Gender and car insurance rates have been a topic of discussion for a long time. Many people are curious about why and how their gender affects car insurance rates. Is it fair that certain genders have to pay more than others? What are the factors that determine these rates? The answers to these questions are complex and multifaceted, but here is everything you need to know about how your gender affects car insurance rates.

Why Gender Matters

Gender matters because car insurance companies use statistical data to determine rates. For example, men are statistically more likely to be involved in accidents than women. The data shows that men tend to drive more aggressively, take more risks, and get into more accidents. This is why car insurance rates for men are typically higher than for women.

However, these statistics are not the whole story. There are many other factors that go into determining car insurance rates, such as age, driving record, and the type of car you drive. These factors can also influence your premiums, regardless of your gender.

How Gender Affects Car Insurance Rates

In general, men tend to pay more for car insurance than women. This is because they are more likely to be involved in accidents and file claims. However, the exact difference in rates can vary depending on the insurance company and the state you live in. Some states prohibit gender-based pricing altogether, while others allow it with certain restrictions.

For example, in California, insurance companies are not allowed to use gender as a factor in determining car insurance rates. This means that men and women receive the same rates for the same policies. Other states, such as Florida, allow gender-based pricing, but only if the rates are actuarially justified.

Factors that Affect Car Insurance Rates

While gender is certainly a factor that affects car insurance rates, it is not the only one. There are many other factors that insurance companies take into account when calculating rates. Here are some of the most important factors to consider:

Age

Age is one of the biggest factors that affect car insurance rates. Young drivers under the age of 25 tend to have the highest rates, as they are more likely to be involved in accidents. However, rates tend to decrease as drivers get older and gain more experience on the road.

Driving Record

Your driving record is another important factor that affects car insurance rates. If you have a clean driving record with no accidents or tickets, you will likely pay less for car insurance than someone with a history of accidents or other infractions.

Type of Car

The type of car you drive can also affect your car insurance rates. If you drive a high-performance sports car, you will likely pay more for insurance than if you drive a more practical sedan. This is because sports cars are more expensive to repair and replace, and they are more likely to be stolen.

Credit Score

Believe it or not, your credit score can also affect your car insurance rates. Insurance companies use credit scores as a way to predict risk, as studies have shown that drivers with lower credit scores are more likely to file claims. However, this practice has been criticized by consumer advocates, as some people think it is unfair to penalize someone for their financial situation.

Tips for Lowering Car Insurance Rates

If you are looking to lower your car insurance rates, there are several things you can do. Here are some tips to keep in mind:

Shop Around

The first thing you should do when looking for car insurance is to shop around. Different insurance companies offer different rates, so it is important to compare quotes from multiple providers. This will help you find the best rate for the coverage you need.

Raise Your Deductible

Another way to lower your car insurance rates is to raise your deductible. The deductible is the amount you pay out of pocket before your insurance kicks in. By raising your deductible, you can lower your premiums, although you should make sure you can afford to pay the higher deductible if you get into an accident.

Maintain a Good Driving Record

As we mentioned earlier, your driving record is a major factor that affects car insurance rates. By maintaining a clean driving record with no accidents or tickets, you can keep your rates low.

Drive a Safe Car

If you are in the market for a new car, consider choosing a model with a high safety rating. Cars that are equipped with the latest safety features are less likely to be involved in accidents, and insurance companies may offer lower rates for these vehicles.

Conclusion

In conclusion, gender is one of many factors that affect car insurance rates. While men tend to pay more for car insurance than women, there are many other factors that come into play when determining rates, such as age, driving record, and the type of car you drive. By understanding these factors and taking steps to lower your risk, you can save money on your car insurance and stay protected on the road.

If you are searching about Does Gender Affect Car Insurance? you've came to the right web. We have 8 Pics about Does Gender Affect Car Insurance? like Does Gender Affect Car Insurance?, Car Insurance Alberta | Average Rate is $114 per month and also 2022 Car Insurance Rates by Age and Gender - NerdWallet. Here you go:

Does Gender Affect Car Insurance?

www.quoteme.ie

www.quoteme.ie callaghan 13th

2022 Car Insurance Rates By Age And Gender - NerdWallet

www.nerdwallet.com

www.nerdwallet.com nerdwallet marder

Gender, Age Have A Link On The Car Insurance Premium You Have To Pay

www.mausertobin.com

www.mausertobin.com In California, Gender Can No Longer Be Considered In Setting Car

www.nytimes.com

www.nytimes.com In California, Gender Can No Longer Be Considered In Setting Car

www.nytimes.com

www.nytimes.com Gender And Car Insurance [infographic] | Car Insurance Uk, Car

![Gender and car insurance [infographic] | Car insurance uk, Car](https://i.pinimg.com/originals/ac/e7/0b/ace70bb068b75e65b08fcf6c143c3f24.jpg) www.pinterest.com

www.pinterest.com diyetyemekleri autoinsurance

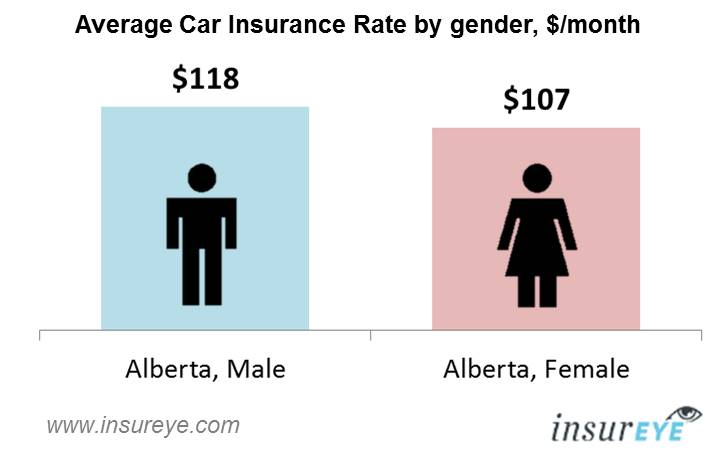

Car Insurance Alberta | Average Rate Is $114 Per Month

insureye.com

insureye.com insurance car alberta gender rates cost

Which Gender Pays More For Car Insurance?

clovered.com

clovered.com In california, gender can no longer be considered in setting car. Callaghan 13th. Gender and car insurance [infographic]

0 Comments