There's no denying that owning a car is expensive, but one cost that often gets overlooked is car insurance. The amount you pay for car insurance can vary depending on a number of factors, including the type of car you drive, your driving record, and even where you live. In this post, we'll take a closer look at car insurance rates across the United States to see how they differ from state to state and what factors can influence them.

Car Insurance Costs by State

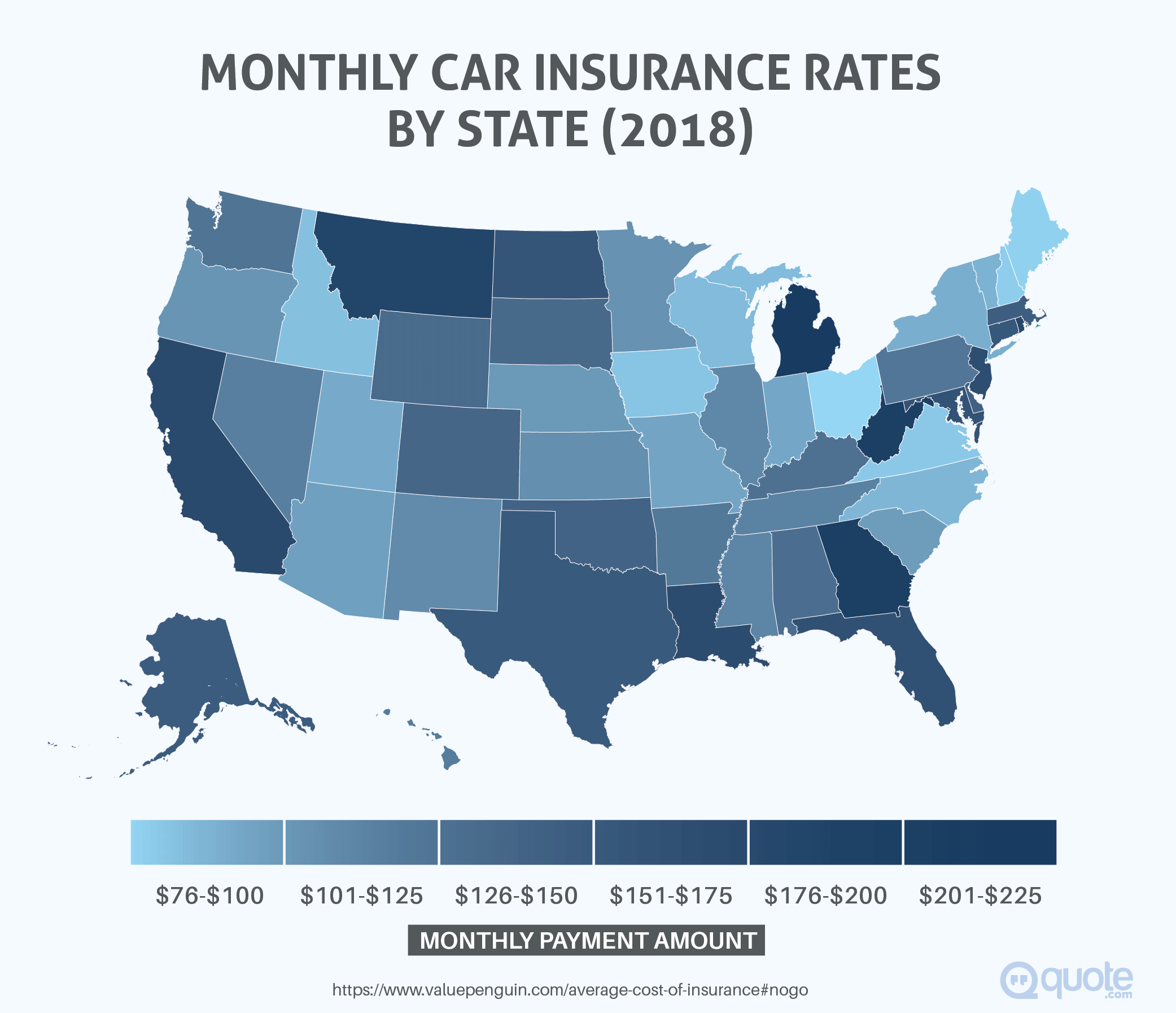

It probably comes as no surprise that car insurance rates vary widely from state to state. According to data from Money, the average annual car insurance premium in the United States is $1,502. However, this number can vary significantly based on where you live. For example, if you live in Michigan, you can expect to pay an average of $2,878 per year for car insurance. On the other end of the spectrum, if you live in Maine, you'll pay an average of just $896 per year for the same coverage.

Best Car Insurance Companies of 2018

When it comes to buying car insurance, it's important to choose a reputable provider that you can trust. According to data from quote.com, some of the best car insurance companies in 2018 included Geico, State Farm, and Nationwide. These companies were selected based on factors such as customer satisfaction, financial strength, and overall value.

What Determines Your Auto Insurance Rates?

If you're wondering why your car insurance rates are so high (or low), there are a few key factors that insurance companies take into account when determining your premium. These can include your age, driving record, and even your credit score. Additionally, the type of car you drive can also influence your rates. Generally speaking, sporty or high-performance cars are more expensive to insure than family sedans or minivans.

Average Cost of Car Insurance

While car insurance rates can vary widely, it's helpful to have a general idea of what to expect. According to data from ValuePenguin, the average cost of car insurance in the United States is around $1,427 per year. However, this number can vary depending on a number of factors, including your age, driving record, and the type of car you drive.

Auto Insurance Rates by Region

In addition to varying by state, car insurance rates can also differ depending on where you live within a state. For example, drivers in rural areas often pay less for car insurance than those in urban areas. Similarly, drivers in the Northeast tend to pay higher premiums than those in the Midwest or South. According to data from 2 Pass Driving School, drivers in Alaska, Montana, and Wyoming tend to pay the most for car insurance, while those in Maine, Idaho, and Iowa pay the least.

Average Price of Car Insurance Per Month

While most car insurance policies are paid annually, it can be helpful to think about the cost of car insurance on a monthly basis. According to data from Design by 4D, the average monthly car insurance premium in the United States is around $125. However, this number can vary depending on a variety of factors, as we've already discussed.

Car Insurance Rates by State

Finally, it's worth taking a closer look at how car insurance rates vary from state to state. According to data from Great Outdoors, the five most expensive states for car insurance are Michigan, Louisiana, Florida, Rhode Island, and California. On the other hand, the five least expensive states for car insurance are Maine, Iowa, Wisconsin, Idaho, and North Dakota.

In conclusion, car insurance rates can vary widely depending on a number of factors, from where you live to the type of car you drive. While it's important to choose a reputable insurance provider, it's also helpful to shop around and compare rates to make sure you're getting the best possible deal. By understanding the factors that influence car insurance rates, you can make more informed decisions when it comes to buying and maintaining your vehicle.

If you are looking for Average Price Of Car Insurance Per Month - designby4d you've visit to the right page. We have 8 Pics about Average Price Of Car Insurance Per Month - designby4d like Best Car Insurance Companies of 2018 | quote.com, Car insurance rates are going up for women across the US — here's where and also Best Car Insurance Companies of 2018 | quote.com. Read more:

Average Price Of Car Insurance Per Month - Designby4d

rates howmuch

Do You Know What Determines Your Auto Insurance Rates? - Velox® Insurance

Car Insurance Rates By State - Insurance

insurance

Auto Insurance Rates By Regions In America - 480-246-1930 In The Midst

regions

Best Car Insurance Companies Of 2018 | Quote.com

halt screeching

Car Insurance Costs By State | Money

insurance car costs auto state money states rate premiums

Average Cost Of Car Insurance (2018) | Average Cost Of Insurance

insurance car rates age cost average auto graph gender value

Car Insurance Rates Are Going Up For Women Across The US — Here's Where

rates shayanne

Average price of car insurance per month. Auto insurance rates by regions in america. Average cost of car insurance (2018)

0 Comments