Are you tired of paying high car insurance rates? You're not alone. It turns out that car insurance rates can vary widely across different regions and states in America. Let's take a closer look at what factors can determine your auto insurance rates and see how they compare across the US.

The Geography of Car Insurance Rates

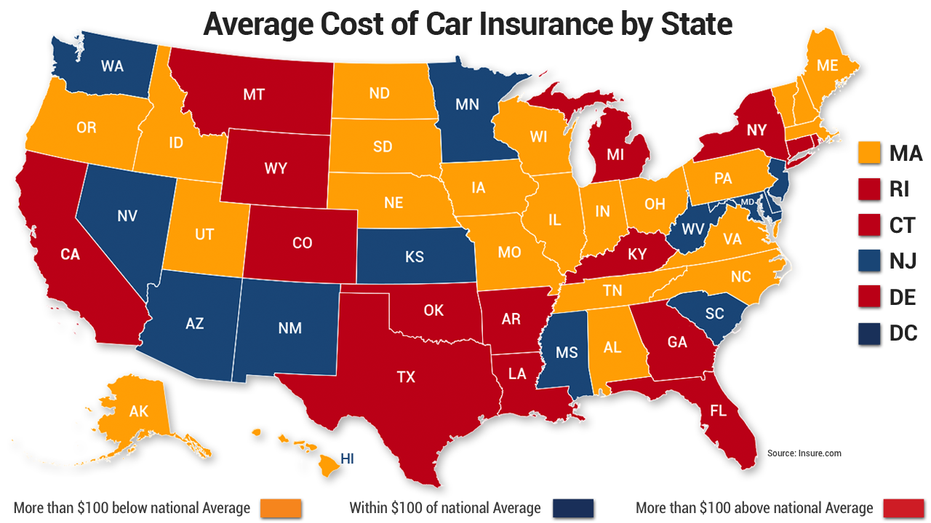

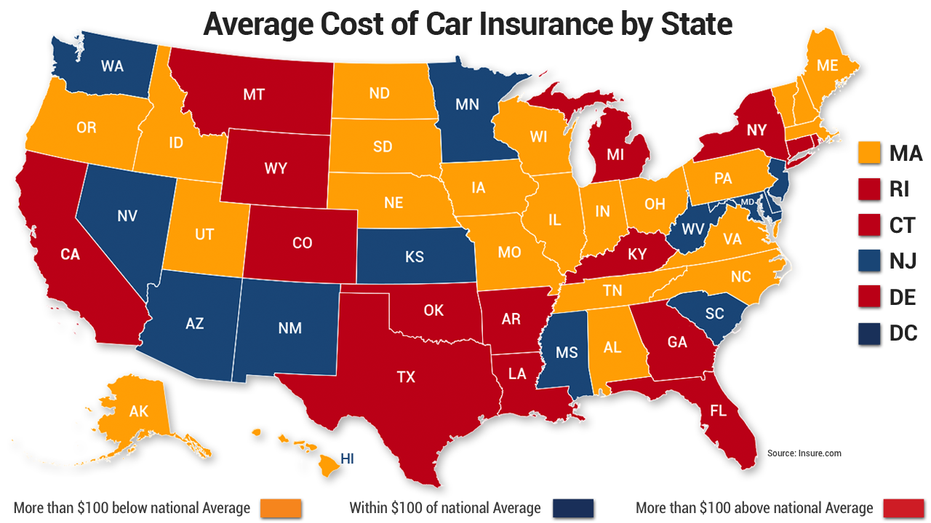

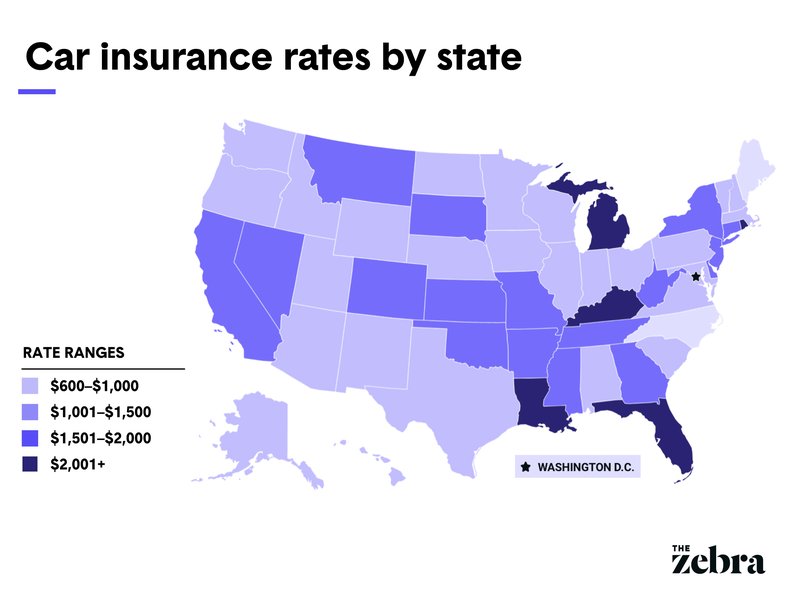

As the saying goes, "location, location, location" matters when it comes to car insurance. Various factors, like crime rates, traffic congestion, weather patterns and local laws, can all impact insurance rates in any given region. For example, in Milwaukee, Wisconsin, drivers can expect to pay between $693-$1604 per year for car insurance. But in Louisiana, rates can be even higher.

Our data shows that Louisiana has the highest car insurance rates by state. President Trump even called out Louisiana for their high rates. But why are rates so high in Louisiana? One contributing factor is that the state has a high number of uninsured drivers - about 13% of all drivers in the state lack car insurance. Additionally, Louisiana has one of the highest rates of car accidents in the country.

But even within a state, car insurance rates can vary widely. Factors like your age, gender, driving record, and credit score can all impact how much you'll pay for coverage.

What Determines Your Auto Insurance Rates?

So what exactly goes into calculating your auto insurance rates? Here are some of the most important factors:

- Driving record: If you have a history of accidents or traffic violations, you'll likely pay higher rates for car insurance. On the other hand, a clean driving record can earn you discounts.

- Age and gender: Young drivers and men are statistically more likely to be involved in car accidents, so they may pay higher rates.

- Vehicle make and model: The more expensive or powerful your car is, the more it will cost to insure.

- Miles driven per year: Drivers who put more miles on their cars are generally considered higher risk and may pay higher rates.

- Location: As we mentioned earlier, your ZIP code can impact your car insurance rates. Cities typically have higher rates due to more traffic and higher rates of car theft.

- Credit score: Believe it or not, your credit score can actually influence your car insurance rates. Insurance companies believe that people with good credit are less likely to file claims.

How to Lower Your Car Insurance Rates

While it's true that some factors, like your age and driving record, can't be changed, there are steps you can take to lower your auto insurance rates:

- Shop around: Don't assume that your current insurer is giving you the best rate. Get quotes from multiple companies to compare rates.

- Bundled policies: If you have home or renters insurance, consider bundling your policies to get a discount.

- Raise your deductible: The higher your deductible, the lower your monthly premium. Just make sure you have enough money saved up to cover the deductible in case of an accident.

- Drive less: If you can carpool or use public transportation, you may qualify for a low-mileage discount.

- Drive safely: Maintaining a clean driving record can earn you discounts from your insurer.

The Bottom Line

While car insurance rates can be a headache, it's important to have coverage to protect yourself and your vehicle in case of an accident. By understanding what factors influence your rates and taking steps to lower them, you can find the best coverage at a price that works for you.

If you are looking for Car Insurance Costs by State | Money you've visit to the right place. We have 8 Pics about Car Insurance Costs by State | Money like What Is 6 Month Premium Car Insurance - momodesignsaus, Car Insurance Costs by State | Money and also Car Insurance Rate Ranges Between $693-$1604 in Milwaukee, WI. Here it is:

Car Insurance Costs By State | Money

money.com

money.com insurance car costs auto state money states rate premiums

Trump Calls Out Louisiana's High Car Insurance Rates | Fox Business

www.foxbusiness.com

www.foxbusiness.com insurance car rates louisiana high fox calls trump business state clicking go

Car Insurance Rate Ranges Between $693-$1604 In Milwaukee, WI

www.zimlon.com

www.zimlon.com insurance car rate 1604 milwaukee ranges wi between cost

Do You Know What Determines Your Auto Insurance Rates? - Velox® Insurance

veloxinsurance.com

veloxinsurance.com Car Insurance Prices Highest In History, Up For Two Thirds Of Drivers

www.thezebra.com

www.thezebra.com insurance thezebra drivers highest thirds prices history two car zebra downloaded roll credit used assets

What Is 6 Month Premium Car Insurance - Momodesignsaus

momodesignsaus.blogspot.com

momodesignsaus.blogspot.com howmuch

Auto Insurance Rates By Regions In America - 480-246-1930 In The Midst

regions

Find Out Why Do Car Insurance Rates Vary By State

jackstoneinsurance.com

jackstoneinsurance.com autoinsurance accidents premiums tax regions oversees deductible dialects coke america cpc dramatically

Find out why do car insurance rates vary by state. What is 6 month premium car insurance. Do you know what determines your auto insurance rates?

0 Comments