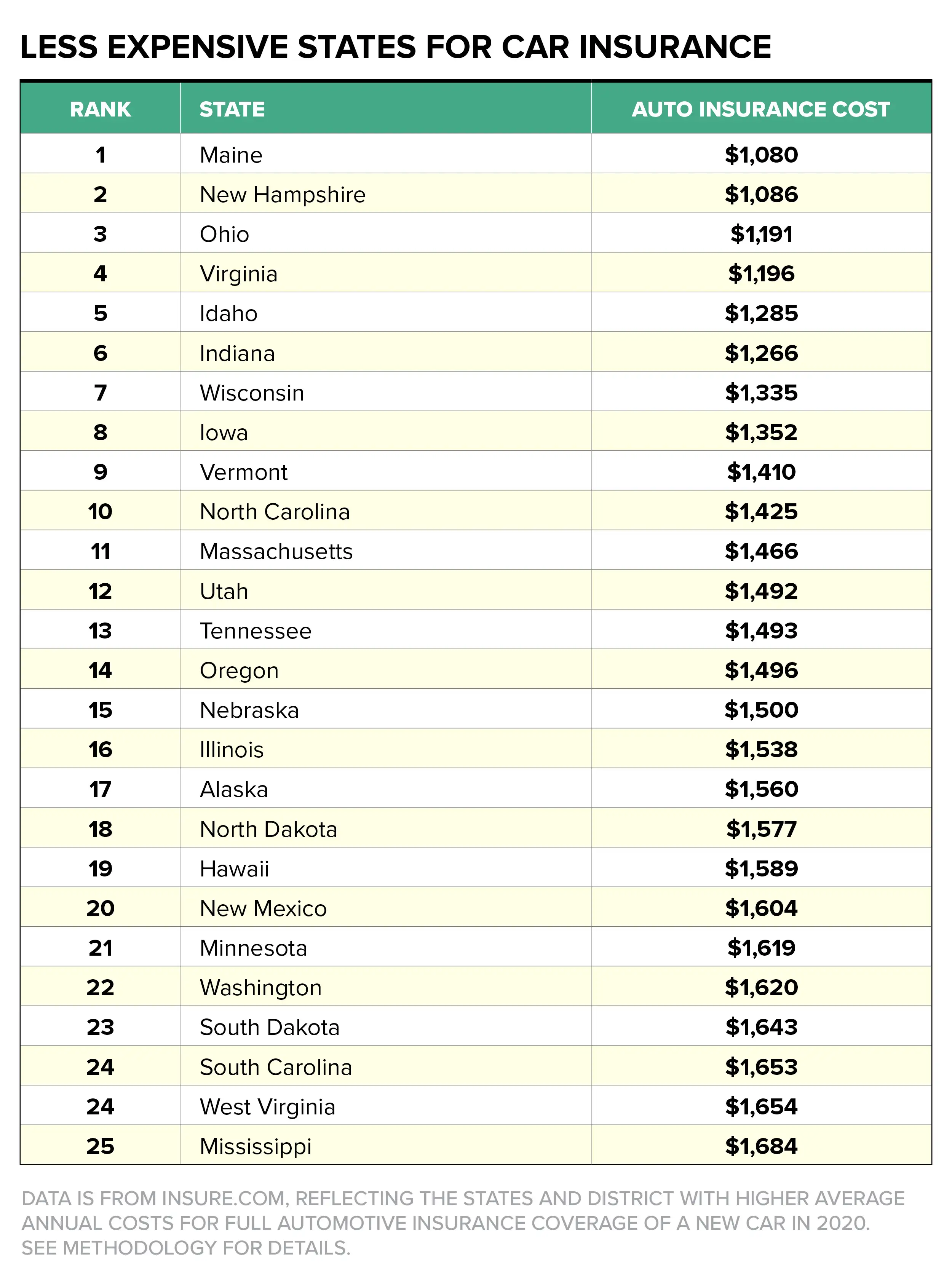

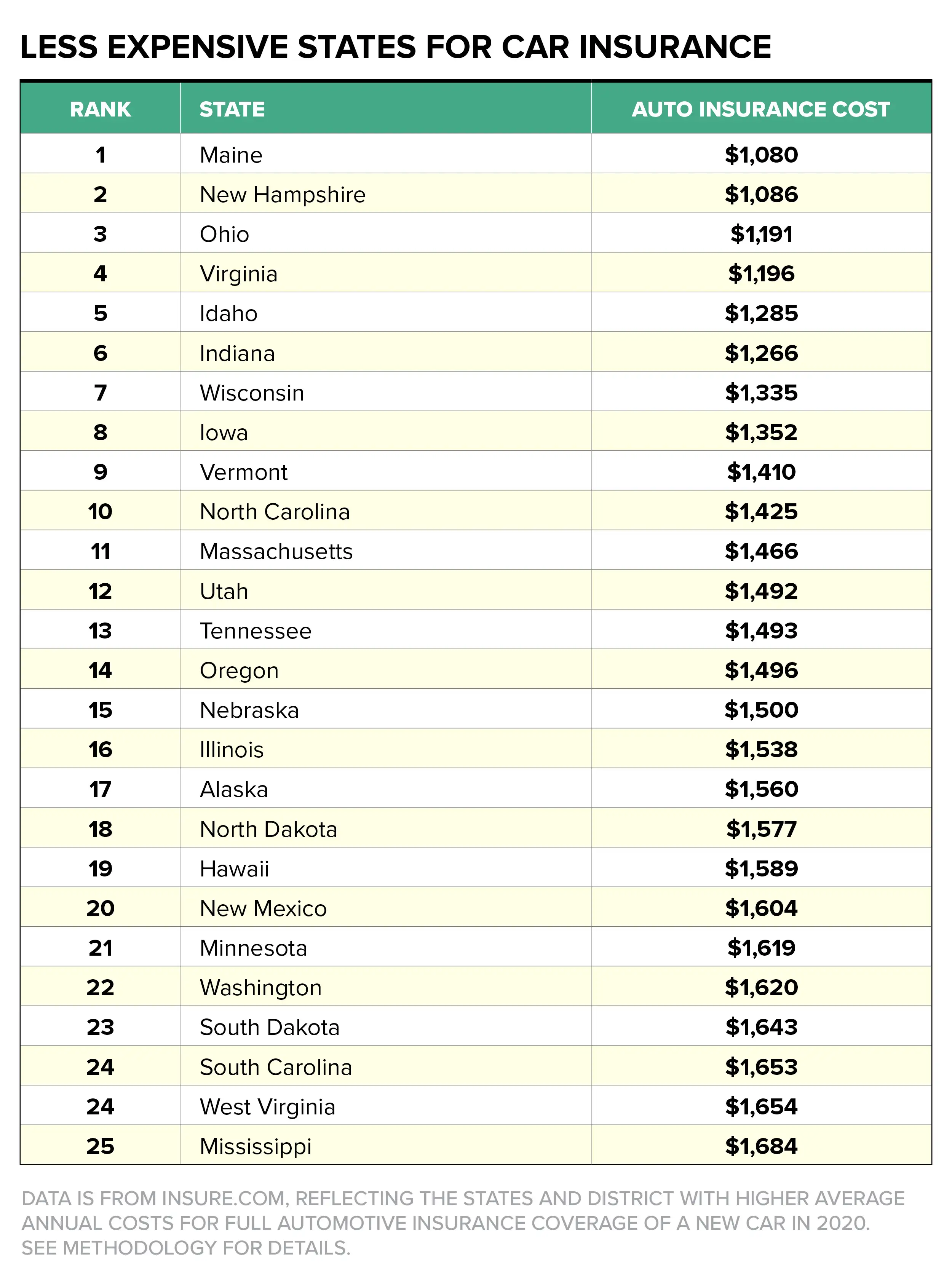

Average Car Insurance By State / Minnesota Auto Insurance Made Easy

entretriperos.blogspot.com

entretriperos.blogspot.com insurance average renewal costs

Cheapest Car Insurance In Florida For Young Drivers – Simple Zetb

simplezetb.blogspot.com

simplezetb.blogspot.com Factors That Affect Car Insurance Rates | FindBestQuote

findbestquote.com

findbestquote.com Car Insurance Costs By State | Money

money.com

money.com insurance auto car state money states rates rate

Do You Know What Determines Your Car Insurance Rate?

hukariinsurance.com

hukariinsurance.com Significance Of Anti-Theft Devices In Car Insurance Rate Reduction

www.newsorator.com

www.newsorator.com insurance car fraud financial phishing protection rate insurances type deception scam caution concept rates carolina north linkedin significance reduction theft

Average car insurance by state / minnesota auto insurance made easy. Cheapest car insurance in florida for young drivers – simple zetb. Car insurance rates across canada: who's paying the most and why

www.moneydibs.com

www.moneydibs.com  www.autowinnipegcreditsolutions.com

www.autowinnipegcreditsolutions.com  entretriperos.blogspot.com

entretriperos.blogspot.com  simplezetb.blogspot.com

simplezetb.blogspot.com  findbestquote.com

findbestquote.com  money.com

money.com  hukariinsurance.com

hukariinsurance.com  www.newsorator.com

www.newsorator.com

0 Comments